FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

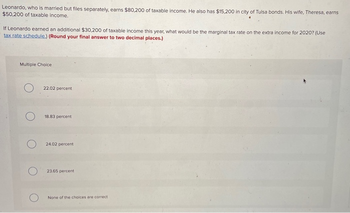

Transcribed Image Text:Leonardo, who is married but files separately, earns $80,200 of taxable income. He also has $15,200 in city of Tulsa bonds. His wife, Theresa, earns

$50,200 of taxable income.

If Leonardo earned an additional $30,200 of taxable income this year, what would be the marginal tax rate on the extra income for 2020? (Use

tax rate schedule.) (Round your final answer to two decimal places.)

Multiple Choice

O

22.02 percent

18.83 percent

24.02 percent

23.65 percent

None of the choices are correct

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Nikularrow_forwardJacob has $180,000 of self-employment earnings from a sole proprietorship. Jacob's self-employment tax for 2022 is (Round your intermediary and final answers to the nearest dollar.) a. $23,049. b. $25,433. c. $27,540. d. $23,448.arrow_forwardIn 2022, Elaine paid $2,800 of tuition and $600 for books for her dependent son to attend State University this past fall as a freshman. Elaine files a joint return with her husband. What is the maximum American opportunity tax credit that Elaine can claim for the tuition payment and books in each of the following alternative situations? Note: Leave no answer blank. Enter zero if applicable. Required: a. Elaine's AGI is $80,000. b. Elaine's AGI is $168,000. c. Elaine's AGI is $184,000.arrow_forward

- Arthur files a single income tax return and his maximum tax-free interest under the education savings bond program is $6,000. How much of the interest is excludible if his modified adjusted gross income exceeds the applicable dollar limit by $5,000 (one-third of the phaseout range)?arrow_forwardSergei owns some property that has an assessed value of $242,675. Calculate the tax due if the tax rate is 51.50 mills. (Round your answer to the nearest cent if necessary)arrow_forward[The following information applies to the questions displayed below.] Henrich is a single taxpayer. In 2023, his taxable income is $532,500. What are his income tax and net investment income tax liability in each of the following alternative scenarios? Use Tax Rate Schedule. Dividends and Capital Gains Tax Rates for reference. Note: Do not round intermediate calculations. Leave no answer blank. Enter zero if applicable. Round your final answers to 2 decimal places. a. All of his income is salary from his employer. Assume his modified AGI is $570,000. Income tax Net investment income tax Total tax liability $ Amount 0.00arrow_forward

- Marc, a single taxpayer, earns $64,600 in taxable income and $5,460 in interest from an investment in city of Birmingham bonds. Using the US tax rate schedule for year 2021, what is his effective tax rate? (Round your final answer to two decimal places.) (Use tax rate schedule) Multiple Choice 20.75 percent 14.22 percent 15.49 percent 11.90 percent None of the choices are correctarrow_forwardDuring 2020, Joan Matel is a resident of Ontario, Canada and has calculated her Taxable Income to be $56,700. Assume that Ontario’s rates are 5.05 percent on Taxable Income up to $48,535 and 9.15 percent on the next $48,534. Calculate her 2020 federal and provincial Tax Payable before consideration of credits, and her average rate of tax.arrow_forwardOn April 1, 2023, Farid sold a house to Amy. The property tax on the house, which is based on a calendar year, was due September 1, 2023. Amy paid the full amount of property tax of $2,100. Required: Calculate both Farid's and Amy's allowable deductions for the property tax. Assume a 365-day year. Note: Do not round your intermediate calculations. Round your final answers to 2 decimal places.arrow_forward

- Chuck, a single taxpayer, earns $80,200 in taxable income and $12,900 in interest from an investment in City of Heflin bonds. (Us the U.S tax rate schedule.) Required: a. How much federal tax will he owe? b. What is his average tax rate? c. What is his effective tax rate? d. What is his current marginal tax rate? Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D How much federal tax will he owe? Note: Do not round intermediate calculations. Round "Federal tax" to nearest whole dollar amount. Federal taxarrow_forwardManny is a single taxpayer, earns $65,000 per year in taxable income and an additional $12,000 per year in city of Boston bonds. If Manny earns an additional $35,000 in taxable income in 2023, what is his marginal tax rate on this income? (Use tax rate schedule.) 2023 Tax Rate Schedules IndividualsSchedule X-Single If taxable income is over: But not over: The tax is: $ 0 $ 11,000 10% of taxable income $ 11,000 $ 44,725 $1,100 plus 12% of the excess over $11,000 $ 44,725 $ 95,375 $5,147 plus 22% of the excess over $44,725 $ 95,375 $ 182,100 $16,290 plus 24% of the excess over $95,375 $ 182,100 $ 231,250 $37,104 plus 32% of the excess over $182,100 $ 231,250 $ 578,125 $52,832 plus 35% of the excess over $231,250 $ 578,125 — $174,238.25 plus 37% of the excess over $578,125 Schedule Z-Head of Household If taxable income is over: But not over: The tax is: $ 0 $ 15,700 10% of…arrow_forwardGive typing answer with explanation and conclusionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education