Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN: 9781285190907

Author: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

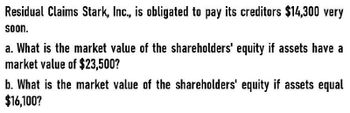

Residual Claims Stark, Inc., is obligated

Transcribed Image Text:Residual Claims Stark, Inc., is obligated to pay its creditors $14,300 very

soon.

a. What is the market value of the shareholders' equity if assets have a

market value of $23,500?

b. What is the market value of the shareholders' equity if assets equal

$16,100?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Assume that the Kelso Company operates in an industry for which NOL carryback is allowed. The Kelso Company had the following operating results: O $22,800. Year 2019 2020 2021 25% What is the income tax refund receivable? O $24,300 O $28,800. Income (loss) 54,000 57,000 (72,000) O 23,550. Tax rate 35% 30% Income tax 18,900first year of operations 17,100 0arrow_forwardAssume you are given the following relationships for the Haslam Corporation:Sales/total assets 1.2Return on assets (ROA) 4%Return on equity (ROE) 7%Calculate Haslam’s profit margin and liabilities-to-assets ratio. Suppose half its liabilities are in the form of debt. Calculate the debt-to-assets ratio.arrow_forwardGeneral Accountingarrow_forward

- 4. Given: Operating Income (or EBIT) Dividends Income Dividends Distributed to Shareholders Interest Expenses Interest Income $500,000 100,000 125,000 220,000 30,000 50,000 Net Realized Capital Gain Calculate the taxable income given the above information, assume that adjusted taxable income is the same as the taxable income.arrow_forwardroaarrow_forwardQuestions from no. 9 to no. 11 are based on the following fact. Boulder, Inc., obtained 90 percent of Rock Corporation on January 1, 2016. Annual amortization of $22,000 is applicable on the allocations of Rock's acquisition-date business fair value. On January 1, 2017, Rock acquired 75 percent of Stone Company's voting stock. Excess business fair-value amortization on this second acquisition amounted to $8,000 per year. For 2018, each of the three companies reported the following information accumulated by its separate accounting. system. Separate operating income figures do not include any investment or dividend income: Separate Operating Boulder Rock Stone Income $245,000 85,000 150,000 Dividends Declared $120,000 28,000 42,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi...

Finance

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning