FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

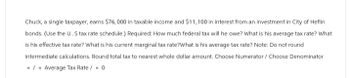

Transcribed Image Text:Chuck, a single taxpayer, earns $76,000 in taxable income and $11,100 in interest from an investment in City of Heflin

bonds. (Use the U.S tax rate schedule.) Required: How much federal tax will he owe? What is his average tax rate? What

is his effective tax rate? What is his current marginal tax rate?What is his average tax rate? Note: Do not round

intermediate calculations. Round total tax to nearest whole dollar amount. Choose Numerator / Choose Denominator

=/= Average Tax Rate / = 0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Geronimo files his tax return as a head of household for year 2022. If his taxable income is $73,000, what is his average tax rate? (Use tax rate schedule.) Note: Round your final answer to two decimal places. Multiple Choice 13.94 percent 16.20 percent 11.56 percent 22.00 percent None of the choices are correct.arrow_forwardTimmy Tappan is single and had $189,000 in taxable income. Use the rates from Table 2.3. a. Calculate his income taxes. (Do not round intermediate calculations.) b. What is the average tax rate? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) c. What is the marginal tax rate? (Do not round intermediate calculations.) Answer is complete but not entirely correct. $ a. Income taxes b. Average tax rate c. Marginal tax rate 47,843 X 478.43 X % 32 %arrow_forwardSergei owns some property that has an assessed value of $242,675. Calculate the tax due if the tax rate is 51.50 mills. (Round your answer to the nearest cent if necessary)arrow_forward

- Problem 1-34 (LO 1-3) (Algo) Chuck, a single taxpayer, earns $75,200 in taxable income and $10,200 in interest from an investment in City of Heflin bonds. (Use the U.S tax rate schedule.) Required: a. How much federal tax will he owe? b. What is his average tax rate? c. What is his effective tax rate? d. What is his current marginal tax rate? Complete this question by entering your answers in the tabs below. Required A Required B Required C Answer is not complete. Federal tax Required D How much federal tax will he owe? Note: Do not round intermediate calculations. Round "Federal tax" to nearest whole dollar amount.arrow_forwardConsider the following hypothetical income tax brackets for a single taxpayer. Assume for simplicity there are no exemptions or deductions. Income $0-$10,000 $10,000-$40,000 $40,000-$100,000 Over $100,000 Is this tax regressive, progressive, or proportional? The income tax is progressive Suppose Susan's income is $30,000. How much will she pay in income taxes? Susan will pay $ in income taxes. (Enter your response as an integer) Tax Rate 10% 20 35 50arrow_forwardI need help with b, c, and d.arrow_forward

- kuk.3arrow_forwardDuela Dent is single and had $181,600 in taxable income. Using the rates from Table 2.3, calculate her income taxes. What is the average tax rate? What is the marginal tax rate? Note: Do not round intermediate calculations and round your income tax answer to 2 decimal places, e.g., 32.16. Enter the average and marginal tax rate answers as a percent, rounded 2 decimal places, e.g., 32.16. Income taxes Average tax rate Marginal tax rate 39,801.50 X 22.00 × % % 32.00arrow_forwardGiven the following tax structure, what minimum tax would need to be assessed on Shameika to make the tax progressive with respect to effective tax rates? (Round your final answer to nearest whole dollar amount.) Muni-Bond Total Tax Salary $ 10,000 $ 50,000 Тахраyer Interest $ 600 $ 10,000 $ 30,000 Mihwah Shameika ??? Minimum taxarrow_forward

- Chuck, a single taxpayer, earns $75,400 in taxable income and $10,400 in interest from an investment in City of Heflin bonds. (Use the U.S. tax rate schedule.) Required: a. If Chuck earns an additional $40,000 of taxable income, what is his marginal tax rate on this income? b. What is his marginal rate if, instead, he had $40,000 of additional deductions? Note: For all requirements, do not round intermediate calculations. Round percentage answers to 2 decimal places. a. Marginal tax rate b. Marginal tax rate % %arrow_forwardDuring 2020, Joan Matel is a resident of Ontario, Canada and has calculated her Taxable Income to be $56,700. Assume that Ontario’s rates are 5.05 percent on Taxable Income up to $48,535 and 9.15 percent on the next $48,534. Calculate her 2020 federal and provincial Tax Payable before consideration of credits, and her average rate of tax.arrow_forwardCharlie's regular tax liability is $43,695. His tentative minimum tax is $58,304. He doesn't have any tax credits. What is the amount of Charlie's alternative minimum tax (AMT) and how much will he actually pay in tax for the current year?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education