FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

need answer this question without

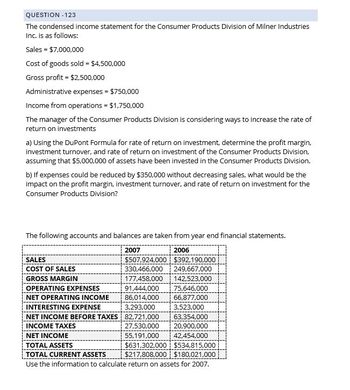

Transcribed Image Text:QUESTION -123

The condensed income statement for the Consumer Products Division of Milner Industries

Inc. is as follows:

Sales = $7,000,000

Cost of goods sold = $4,500,000

Gross profit = $2,500,000

Administrative expenses = $750,000

Income from operations = $1,750,000

The manager of the Consumer Products Division is considering ways to increase the rate of

return on investments

a) Using the DuPont Formula for rate of return on investment, determine the profit margin,

investment turnover, and rate of return on investment of the Consumer Products Division,

assuming that $5,000,000 of assets have been invested in the Consumer Products Division.

b) If expenses could be reduced by $350,000 without decreasing sales, what would be the

impact on the profit margin, investment turnover, and rate of return on investment for the

Consumer Products Division?

The following accounts and balances are taken from year end financial statements.

SALES

COST OF SALES

GROSS MARGIN

2007

2006

$507,924,000 $392,190,000

330,466,000

249,667,000

177,458,000

142,523,000

OPERATING EXPENSES

91,444,000 75,646,000

NET OPERATING INCOME

86,014,000 66,877,000

INTERESTING EXPENSE

3,293,000

3,523,000

NET INCOME BEFORE TAXES

82,721,000

63,354,000

INCOME TAXES

27,530,000

20,900,000

NET INCOME

55,191,000 42,454,000

$631,302,000 $534,815,000

TOTAL ASSETS

TOTAL CURRENT ASSETS

$217,808,000 $180,021,000

Use the information to calculate return on assets for 2007.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education