Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Solve this cost accounting question

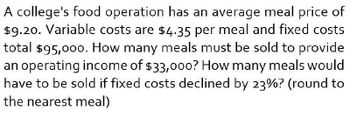

Transcribed Image Text:A college's food operation has an average meal price of

$9.20. Variable costs are $4.35 per meal and fixed costs

total $95,000. How many meals must be sold to provide

an operating income of $33,000? How many meals would

have to be sold if fixed costs declined by 23%? (round to

the nearest meal)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A college's food operation has an average meal price of $9.20. Variable costs are $4.35 per meal and fixed costs total $95,000. How many meals must be sold to provide an operating income of $33,000? How many meals would have to be sold if fixed costs declined by 23%? (round to the nearest meal) answer this accounting questionarrow_forwardA college's food operation has an average meal price of $9.20. Variable costs are $4.35 per meal and fixed costs total $95,000. How many meals must be sold to provide an operating income of $33,000? How many meals would have to be sold if fixed costs declined by 23%? (round to the nearest meal)arrow_forwardRound to the nearest mealarrow_forward

- Can you solve this financial accounting problem using appropriate financial principles?arrow_forwardNO WRONG ANSWERarrow_forwardProjected financial results for the university's cafeteria for next year are shown. Answer each of the following independent questions. Sales $944,000 Fixed Cost $597,000 Total Variable Cost $235, 470 Total Cost $832, 470 Net Income $111,530 (a) How much is the contribution margin and the contribution rate?(b) How much does the business need to sell to break even?(c) If the business was to spend $24,000 to upgrade their processes, how much does the business need to sell to break even?(d) If 9% more meals were sold, what would be the resulting net income?arrow_forward

- Can you explain the process for solving this financial accounting question accurately?arrow_forwardGood Times Restaurant estimates the following costs for next year: fixed costs $120,000, variable cost per meal $15. If they want to earn a profit of $90,000 and charge $35 per meal, calculate the required number of meals. Accounting 23arrow_forwardAssume the total monthly operating costs of a Hardee’s restaurant are: $35,000 + $0.75Xwhere X = Number of burgers ordered Determine the average cost per burger if the monthly volume of burgers ordered is 20,000.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College