FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

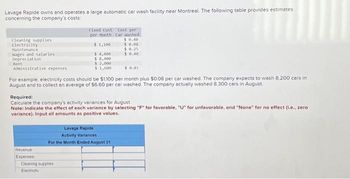

Transcribed Image Text:Lavage Rapide owns and operates a large automatic car wash facility near Montreal. The following table provides estimates

concerning the company's costs:

Cleaning supplies

Electricity

Maintenance

Wages and salaries

Depreciation

Rent

Administrative expenses

$ 0.01

For example, electricity costs should be $1,100 per month plus $0.08 per car washed. The company expects to wash 8,200 cars in

August and to collect an average of $6.60 per car washed. The company actually washed 8.300 cars in August.

Fixed Cost Cost per

per Month Car Washed

$0.40

$ 0.08

$1,100.

$ 0.25

$ 4,400

$ 0.40

$ 8,400

Revenue

Expenses

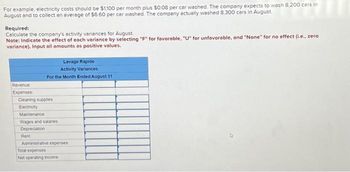

Required:

Calculate the company's activity variances for August

Note: Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero

variance). Input all amounts as positive values.

$2,000

$1,600

Cleaning supplies

Electricity

Lavage Rapide

Activity Variances

For the Month Ended August 31

Transcribed Image Text:Lavage Rapide owns and operates a large automatic car wash facility near Montreal. The following table provides estimates

concerning the company's costs:

Cleaning supplies

Electricity

Maintenance

Wages and salaries

Depreciation

Rent

Administrative expenses

$ 0.01

For example, electricity costs should be $1,100 per month plus $0.08 per car washed. The company expects to wash 8,200 cars in

August and to collect an average of $6.60 per car washed. The company actually washed 8.300 cars in August.

Fixed Cost Cost per

per Month Car Washed

$0.40

$ 0.08

$1,100.

$ 0.25

$ 4,400

$ 0.40

$ 8,400

Revenue

Expenses

Required:

Calculate the company's activity variances for August

Note: Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero

variance). Input all amounts as positive values.

$2,000

$1,600

Cleaning supplies

Electricity

Lavage Rapide

Activity Variances

For the Month Ended August 31

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- JPAK manufactures and sells mountain bikes. It operates eight hours a day, five days a week. Using this information,classify each of the following costs as fixed or variable with respect to the number of bikes made. Gas used for heatingarrow_forwardIm having an issue with this problem. Thank you!arrow_forwardVinubhaiarrow_forward

- Espresso Express operates a number of espresso coffee stands in busy suburban malls. The fixed weekly expense of a coffee stand is $1.300 and the variable cost per cup of coffee served is $0.56. Required: 1. Fill in the following table with your estimates of the company's total cost and average cost per cup of coffee at the indicated levels of activity. 2. Does the average cost per cup of coffee served increase, decrease, or remain the same as the number of cups of coffee served in a week increases? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Fill in the following table with your estimates of the company's total cost and average cost per cup of coffee at the indicated levels of activity. Note: Round the "Average cost per cup of coffee served" to 3 decimal places. Cups of Coffee Served in a Week 2,500 Fixed cost Variable cost Average cost per cup of coffee served 2,400 0 $ Required 1 0 $ 2,600 Required 2 >arrow_forwardLavage Rapide is a Canadian company that owns and operates a large automatic car wash facility near Montreal. The following table provides data concerning the company's costs: Cleaning supplies Electricity Maintenance Wages and salaries Depreciation Administrative expenses Rent For example, electricity costs are $1,200 per month plus $0.09 per car washed. The company actually washed 8,400 cars in August and collected an average of $6.50 per car washed. Required: Prepare the company's flexible budget for August. Lavage Rapide Flexible Budget For the Month Ended August 31 Actual cars washed Revenue Expenses: Cleaning supplies Electricity Maintenance Fixed Cost per Month $ 1,200 $ 4,400 $ 8,000 $ 1,800 $ 1,600 Wages and salaries Depreciation Rent Cost per Car Washed $ 0.50 $ 0.09 $ 0.20 $ 0.20 Administrative expenses $ 0.04arrow_forwardDineshbhaiarrow_forward

