Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Provide correct answer general Accounting question

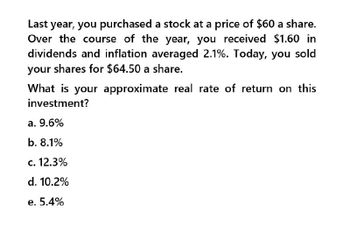

Transcribed Image Text:Last year, you purchased a stock at a price of $60 a share.

Over the course of the year, you received $1.60 in

dividends and inflation averaged 2.1%. Today, you sold

your shares for $64.50 a share.

What is your approximate real rate of return on this

investment?

a. 9.6%

b. 8.1%

c. 12.3%

d. 10.2%

e. 5.4%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Last year, you purchased a stock at solve this questionarrow_forwardToday, you sold your Riot Blockchain, Inc stock (ticker: RIOT) for $54.5/share. Last year, you paid $51.5/share for that stock. During the year, RIOT paid you $2/share in dividends. If inflation averaged 2.8% during the year, your approximate real rate of return on the RIOT investment is: a. 12.5 percent b. 9.7 percent c. 12.2 percent d. 3.5 percent e. 6.9 percentarrow_forwardFinancial accountingarrow_forward

- You presently own stock that you purchased one year ago. Your return on the stock for the past year was 20%. You calculate your real return on investment was 12.15%. The rate of inflation must have been Select one: О a.5% O b. 7% O c.3% O d.11% O e. 9%arrow_forwardYou purchased a stock at a price of $24. A year later the stock is worth $29, and during the year it paid $1.0 in dividends. What was the rate of return you earned on this investment? Show your answer in percent (but without the percent sign), and to one decimal place. E.g. 4.67% should be inputted as 4.7arrow_forward2. Answer both questions: a. You purchase 100 shares of stock for $40 a share. The stock pays a $2 per share dividend at year-end. What is the rate of return on your investment if the year-end stock prices turn out to be $38, $40, and $42? What is your real (inflation-adjusted) rate of return in each case, assuming an inflation rate of 3%? b. Consider the following information on the returns on stock and bond investment. Scenario Profitability Stocks Bonds Recession .2 -5% +14% Normal Economy .6 +15% +8% Boom .2 +25% +4% i) Calculate the expected rate of return and standard deviation in each investment. ii) Do your results support or contradict the historical record on the relationship between risk and return in the financial market in both Canada and the United States? iii) Which investment would you prefer? Explain your answer.arrow_forward

- You bought a stock at $22 last year. After one year, you received a dividend of $0.61 and then sold the stock for $30. What was your rate of return on this investment? a. 36.36% b. 43.05% c. 39.14% d. 26.12% e. 28.70%arrow_forwardOne year ago, you bought a stock for $50.39 a share. You received a dividend of $2.97 per share last month and sold the stock today for $49.58 a share. What is the capital gains yield (in percent) on this investment? Correct pls.arrow_forwardYou purchase 100 shares of stock for $25 a share. The stock pays a $3 per share dividend at year-end. a. What is the rate of return on your investment if the end-of-year stock price is (i) $22; (ii) $25; (iii) $26? b. What is your real (inflation-adjusted) rate of return if the inflation rate is 2%?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT