FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Jay

Don't upload any image

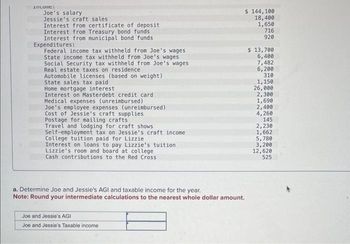

Transcribed Image Text:income:

Joe's salary

Jessie's craft sales

Interest from certificate of deposit

Interest from Treasury bond funds

Interest from municipal bond funds

Expenditures:

Federal income tax withheld from Joe's wages

State income tax withheld from Joe's wages

Social Security tax withheld from Joe's wages

Real estate taxes on residence

Automobile licenses (based on weight)

State sales tax paid

Home mortgage interest

Interest on Masterdebt credit card

Medical expenses (unreimbursed)

Joe's employee expenses (unreimbursed)

Cost of Jessie's craft supplies

Postage for mailing crafts

Travel and lodging for craft shows

Self-employment tax on Jessie's craft income

College tuition paid for Lizzie

Interest on loans to pay Lizzie's tuition

Lizzie's room and board at college

wwwww

Cash contributions to the Red Cross

$ 144, 100

18,400

1,650

716

920

a. Determine Joe and Jessie's AGI and taxable income for the year.

Note: Round your intermediate calculations to the nearest whole dollar amount.

Joe and Jessie's AGI

Joe and Jessie's Taxable income

$ 13,700

6,400

7,482

6,200

310

1,150

26,000

2,300

1,690

2,400

4,260

145

2,230

1,662

5,780

3,200

12,620

525

![Required information

[The following information applies to the questions displayed below.]

Joe and Jessie are married and have one dependent child, Lizzie. Lizzie is currently in college at State University. Joe

works as a design engineer for a manufacturing firm, while Jessie runs a craft business from their home. Jessie's craft

business consists of making craft items for sale at craft shows that are held periodically at various locations. Jessie spends

considerable time and effort on her craft business, and it has been consistently profitable over the years. Joe and Jessie

own a home and pay interest on their home loan (balance of $220,000) and a personal loan to pay for Lizzie's college

expenses (balance of $35,000)...

Neither Joe nor Jessie is blind or over age 65, and they plan to file as married joint. Assume that the employer portion of

the self-employment tax on Jessie's income is $831. Joe and Jessie have summarized the income and expenses they

expect to report this year as follows:

Income:

Joe's salary

Jessie's craft sales.

Interest from certificate of deposit

Interest from Treasury bond funds

Interest from municipal bond funds

Expenditures:

Federal income tax withheld from Joe's wages

State income tax withheld from Joe's wages

Social Security tax withheld from Joe's wages

Real estate taxes on residence

Automobile licenses (based on weight)

State sales tax paid

Home mortgage interest

Interest on Masterdebt credit card.

Medical expenses (unreimbursed)

Joe's employee expenses (unreimbursed)

Cost of Jessie's craft supplies

Postage for mailing crafts

Travel and lodging for craft shows.

****

Self-employment tax on Jessie's craft income.

College tuition paid for Lizzie

Interest on loans to pay Lizzie's tuition.

Lizzie's room and board at college.

Cash contributions to the Red Cross

$ 144,100

18,400

1,650

716

920

$ 13,700

6,400

7,482

6,200

310

1,150

26,000

2,300

1,690

2,400

4,260

145

2,230

1,662

5,780

3,200

12,620

525](https://content.bartleby.com/qna-images/question/4bc095e3-926a-48ec-be86-9359d4e19b6f/76f1c6ec-c084-4e6c-a824-9bd4dfb46a98/sq8i8ek_thumbnail.jpeg)

Transcribed Image Text:Required information

[The following information applies to the questions displayed below.]

Joe and Jessie are married and have one dependent child, Lizzie. Lizzie is currently in college at State University. Joe

works as a design engineer for a manufacturing firm, while Jessie runs a craft business from their home. Jessie's craft

business consists of making craft items for sale at craft shows that are held periodically at various locations. Jessie spends

considerable time and effort on her craft business, and it has been consistently profitable over the years. Joe and Jessie

own a home and pay interest on their home loan (balance of $220,000) and a personal loan to pay for Lizzie's college

expenses (balance of $35,000)...

