FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

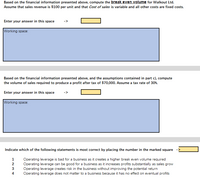

Transcribed Image Text:Based on the financial information presented above, compute the break even volume for Walkout Ltd.

Assume that sales revenue is $100 per unit and that Cost of sales is variable and all other costs are fixed costs.

Enter your answer in this space

Working space:

Based on the financial information presented above, and the assumptions contained in part c), compute

the volume of sales required to produce a profit after tax of $70,000. Assume a tax rate of 30%.

Enter your answer in this space

Working space:

Indicate which of the following statements is most correct by placing the number in the marked square

Operating leverage is bad for a business as it creates a higher break even volume required

Operating leverage can be good for a business as it increases profits substantially as sales grow

Operating leverage creates risk in the business without improving the potential return

Operating leverage does not matter to a business because it has no effect on eventual profits

2

4.

Transcribed Image Text:Located below is a sample from the income statement for Walkout Ltd.

Sales revenue

Cost of sales

200,000

(110,000)

Gross Profit

90,000

Selling expenses

General expenses

Depreciation

Salaries and wages

(15,500)

(20,000)

(12,000)

(7,000)

35,500

Operating Profit

Management of Walkout Ltd is looking to gather insights into their operating leverage and the effect of changes in the volume of their output on profitability.

a)

Indicate which of the following statements is most correct by placing the number in the marked square

Analysing outcomes with Cost-Volume-Profit analysis is objective because it is based on calculations are requires on subjective inputs

Cost-Volume-Profit analysis can precisely be applied to external financial reporting

Cost-Volume-Profit analysis provides a simple way to estimate the effects of changes in demand for goods or services on profit

As Cost-Volume-Profit analysis takes account of both variable and fixed costs, it is always likely to mirror the cost-structure of the business

1

2

4

b)

Indicate which of the following statements is most correct by placing the number in the marked square

->

Cost-Volume-Profit calculations are only useful for management or business employees

Conceptually, Cost-Volume-Profit calculations can only be performed using fixed and linearly variable cost categories

Cost-Volume-Profit calculations require the company to only produce one product

Cost-Volume-Profit analysis estimates must be critiqued to ensure they stay within the relevant range

1

3

4

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A family friend has asked your help in analyzing the operations of three anonymous companies operating in the same service sector industry. Supply the missing data in the table below: (Loss amounts should be indicated by a minus sign. Round your percentage answers to nearest whole percent and other amounts to whole dollars.) Sales Net operating income Average operating assets Return on investment (ROI) Minimum required rate of return: Percentage Dollar amount Residual income $ $ A 500,000 164,000 21 % 13 % $ $ $ Company B 760,000 35,000 19 % 53,000 % C $ 510,000 $ $ 151,000 % 9 % 6,000arrow_forwardFinancial information for BDS Enterprises for the year-ended December 31, 20xx, was gathered from an accounting intern, who has asked for your guidance on how to prepare an income statement format that will be distributed to management. Subtotals and totals are included in the information, but you will need to calculate the values. Pretax income ? Gross profit ? Allocated costs (uncontrollable) $2,040 Labor expense 41,580 Sales 190,000 Research and development (uncontrollable) 310 Depreciation expense 17,000 Net income/(loss) ? Cost of goods sold 119,700 Selling expense 1,260 Total expenses ? Marketing costs (uncontrollable) 790 Administrative expense 690 Income tax expense (21% of pretax income) ? Other expenses 330 A. Prepare the income statement to include all costs, but separate out uncontrollable costs using the above information. Round your answers to the nearest dollar. BDS Enterprises Income Statement For the Year Ended December…arrow_forwardThe managers of the XYZ clubs, who have the authority to make investments as needed, are evaluated based largely on return on investment (ROI). The company's X Club reported the following results for the past year: Sales Net operating income Average operating assets $ 730,000 $ 13, 140 $ 100,000 The following questions are to be considered independently. 2. Assume that the manager of the club is able to increase sales by $73,000 and that, as a result, net operating income increases by $5,329. Further assume that this is possible without any increase in average operating assets. What would be the club's return on investment (ROI)? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Return on investment (ROI) %arrow_forward

- Rahularrow_forwardA family friend has asked your help in analyzing the operations of three anonymous companies operating in the same service sector industry. Supply the missing data in the table below: (Loss amounts should be indicated by a minus sign. Do not round your intermediate calculations.) Sales Net operating income Average operating assets Return on investment (ROI) Minimum required rate of return: Percentage Dollar amount Residual income $ $ Company A 420,000 151,000 17% 12 % $ $ $ Company B 760,000 35,000 T 18 % 47,000 % $ $ $ Company C 650,000 153,000 % 9% 6,000arrow_forwardProfit Margin, Investment Turnover, and return on investment The condensed income statement for the Consumer Products Division of Fargo Industries Inc. is as follows (assuming no service department charges): Sales $540,000 Cost of goods sold 243,000 Gross profit $297,000 Administrative expenses 135,000 Income from operations $162,000 The manager of the Consumer Products Division is considering ways to increase the return on investment. a. Using the DuPont formula for return on investment, determine the profit margin, investment turnover, and return on investment of the Consumer Products Division, assuming that $1,350,000 of assets have been invested in the Consumer Products Division. Round the investment turnover to one decimal place. Profit margin fill in the blank 1 % Investment turnover fill in the blank 2 Rate of return on investment fill in the blank 3 % b. If expenses could be reduced by $27,000 without decreasing sales, what would be the impact on the…arrow_forward

