FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

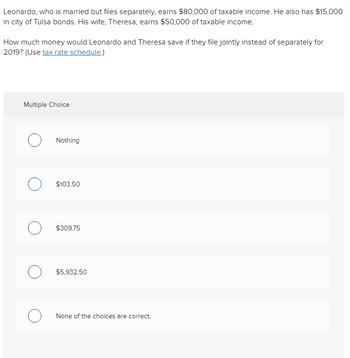

Transcribed Image Text:Leonardo, who is married but files separately, earns $80,000 of taxable income. He also has $15,000

in city of Tulsa bonds. His wife, Theresa, earns $50,000 of taxable income.

How much money would Leonardo and Theresa save if they file jointly instead of separately for

2019? (Use tax rate schedule.)

Multiple Choice

Nothing

O $103.50

о

$309.75

$5,932.50

None of the choices are correct.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 4 images

Knowledge Booster

Similar questions

- If Susie earns $750,000 in taxable income, how much tax will she pay as a single taxpayer for 2023? (Use tax rate schedule.) Multiple Choice $207,414 $277,500 $237,832 $189,625 None of the choices are correct.arrow_forwardKeith has a 2020 tax liability of $2,250 before taking into account his American Opportunity tax credit. He paid $2,600 in qualifying expenses, was a full-time student, was not claimed as a dependent on his parents' return, and his American Opportunity tax credit was not subject to phase-out. What is the amount of his American Opportunity tax credit allowed? a.$2,600 b.$0 c.$2,150 d.$2,250 e.$4,000arrow_forwardVishnuarrow_forward

- Marc, a single taxpayer, earns $60,000 in taxable income and $5,000 in interest from an investment in city of Birmingham bonds. Using the U.S. tax rate schedule for year 2023, what is his effective tax rate? ( Use tax rate schedule.) Note: Round your final answer to two decimal places. Multiple Choice 22 percent 13.09 percent 14.98 percent 10.62 percent None of the choices are correct. Don't use any AI. It's strictly prohibited.arrow_forward2Aarrow_forwardFelix and Freddie are married with annual taxable income of $230,000. They pay income tax according to the following schedule: over not tax rate 0 $43,850 15% $43,850 $105,950 ??? $105,950 $361,450 31% If the total personal income tax they pay is $58,695, which of the following comes closest to the tax rate for income between $43,850 and 105,950 (the middle tax rate)? Select one: a. 21% b. 24% c. 23% d. 22% e. 25%arrow_forward

- The Lees, a family of two adults and two dependent children under age 16, had a gross annual income of $72 comma 000.0072,000.00 for 20202020. Determine their standard deduction and child tax credit amounts, as well as their marginal and average tax rates, assuming their filing status is married filing jointly. Why is their average tax rate lower than their marginal rate?arrow_forwardLeonardo, who is married but files separately, earns $80,200 of taxable income. He also has $15,200 in city of Tulsa bonds. His wife, Theresa, earns $50,200 of taxable income. If Leonardo earned an additional $30,200 of taxable income this year, what would be the marginal tax rate on the extra income for 2020? (Use tax rate schedule.) (Round your final answer to two decimal places.) Multiple Choice O 22.02 percent 18.83 percent 24.02 percent 23.65 percent None of the choices are correctarrow_forwardClayton received a $140,000 distribution from his 401(k) account this year. Assuming Clayton's marginal tax rate is 25 percent, what is the total amount of tax and penalty Shauna will be required to pay if she receives the distribution on her 62nd birthday and she has not yet retired? Group of answer choices $0 $14,000 $35,000 $49,000 None of the choices is correct.arrow_forward

- Use the marginal tax rates in the table below to compute the tax owed in the following situation. The tax owed is S (Simplify your answer. Round to the nearest dollar as needed.) Marco is married filing separately with a taxable income of $67,900. Tax Rate 10% 15% 25% 28% 33% 35% 39.6% Standard deduction Exemption (per person) Married Filing Separately up to $9325 up to $37,950 up to $76,550 up to $116,675 up to $208,350 up to $235,350 above $235,350 $6350 $4050arrow_forwardRequired information [The following information applies to the questions displayed below.] Steve and Stephanie Pratt purchased a home in Spokane, Washington, for $400,000. They moved into the home on February 1 of year 1. They lived in the home as their primary residence until November 1 of year 1, when they sold the home for $500,000. The Pratts' marginal ordinary tax rate is 35 percent. (Leave no answer blank. Enter zero if applicable.) d. Assume the same facts as part (b), except that on December 1 of year 0 the Pratts sold their home in Spokane and excluded the $300,000 gain from income on their year 0 tax return. How much gain will the Pratts recognize on the sale of their Spokane home? Recognized gain on salearrow_forwardIndividual Retirement Accounts (LO 5.3) Phil and Linda are 25-year-old newlyweds and file a joint tax return. Linda is covered by a retirement plan at work, but Phil is not. If an amount is zero, enter "0". a. Assuming Phil's wages were $27,000 and Linda's wages were $18,500 for 2018 and they had no other income, what is the maximum amount of their deductible contributions to a traditional IRA for 2018? Phil $ Linda $ b. Assuming Phil's wages were $53,000 and Linda's wages were $70,000 for 2018 and they had no other income, what is the maximum amount of their deductible contributions to a traditional IRA for 2018? Phil $ Linda $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education