Neither Joe nor Jessie is blind or over age 65, and they plan to file as married joint. Assume that the employer portion of

the self-employment tax on Jessie's income is $831. Joe and Jessie have summarized the income and expenses they

expect to report this year as follows:

Income:

Joe's salary

Jessie's craft sales.

Interest from certificate of deposit

Interest from Treasury bond funds

Interest from municipal bond funds

Expenditures:

Federal income tax withheld from Joe's wages

State income tax withheld from Joe's wages

Social Security tax withheld from Joe's wages

Real estate taxes on residence

Automobile licenses (based on weight)

State sales tax paid

Home mortgage interest

Interest on Masterdebt credit card.

Medical expenses (unreimbursed)

Joe's employee expenses (unreimbursed)

Cost of Jessie's craft supplies

Postage for mailing crafts

Travel and lodging for craft shows.

****

Self-employment tax on Jessie's craft income.

College tuition paid for Lizzie

Interest on loans to pay Lizzie's tuition.

Lizzie's room and board at college.

Cash contributions to the Red Cross

$ 144,100

18,400

1,650

716

920

$ 13,700

6,400

7,482

6,200

310

1,150

26,000

2,300

1,690

2,400

4,260

145

2,230

1,662

5,780

3,200

12,620

525

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- omework x ezto.mheducation.com/ext/map/index.html?_con3con&external_browser%3D0&launchUrl=https%253A%252F%252Ffaytechcc.blackboard.co.. Q E User Management,. H https://outlook.offi. FES Protection Plan System 7 - North C... ework Exercises Saved Help Bushard Company (buyer) and Schmidt, Inc. (seller), engaged in the following transactions during February 20X1: Bushard Company DATE TRANSACTIONS 20X1 Feb. 10 Purchased merchandise for $6,800 from Schmidt, Inc., Invoice 1980, terms 1/10, n/30. 13 Received Credit Memorandum 230 from Schmidt, Inc., for damaged merchandise totaling $380 that was returned; the goods were purchased on Invoice 1980, dated February 10. 19 Paid amount due to Schmidt, Inc., for Invoice 1980 of February 10, less the return of February 13 and less the cash discount, Check 2010. Schmidt, Inc. DATE TRANSACTIONS 20X1 Feb. 10 Sold merchandise for $6,800 on account to Bushard Company, Invoice 1980, terms 1/10, n/30. The cost of merchandise sold was $3,900. 13 Issued…arrow_forwardsignments: X M Question 7-C X work i FILE Paste ducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Flms.mheducation.com%252Fmg A1 Clipboard G 5 6 L EB- 7 HOME 8 9 10 11 12 13 Calibri B IU • INSERT : Font READY Attempt(s) X 11 Q Accounting Ex x PAGE LAYOUT Accounts Payable Accounts Receivable Cash Equipment Insurance Expense Operating Expense *** T A A Tutoring Revenue Unearned Revenue Y A. Other Expenses Other Revenues Rent Expense Salaries Expense Short-term Notes Payable Test Prep Revenue 5 B C D 1 The list below shows select accounts for Reading Readiness Company as of January 31, 20X1. Accounts are in alphabetical order.) 2 3 4 M Week 3 Anno X FORMULAS Saved S DATA % Alignment Number Conditional Format as Cell Formatting Table Styles Styles REVIEW ✓ fx The list below shows select accounts for Reading Readiness Company as of o Mail - Pedro X E # Editing m F + Sign In ▶ 100% Hint Help Sa A + Y CAarrow_forwardAutoSave On Exam 2 ch 14-16.xlsx - Saved - O Search Rolando Borjas Jr. 困 File Home Insert Page Layout Formulas Data Review View Help A Share P Comments E A I AutoSum - Fill v X Cut - A A° 22 Wrap Text Calibri 11 General B Copy Paste BIU v A v EEE E E E Merge & Center $ • % 9 8 -98 Conditional Format as Cell Insert Delete Format Sort & Find & Ideas Sensitivity S Format Painter Formatting v Table v Styles v O Clear v Filter v Select v Clipboard Font Alignment Number Styles Cells Editing Ideas Sensitivity AG28 fe P R S V Y AA АВ AC AD AE AF AG АН Al AJ AK AL AM AN AO AP AQ AR AS 16 The Annapolis Corporation's stockholders' equity accounts have the following balances as of January 1, 2016: 12% preferred stock, cumulative, $50 par, 10,000 shares issued and outstanding $ 500,000 5 Common stock, $10 par (100,000 shares issued and outstanding) 1,000,000 Additional paid-in capital: common 1,000,000 6 1,000,000 7 Retained earnings 3,750,000 8 Total stockholders' equity 6,250,000 9 10 Annapolis…arrow_forward

