FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

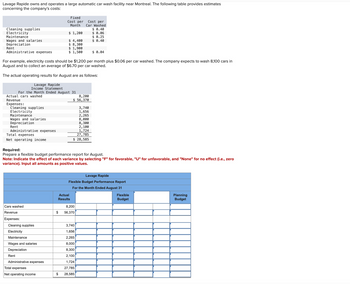

Transcribed Image Text:Lavage Rapide owns and operates a large automatic car wash facility near Montreal. The following table provides estimates

concerning the company's costs:

Cleaning supplies

Electricity

Maintenance

Wages and salaries.

Depreciation

Administrative expenses

Rent

Actual cars washed

Revenue

Expenses:

For example, electricity costs should be $1,200 per month plus $0.06 per car washed. The company expects to wash 8,100 cars in

August and to collect an average of $6.70 per car washed.

The actual operating results for August are as follows:

Lavage Rapide

Income Statement

For the Month Ended August 31

Cleaning supplies

Electricity

Maintenance

Wages and salaries

Depreciation

Rent

Administrative expenses

Total expenses

Net operating income

Cars washed

Revenue

Expenses:

Cleaning supplies

Electricity

Maintenance

Wages and salaries

Depreciation

Rent

Fixed

Cost per Cost per

Month Car Washed

$0.40

$ 1,200

$ 0.06

$ 0.25

$ 0.40

$4,400

$ 8,300

$1,900

$1,500

Administrative expenses

Total expenses

Net operating income

Required:

Prepare a flexible budget performance report for August.

Note: Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero

variance). Input all amounts as positive values.

8,200

$ 56,370

Actual

Results

$

8,000

8,300

2,100

1,724

27,785

$ 28,585

3,740

1,656

2,265

8,200

$ 56,370

$ 0.04

Lavage Rapide

Flexible Budget Performance Report

For the Month Ended August 31

3,740

1,656

2,265

8,000

8,300

2,100

1,724

27,785

28,585

Flexible

Budget

Planning

Budget

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Leander Office Products Inc. produces and sells small storage and organizational products for office use. During the first month of operations, the products sold well. Andrea Leander, the owner of the company, was surprised to see a loss for the month on her income statement. This statement was prepared by a local bookkeeping service recommended to her by her bank manager. The statement follows: LEANDER OFFICE PRODUCTS INC. Income Statement Sales (43,000 units) Variable expenses: Variable cost of goods sold✶ Variable selling and administrative expenses Contribution margin Fixed expenses: Fixed manufacturing overhead Fixed selling and administrative expenses Operating loss $253,700 $116,530 49,880 166,410 87,290 89,586 17,200 106,786 $(19,496) *Consists of direct materials, direct labour, and variable manufacturing overhead. Leander is discouraged over the loss shown for the month, particularly since she had planned to use the statement to encourage investors to purchase shares in the…arrow_forwardThe following table provides data concerning a company’s costs: Fixed Cost per Month Cost per Car Washed Cleaning supplies $ 0.40 Electricity $ 1,400 $ 0.08 Maintenance $ 0.15 Wages and salaries $ 4,900 $ 0.30 Depreciation $ 8,400 Rent $ 1,800 Administrative expenses $ 1,400 $ 0.04 For example, electricity costs are $1,400 per month plus $0.08 per car washed. The company expects to wash 8,000 cars in August and to collect an average of $6.10 per car washed. Prepare the company’s planning budget for August. Budgeted Cars Washed Revenue Expenses: Cleaning Supplies Electricity Maintenance Wages and Salaries Depreciation Rent Administrative Expenses Total Expenses Net Operating Income $arrow_forwardSolve the following problem: The service department at Major Motors sold $48,000 in service last month. They had direct labor costs of $16,500 to pay their technicians. They were not given credit for any parts sales or expenses because that was the responsibility of their separate parts department. They were, however, allocated $29,250 in fixed expenses. What was Major Motors net profit?arrow_forward

- Vdarrow_forwardGlass time repairs chips in car windshields. The company incurred the following operating cost for the month of March 2024 Glass time earned $28,000 in service revenues for the month of March by repairing 250 windshields. All cost shown are considered to be directly related to the repair service. 1) prepare an income statement for the month of March 2) compute the cost per unit of repairing one windshield 3) the manager of glass time must keep the unit operating costs below $60 per windshield in order to get his bonus. Did he meet the goal?arrow_forwardJake's Roof Repair has provided the following data concerning its costs: Fixed Cost Cost per per Month Repair-Hour Wages and salaries Parts and supplies $ 21,400 $ 15.00 $ 7.20 Equipment depreciation $ 2,740 $ 0.55 Truck operating expenses Rent $ 5,720 $ 1.70 $ 4,660 $ 3,880 $ 0.70 Administrative expenses For example, wages and salaries should be $21,400 plus $15.00 per repair-hour. The company expected to work 2,700 repair-hours in May, but actually worked 2,600 repair-hours. The company expects its sales to be $47.00 per repair-hour. Required: Compute the company's activity variances for May. Note: Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values. Revenue Expenses: Jake's Roof Repair Activity Variances For the Month Ended May 31 Wages and salaries Parts and supplies Equipment depreciation Truck operating expenses Rent Administrative expenses Total expense Net…arrow_forward