- Lavage Rapide owns and operates a large automatic car wash facility near Montreal. The following table provides estimates concerning the company's costs: Cleaning supplies Electricity Maintenance Wages and salaries Depreciation Rent Administrative expenses. $ 0.03 For example, electricity costs should be $1,000 per month plus $0.07 per car washed. The company expects to wash 8.300 cars in August and to collect an average of $6.20 per car washed. The actual operating results for August are as follows: Lavage Rapide Income Statement Actual cars washed Revenue Expenses: For the Month Ended August 31 Cleaning supplies Electricity Maintenance Wages and salaries Depreciation Rent Fixed Cost Cost per per Month Car Washed $ 0.70 $1,000 $ 0.07 $0.10 $.0.30 $ 4,300 $ 8,200 $2,100 $ 1,700 Administrative expenses Total expenses Het operating income 8,400 $53,560 6,310 1,551 1,070 7,150 8,200 2.300 1,849 28,430 $ 25,110arrow_forwardEspresso Express operates a number of espresso coffee stands in busy suburban malls. The fixed weekly expense of a coffee stand is $1,400 and the variable cost per cup of coffee served is $0.54. 1. Fill in the following table with your estimates of the company's total cost and average cost per cup of coffee at the indicated levels of activity. 2. Does the average cost per cup of coffee served increase, decrease, or remain the same as the number of cups of coffee served in a week increases? Fill in the following table with your estimates of the company's total cost and average cost per cup of coffee at the indicated levels of activity. (Round the "Average cost per cup of coffee served" to 3 decimal places.) Cups of Coffee Served in a Week 1,000 1,100 1,200 Fixed cost Variable cost Total cost $0 $0 $0 Average cost per cup of coffee servedarrow_forwardAuto Lavage is a Canadian company that owns and operates a large automatic carwash facility near Quebec. The following table provides data concerning the company's costs: Cleaning supplies Electricity Maintenance Wages and salaries Depreciation Rent Administrative expenses Variable expenses: Total variable expenses Fixed expenses: Fixed Cost per Month Total fixed expenses $1,600 4,900 8,500 2,300 2,000 The company expects to charge customers an average of $6.10 per car washed. Required: Prepare a flexible budget for October assuming either 9,000 or 10,000 cars are washed. AUTO LAVAGE INC. Flexible Budget For the Month Ended October 31 Budgeted Amount Per Unit (per car) Cost per Car Washed $0.99 0.30 8.50 0.68 9,000 Cars Washed 0.07 10,000arrow_forward

- Espresso Express operates a number of espresso coffee stands in busy suburban malls. The fixed weekly expense of a coffee stand is $2,000 and the variable cost per cup of coffee served is $0.51. Required: 1. Fill in the following table with your estimates of the company's total cost and average cost per cup of coffee at the indicated levels of activity. 2. Does the average cost per cup of coffee served increase, decrease, or remain the same as the number of cups of coffee served in a week increases? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Fill in the following table with your estimates of the company's total cost and average cost per cup of coffee at the indicated levels of activity. (Round the "Average cost per cup of coffee served" to 3 decimal places.) Fixed cost Variable cost Total cost Average cost per cup of coffee served $ Cups of Coffee Served in a Week 1,300 1,200 0 $ Required 1 0 $ 1,400 Required 2 > 0arrow_forwardPlease help me. Thankyou.arrow_forwardAn example of an uncontrollable cost would include all of the following except ________. A) hourly rate of pay for the company's purchasing manager B) federal income tax rate paid by the company C) real estate taxes charged by the county in which the business operates D) per-gallon cost of fuel for the company's delivery trucksarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education