- File Paste C26 4 5 6 7 8 9 10 11 12 13 Clipboard Home Insert Page Layout 23 24 Cut Copy Format Painter 25 26 27 28 Readly H A Q 19 Z 1 X ✓ fix Current ratio Quick ratio Calibri BIU- Receivables turnover Inventory turnover Debt to equity ratio Return on assets Gross margin Profit margin Return on equity 2 AP12 10 AP12-14B Accessibility: Good to go. Type here to search A B C 1 AP12-14B (Analysis using selected ratios) 2 3 The UCW Furniture Inc. operates several stores selling pine furniture. Selected financial ratios are as follows: W S Formulas Data X 3 -11 ☆ 168- Fort E D + - A A A 2024 2.35 0.96 10.43 5.61 0.88 5.5% 8.7% 3.8% 14.2% C с $ 4410 4 Review View JL 23 R 19 F = === 14 15 16 In 2022, UCW Furniture Inc decided to change its strategy from selling high-end furniture to selling lower-cost items in order to be more competitive 17 and began importing low-cost furniture. In order to do this the company invested in new warehouse facilities and its total assets grew from 18 $2.5…arrow_forwardCan you send another picture or write it down cuz i dont understandarrow_forwardAutoSave Normal 因 Document1 - Word Search badiya aldujaili ff BА EN File Home Insert Draw Design Layout References Mailings Review View Help A Share O Comments X Cut Calibri (Body) v 11 - A^ A Aav A E E O Find - AaBbCcDc AaBbCcDc AABBCC AABBCCC AaB AABBCCC AaBbCcDa 自Copy Paste S Replace В IUvab х, х* А 1 Normal 1 No Spac. Heading 1 Heading 2 Title Subtitle Subtle Em.. A Select v Dictate Editor Format Painter Clipboard Font Paragraph Styles Editing Voice Editor 2 3 4 Winter Company reported the following for the most recent month: Physical Units 700 Beginning work in process (60% complete) Units transferred in (started) during month Ending work in process 4,800 950 Materials are added at the end of the process and conversion costs are added evenly throughout the process. If equivalent whole units of production for conversion using the weighted average were 4,816, what percent complete was ending work in process at the end of the month? (Round to the nearest whole percent.) а. 20% b. 16%…arrow_forward

- ne File Edit View History Bookmarks Profiles Tab Window Help M Inbox (2 x MACC101 x (4726) || X Account x| Account X WiConnec× M Question X Content c ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%2 Chapter 7 Quiz i 7 7.58 points Ask Mc Graw Hill Saved QS 7-13 (Algo) Indicating journals used for posting LO P1, P2, P3, P4 The following T-accounts show postings of selected transactions. Indicate the journal used in recording each of these postings a through e. Cash Accounts Receivable Inventory Debit (d) 700 Credit (e) Debit 340 (b) 1,700 Credit (d) Debit Credit 700 (a) 1,520 (c) 1,040 Accounts Payable Sales Debit (e) 340 Credit (a) Debit 1,520 Credit (b) Cost of Goods Sold Credit Debit 1,700 (c) 1,040 Transaction a. b. C. d. e. Journal 12.020 ANE 18 tv Aarrow_forward%24 %23 AutoSave H UnitllILabAssignment Question8 Protected View O Search (Alt+Q) Off Home Insert Draw Page Layout Formulas Data Review View Help PROTECTED VIEW Be careful-files from the Internet can contain viruses. Unless you need to edit, it's safer to stay in Protected View. Enable Editing :X v fx Function: SUM; Formula: Multiply, Subtract; Cell Referencing D E B. C. F. H. Function: SUM; Formula: Multiply, Subtract; Cell Referencing B Using Excel to Determine Dividends Paid to Common 4 and Preferred Stockholders Student Work Area Required: Provide input into cells shaded in yellow in this template. Use mathematical formulas with cell references to the Problem or work 5 PROBLEM 6 M. Bot Corporation has common stock and cumulative 7 preferred stock outstanding at December 31, 2022. No 8 dividends were declared in 2020 or 2021. area as indicated. What amount of dividends will common stockholders receive? Total dividend payment in 2022 $ 375,000 11 Preferred stock par value Annual…arrow_forwardLutoSave 日 Off UnitlILabAssignment_Question1 O Search (Alt-Q) Protected View Home Insert Draw Page Layout Formulas Data Review View Help PROTECTED VIEW Be careful-files from the Internet can contain viruses. Unless you need to edit, it's safer to stay in Protected View. Enable Editing fx Formula: Multiply, Subtract; Cell Referencing A D E F G H. K Formula: Multiply, Subtract; Cell Referencing Using Excel to Record Stock Entries Student Work Area PROBLEM Required: Provide input into cells shaded in yellow in this template. Select account names from the drop-down lists. Use cell references to the data area. Use mathematical formulas to calculate any amounts not given. On May 10, Jack Corporation issues common stock for cash. Shares of stock issued Par value per share 2,000 24 %24 10.00 Amount at which stock issued 18.00 Journalize the issuance of the stock. 10 11 Date Debit Credit 12 May 10 13 14 15 16 17 18 19 20 21 22 23 25 26 27 28 29 30 31 32 33 Enter Answer Ready 24arrow_forward