- Financial information for BDS Enterprises for the year-ended December 31, 20xx, was gathered from an accounting intern, who has asked for your guidance on how to prepare an income statement format that will be distributed to management. Subtotals and totals are included in the information, but you will need to calculate the values. Pretax income ? Gross profit ? Allocated costs (uncontrollable) $2,030 Labor expense 41,580 Sales 190,000 Research and development (uncontrollable) 310 Depreciation expense 18,000 Net income/(loss) ? Cost of goods sold 119,700 Selling expense 1,260 Total expenses ? Marketing costs (uncontrollable) 800 Administrative expense 690 Income tax expense (21% of pretax income) ? Other expenses 330 Question Content Area A. Prepare the income statement using the above information. Round your answers to the nearest dollar. BDS EnterprisesIncome StatementFor the Year Ended Dec. 31, 20xx $Sales Cost of Goods Sold…arrow_forwardFinancial information for BDS Enterprises for the year-ended December 31, 20xx, was gathered from an accounting intern, who has asked for your guidance on how to prepare an income statement format that will be distributed to management. Subtotals and totals are included in the information, but you will need to calculate the values. Pretax income ? Gross profit ? Allocated costs (uncontrollable) $2,040 Labor expense 41,570 Sales 188,000 Research and development (uncontrollable) 315 Depreciation expense 18,000 Net income/(loss) ? Cost of goods sold 118,440 Selling expense 1,250 Total expenses Marketing costs (uncontrollable) 780 Administrative expense 690 Income tax expense (21% of pretax income) ? Other expenses 320 A. Prepare the income statement to include all costs, but separate out uncontrollable costs using the above information. Round your answers to the nearest dollar. BDS Enterprises Income Statement For the Year Ended December 31, 20xx Controllable Expenses: Total Controllable…arrow_forwardneed answer this question without AI please provide itarrow_forward

- Profit Margin, Investment Turnover, and Return on Investment The condensed income statement for the Consumer Products Division of Tri-State Industries Inc. is as follows (assuming no support department allocations): Sales $508,000 Cost of goods sold (228,600) Gross profit $279,400 Administrative expenses (127,000) Operating income $152,400 The manager of the Consumer Products Division is considering ways to increase the return on investment. a. Using the DuPont formula for return on investment, determine the profit margin, investment turnover, and return on investment of the Consumer Products Division, assuming that $1,270,000 of assets have been invested in the Consumer Products Division. Round the investment turnover to one decimal place. Profit margin fill in the blank 1 % Investment turnover fill in the blank 2 Return on investment fill in the blank 3 % b. If expenses could be reduced by $25,400 without decreasing sales, what would be the impact on the…arrow_forwardFinancial information for BDS Enterprises for the year-ended December 31, 20xx, was gathered from an accounting intern, who has asked for your guidance on how to prepare an income statement format that will be distributed to management. Subtotals and totals are included in the information, but you will need to calculate the values. Pretax income ? Gross profit ? Allocated costs (uncontrollable) $2,040 Labor expense 41,580 Sales 190,000 Research and development (uncontrollable) 310 Depreciation expense 18,000 Net income/(loss) ? Cost of goods sold 119,700 Selling expense 1,260 Total expenses ? Marketing costs (uncontrollable) 780 Administrative expense 680 Income tax expense (21% of pretax income) ? Other expenses 320 A. Prepare the income statement using the above information. Round your answers to the nearest dollar. B.Calculate the profit margin, return on investment, and residual income. Assume an investment base of $100,000 and 6% cost of capital.…arrow_forwardProfit Margin, Investment Turnover, and return on investment The condensed income statement for the Consumer Products Division of Fargo Industries Inc. is as follows (assuming no service department charges): Sales $1,026,000 Cost of goods sold 461,700 Gross profit $564,300 Administrative expenses 205,200 Income from operations $359,100 The manager of the Consumer Products Division is considering ways to increase the return on investment. a. Using the DuPont formula for return on investment, determine the profit margin, investment turnover, and return on investment of the Consumer Products Division, assuming that $1,710,000 of assets have been invested in the Consumer Products Division. Round the investment turnover to one decimal place. Profit margin % Investment turnover Rate of return on investment % b. If expenses could be reduced by $51,300 without decreasing sales, what would be the impact on the profit margin, investment turnover, and return on…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education