FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:File

Paste

C26

4

5

6

7

8

9

10

11

12

13

Clipboard

Home Insert Page Layout

23

24

Cut

Copy

Format Painter

25

26

27

28

Readly

H

A

Q

19

Z

1 X ✓ fix

Current ratio

Quick ratio

Calibri

BIU-

Receivables turnover

Inventory turnover

Debt to equity ratio

Return on assets

Gross margin

Profit margin

Return on equity

2

AP12 10 AP12-14B

Accessibility: Good to go.

Type here to search

A

B

C

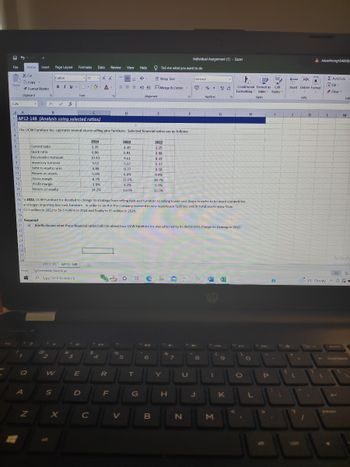

1 AP12-14B (Analysis using selected ratios)

2

3 The UCW Furniture Inc. operates several stores selling pine furniture. Selected financial ratios are as follows:

W

S

Formulas Data

X

3

-11

☆

168-

Fort

E

D

+

- A A

A

2024

2.35

0.96

10.43

5.61

0.88

5.5%

8.7%

3.8%

14.2%

C

с

$

4410

4

Review View

JL

23

R

19

F

=

===

14

15

16 In 2022, UCW Furniture Inc decided to change its strategy from selling high-end furniture to selling lower-cost items in order to be more competitive

17 and began importing low-cost furniture. In order to do this the company invested in new warehouse facilities and its total assets grew from

18 $2.5 million in 2022 to $4.5 million in 2023 and finally to $5 million in 2024.

19

20 Required

21

a) Briefly discuss what these financial ratios indicate about how UCW Furniture Inc was affected by its decision to change its strategy in 2022.

22

%

=

D

2023

2.30

0.91

V

5

9.61

5.37

0.77

6.0%

12.6%

4.2 %

13.0%

Help

T

2

G

Alignment

40

ab Wrap Text

6

B

Tell me what you want to do

Merge & Center

F

2022

2.25

0.88

8.69

5.07

0.58

9.8%

18.7%

6.9%

12.0%

Y

4

&

H

TM

F

7

F

N

Individual Assignment (1) - Excel

U

General

2

8

%;

J

Number

Nov 144

1

M

00

G

(

9

G

K

13

I

S

Conditional Format as Cell

Formatting Table Styles

Styles

>

O

H

O

L

P

1

(?)

:

{

TE EX

H

E

Insert Delete Format

J

Cells

1

K

A aayushisingh54890

.

3°C Cloudy

1

Σ AutoSum -

Fill

✓Clear

L

Edit

M

Activate

3

20

Transcribed Image Text:→

File

Paste

C26

4A

37

38

39

40

41

42

43

44

45

46

47

48

52

53

54

H

Cipboard

55

56

Home Insert Page Layout

Cut

Copy-

Format Painter

57

58

59

60

61

62

63

64

Ready

#

A

Q

▾

N

G

1 X ✓ fx

B

Calibri

2

BIU.

AP12-1B AP12-14B

Accessibility: Good to go

Type here to search

alt

W

S

b) Which measures have deteriorated during the subsequent periods?

49

50

51

c) Which ratios indicate positive action taken by UCW Furniture Inc during the subsequent periods?

X

Formulas Data Review View Help

#

3

-11

84 -

Font

E

D

C

- A A

А.

&

C

$

"10

4

G

R

F

=

%

SE

H

D

5

O E

V

T

← →

G

Alignment

40

6

E

B

Tell me what you want to do

Wrap Text

Merge & Center -

&

H

7

U

N

Individual Assignment (1) - Excel

6

General

2. % '

8

J

Number

to 144

1

M

+0

.00 +4

G

9

D

Conditional Format as

.co

Cell

Formatting Table Styles

Styles

K

F

11

O

H

O

L

P

I

?

FE

EB

Insert Delete Format

J

?

=

EX

Cells

A aayushis

K

1

3°C Cloudy

WE

L

Σ

F

C

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- Solve this problemarrow_forwardPlease provide the correct answerarrow_forwardRETURN ON EQUITY AND QUICK RATIO Lloyd Inc. has sales of $200,000, a net income of $15,000, and the following balance sheet: REFER IMAGE The new owner thinks that inventories are excessive and can be lowered to the point where the current ratio is equal to the industry average, 25×, without affecting sales or net income. If inventories are sold and not replaced (thus reducing the current ratio to 25×); if the funds generated are used to reduce common equity (stock can be repurchased at bookvalue); and if no other changes occur, by how much will the ROE change? What will be the firm’s new quick ratio?arrow_forward

- Find the financial leverage and ROS for Potbelly Corp 2015. Formulas: Financial leverage = Average Total Assets / Average Shareholder’s Equity ROS = Net Income / Salesarrow_forwardApo Don't upload any image pleasearrow_forwardSuppose the Board of Directors of Baldwin mandates that management take measures to increase financial leverage next year. Assuming revenue and profits remain the same, and assets are reduced by 20% through efficiency gains. What will the next year's ROE be if leverage increases by 20%? Baldwin currently ROE is 3.1 Group of answer choices A) 7.8% B) 12.9% C) 4.65% D) 10.3%arrow_forward

- Do not give answer in imagearrow_forwardHaresharrow_forwardA Beta 1.10 Market Capitalization = 122.548B Book Value of Debt = 93.21B Bond Price = 103.10 Interest Rate = 2.75% Maturity = 20 years Therefore - PV = -1,031.00; FV = 1,000; PMT = 27.50; N = 20; CPT I = 2.55% Tax rate 21% Current One Year Treasury Bill Rate (Risk-free Rate) = 5% Market Return: Estimated at 8% Step 1 Calculate the WACC for Deere and Company (DE) given: Step 2 Step 3 Step 4 Search What are the weightings for Equity and Debt? What is the Cost of Equity? What is the After-Tax Cost of Debt? What is the WACC?arrow_forward

- Provide correct solutionarrow_forwardCandlemania, Inc. is a maker of scented candles in decorative containers. During 2020, the company sold 30,000 candles at a sales price of $120 each. Following are the 2022 financial results: Candlemania, Inc. Contribution Format Income Statement For the Year 2022 $ 3,600,000 Sales Less variable costs: Direct mate 540,000 Direct laboi 600,000 Variable ov 660,000 Total variable costs Contribution Margin Less fixed costs: 1,800,000 $ 1,800,000 500,000 $ 1,300,000 Income before taxes You are the top managerial accountant at Candlemania, and are scheduled to meet with the company's CEO next week to discuss the financial outlook for 2023. In particular, the CEO will want to know what steps the company might take to improve its 2022 income performance. You expect to be asked questions about the impact that various changes in sales price, sales volume, and costs would have on the company's contribution margin, breakeven point, margin of safety, and income. In addition, the CEO is likely to…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education