- 同 Mail - Edjouline X Bb Content- ACG2 X CengageNOWv X (58) YouTube + Microsoft Office X PowerPoint from Towards a A v2.cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker%=Dassignments&takeAssignmentSessionLocator=assignment-take&inpro. of mail YouTube Maps eBook Show Me How apter Nine Determine Due Date and Interest on Notes .09-03.BLANKSHEET Determine the due date and the amount of interest due at maturity on the following notes: L09-04.BLANKSHEET Date of Note Face Amount Interest Rate Term of Note 09-03.ALGO January 10* $40,000 90 days a. b. March 19 180 days 000 8. 09-04.ALGO June 5 30 days 000'06 d. September 8 90 days 90-60 3. 000'9E e. November 20 60 days 9-11 4. 000' *Assume that February has 28 days. 9-12 Assume 360-days in a year when computing the interest. -19 Note Due Date Interest > -20 (2) (b) 9-22 -24 (p) (a) 890- 8/12 items Check My Work ( Previous Next LE V O 10: Narrow_forward* CengageNOWv2 | Online teachin X b Home | bartleby x + A v2.cengagenow.com/iln/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false * D 9 : M Gmail O YouTube Maps Blackboard HW #9 - Chpt 21 O eBook Show Me How E Print Item 1. TMM.21.01 Contribution Margin and Contribution Margin Ratio For a recent year, Wicker Company-owned restaurants had the following sales and expenses (in millions): 2. TMM.21.02 Sales $14,100 3. TMM.21.03 Food and packaging $5,994 Рayroll 3,600 4. TMM.21.04 Occupancy (rent, depreciation, etc.) 1,986 5. EX.21,01 General, selling, and administrative expenses 2,100 $13,680 6. EX.21.02 Income from operations $420 7. EX.21.03 Assume that the variable costs consist of food and packaging; payroll; and 40% of the general, selling, and administrative expenses. 8. EX.21.06.ALGO a. What is Wicker Company's contribution margin? Round to the nearest million. (Give answer in millions of dollars.) million 9. EX.21.09.ALGO b. What is Wicker…arrow_forwardFile Edit View History Bookmarks Profiles estion 4 - Proctoring Enable X getproctorio.com/secured #lockdown ctoring Enabled: Chapter 6 Homework Assignm... i 4 kipped ic raw 511 F CUNY Login 2 Req 1 Req 2 to 4 #3 Complete this question by entering your answers in the tabs below. с Tab How many performance obligations are in this contract? Number of performance obligations $ Window Help st X 4 Barrick Gold Corporation is a mining company that produces gold and copper with 16 operating sites in 13 countries. It is headquartered in Toronto, Ontario, Canada. On March 1, 2024, Barrick Gold receives $150,000 from Citizen Bank and promises to deliver 95 units of certified 1-ounce gold bars on a future date. The contract states that ownership passes to the bank when Barrick Gold delivers the products to Brink's, a third-party carrier. In addition, Barrick Gold has agreed to provide a replacement shipment at no additional cost if the product is lost in transit. The stand-alone price of a gold…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education