- Lavage Rapide owns and operates a large automatic car wash facility near Montreal. The following table provides estimates concerning the company's costs: Cleaning supplies Electricity Maintenance Rent Wages and salaries. Depreciation Administrative expenses For example, electricity costs should be $1,300 per month plus $0.08 per car washed. The company expects to wash 8,000 cars in August and to collect an average of $6.70 per car washed. The company actually washed 8,100 cars in August. Revenue Expenses: Fixed Cost per Cost per Month Car Washed $ 1,300 $4,400 $ 8,300 $2,000 $ 1,700 Lavage Rapide Activity Variances For the Month Ended August 31 Cleaning supplies Electricity Maintenance Wages and salaries Depreciation Rent $ 0.70 $ 0.08 Required: Calculate the company's activity variances for August. Note: Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values.…arrow_forwardCullumber provides environmentally friendly lawn services for homeowners. Its operating costs are as follows. Depreciation (straight-line) Advertising Insurance $1,400 per month $300 per month $3,130 per month Weed and feed materials $14 per lawn Direct labor Fuel $12 per lawn $2 per lawn Cullumber charges $70 per treatment for the average single-family lawn. For the month ended July 31, 2027, the company had total sales of $8,400. (a) Prepare a CVP income statement for the month ended July 31, 2027. CULLUMBER $ Total CVP Income Statement $ $ Per Unit Percent of Salesarrow_forwardLavage Rapide is a Canadian company that owns and operates a large automatic car wash facility near Montreal. The following table provides estimates concerning the company's costs: Cleaning supplies Electricity Maintenance Wages and salaries Depreciation Rent Administrative expenses For Actual cars washed Revenue For example, electricity costs should be $1,400 per month plus $0.08 per car washed. The company expects to wash 8,300 cars in August and to collect an average of $6.00 per car washed. The actual operating results for August are as follows: Lavage Rapide Income statement the Month Ended August 31 Expenses: Cleaning supplies Electricity Maintenance Wages and salaries Depreciation Rent Administrative expenses Total expense Net operating income Fixed Cost Cost per per Month Car Washed $ 0.60 $ 1,400 $ 0.08 $ 0.25 $ 4,400 $ 0.30 $ 8,000 $ 2,200 $ 1,700 Cars washed Revenue Expenses: Cleaning supplies Electricity Maintenance 8,400 $ 51,900 Required: Prepare a flexible budget…arrow_forward

- Jake's Roof Repair has provided the following data concerning its costs: Fixed Cost per Month $ 23, 200 Cost per Repair-Hour $16.30 $ 8.60 $ 0.40 $ 1.70 Wages and salaries Parts and supplies Equipment depreciation Truck operating expenses Rent Administrative expenses Revenue Expenses: $ 1,600 $ 6,400 For example, wages and salaries should be $23,200 plus $16.30 per repair-hour. The company expected to work 2,800 repair-hours in May, but actually worked 2,900 repair-hours. The company expects its sales to be $44.50 per repair-hour. $ 3,480 $ 4,500 Required: Compute the company's activity variances for May. (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values.) Wages and salaries Parts and supplies Equipment depreciation Truck operating expenses Rent Jake's Roof Repair Activity Variances For the Month Ended May 31 Administrative expenses Total expense Net operating…arrow_forward(b) Determine the company's break-even point in (1) number of lawns serviced per month and (2) sales dollars. (1) Break-even point in lawns (2) Break-even point in dollars $arrow_forwardJake's Roof Repair has provided the following data concerning its costs: Fixed Cost Cost per per Month Repair-Hour $ 21,500 $ 15.00. $7.30 Wages and salaries Parts and supplies Equipment depreciation Truck operating expenses Rent Revenue Expenses: Administrative expenses $ 0.50 For example, wages and salaries should be $21,500 plus $15.00 per repair-hour. The company expected to work 3,000 repair-hours in May, but actually worked 2,900 repair-hours. The company expects its sales to be $54.00 per repair-hour. $ 2,760 $ 5,740 Required: Compute the company's activity variances for May. (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (.e., zero variance). Input all amounts as positive values.) Wages and salaries Parts and supplies Equipment depreciation Truck operating expenses Rent $ 4,630 $ 3,820 Jake's Roof Repair Activity Variances For the Month Ended May 31 Administrative expenses Total expense Net operating income $…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education