ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

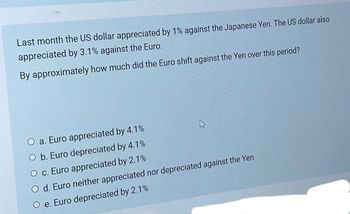

Transcribed Image Text:Last month the US dollar appreciated by 1% against the Japanese Yen. The US dollar also

appreciated by 3.1% against the Euro.

By approximately how much did the Euro shift against the Yen over this period?

O a. Euro appreciated by 4.1%

O b. Euro depreciated by 4.1%

O c. Euro appreciated by 2.1%

4

O d. Euro neither appreciated nor depreciated against the Yen

O e. Euro depreciated by 2.1%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Question 10 a b and c Assume that there is a free-floating exchange rate. Will the following cause sterling toappreciate or depreciate relative to other currencies? In each case, you should considerwhether there is a shift in the demand or supply curves of sterling (or both) and whichway the curve(s) shift(s). You may assume that the impacts are ceteris paribus, that is,everything else remains the same. Illustrate your answers and give a short explanation interms of currency supply and demand. (a) UK imports increase. (b) UK interest rates rise relative to those abroad.(c) The UK experiences lower inflation than other countries, but with no change in interestrates.arrow_forwardSuppose that Great Britain and the United States are trading partners. Assume that the initial exchange rate in Great Britain is £0.76= 1$. Now suppose that the opportunity cost of consumption in the United States begin to rise. Which of the following explain what is expected to happen in the British forex market? O The demand for British pounds will decrease, leading to a depreciation of the US dollar. O The supply of British pounds will increase, leading to an appreciation of the British pound. O The supply of American dollars will decrease, leading to a depreciation of the British pound. O The demand for American dollars will decrease, leading to an appreciation of the British pound. Please do fast ASAP fastarrow_forwardAnswer please fastly...arrow_forward

- 2arrow_forwardSuppose that a laptop computer sells in China for 3,740 yuan, and that the exchange rate between the Canadian dollar and the yuan is 11 yuan per Canadian dollar. Canadian. If you buy the laptop in China it will cost you the equivalent of O A. $41.1 O B. $4,114 OC. $411 OD. $340 O E. $34arrow_forwardSuppose that a laptop computer sells in China for 3,120 yuan, and that the exchange rate between the Canadian dollar and the yuan is 13 yuan per Canadian dollar. If you buy the laptop in China it will cost you the equivalent of Canadian. ..... O A. $406 O B. $40.6 OC. $24 O D. $4,056 O E. $240arrow_forward

- Using the table shown, what is the most current 6-month forward exchange rate shown for British pounds? Use a direct quote from a U.S. perspective and assume today is Tuesday. Country Britain (Pound) £ 1 Month Forward 3 Months Forward 6 Months Forward O $0.6024-£1.00 $1.66 €1.00 O $1.61-£1.00 $1.60-£1.00 O $1.00-£0.6024 U.S. $ equiv. Tuesday Monday 1.6000 1.6100 1.6300 1.6100 1.6300 1.6600 1.6600 1.7200 Currency per U.S. $ Tuesday Monday 0.6250 0.6211 0.6173 0.6024 0.6211 0.6173 0.6024 0.5814arrow_forwardIn the short run, all of the following are disadvantages of a fixed exchange rate regime except: O A. macroeconomic shocks must be addressed with fiscal policy. O B. open market operations are overused. OC. they can lead to future exchange rate crises. O D. interest rates are constant. According to Robert Mundell, for countries to constitute an optimal currency area, such as adopting a common currency, they must have: O A. a different composition of industries. O B. high factor mobility. O C. similar per capita GDP. O D. all of the above.arrow_forwardIf one Canadian dollar buys US$0.85, and one Euro buys US$1.20, then one Euro should buy O a. C$1.02 O b. C$1.41 O c. C$2 O d. C$1.64arrow_forward

- In the long run, with variable real exchange rates, if American goods become less attractive relative to European goods, the dollar will experience a real and a nominal | O appreciation; appreciation O appreciation; depreciation O depreciation; appreciation O depreciation; depreciationarrow_forwardIf countries A and B are the only two countries in the world, then if the currency of country A appreciates, the currency of country B... O a. May appreciate or depreciate, depending on the elasticity of demand for the exports of country A. O b. May appreciate or depreciate, depending on the volume of trade between the two countries. O c. Must appreciate. O d. Can appreciate relative to other countries. O e. Must depreciate.arrow_forwardYou observe the following exchange rates Spot GBP/EUR exchange rate 1.120 € per £ 3 month GBP/EUR forward rate 1.115 Which of the following statements is likely to be true? Select one: O a. Neither of the other options O b. UK interest rates are lower than Eurozone interest rates O c. Speculators are expecting GBP to depreciate against EUR for the next year. d. UK interest rates arhigher than Eurozone interest rates. O e. Speculators are expecting GBP to appreciate against EUR for the next year.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education