Macroeconomics: Private and Public Choice (MindTap Course List)

16th Edition

ISBN: 9781305506756

Author: James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

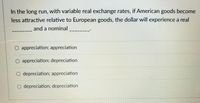

Transcribed Image Text:In the long run, with variable real exchange rates, if American goods become

less attractive relative to European goods, the dollar will experience a real

and a nominal

|

O appreciation; appreciation

O appreciation; depreciation

O depreciation; appreciation

O depreciation; depreciation

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Does a higher rate of return in a nations economy, all other things being equal, affect the exchange rate of its currency? If so, how?arrow_forwardConsider the balance-of-payments accounting information for Lalaland in 2010 as shown in the table below. All values are in billions of dollars and any variables not provided below have a value of zero. Exports Imports Net foreign-investment income Capital outflows Capital inflows 500 510 - 40 180 90 What is the net change in the stock of Lalaland's investments abroad in 2010? ..... O A. an increase of $30 billion O B. a decrease of $30 billion OC. a decrease of $50 billion O D. an increase of $50 billion O E. insufficient information to determinearrow_forwardThe demand for Australian dollars in the foreign exchange market equals 14000 – 3000e and thesupply of Australian dollars in the foreign exchange market equals 2000 + 2000e, where e is thenominal exchange rate expressed in euros per Australian dollar. If the Australian dollar is fixed at 2euros per Australian dollar, then to maintain this fixed rate, what is the required change in theReserve Bank of Australia’s holdings of euros? 1increase by 4000 euros 2decrease by 2000 euros 3decrease by 4000 euros 4increase by 2000 eurosarrow_forward

- If the Japanese price level rises by 5% relative to theprice level in the United States, what does the theoryof purchasing power parity predict will happen to thevalue of the Japanese yen in terms of dollars?arrow_forwardOn the DD curve, exchange rate depreciation causes output to because it affects a component of aggregate demand. O rise; consumption O rise; the current account O fall; investment fall; the current accountarrow_forwardConsider the balance-of-payments accounting information for Lalaland in 2010 as shown in the table below. All values are in billions of dollars and any variables not provided below have a value of zero. Exports 560 Imports Net foreign-investment income Capital outflows Capital inflows 350 - 50 255 95 What is the current account balance for Lalaland in 2010? ..... O A. $160 billion O B. $260 billion OC. - $260 billion O D. - $160 billion O E. $0arrow_forward

- A short-run increase in government spending causes the currency to and output to O appreciate; increase O appreciate; decrease O depreciate; increase O depreciate; decreasearrow_forwardPurchasing power parity theory would suggest that if the Canadian price of a basket of goods is C$1,800, but the same basket in the United States is U.S.$1,300, and the actual exchange rate is C$1.30 = U.S.S1.00, then the value of the Canadian dollar should O A. depreciate by approximately 8.9 percent. O B. depreciate by approximately 6.2 percent. OC. appreciate by approximately 8.9 percent. O D. appreciate by approximately 6.2 percent. O E. remain unchanged.arrow_forwardA big Mac costs $3.35 in the U.S. and 31 Pesos in Mexico. The current exchange rate is $1 buys 11 Pesos. Then according to purchasing power parity, we can predict that the U.S. dollar should over time, and in order for ppp to hold we need Et = %3D O appreciate; 10.11 O appreciate; 9.25 O depreciate; 10.11 O depreciate; 9.25arrow_forward

- If the U.S. Congress imposes a quota on imports of Japanese cars due to claims of "unfair" trade practices, and Japanese demand for American exports increases at the same time, then, inthe long run ________, everything else held constant.a) the Japanese yen will appreciate relative to the U.S. dollarb) the Japanese yen will depreciate relative to the U.S. dollarc) the Japanese yen will either appreciate, depreciate or remain constant against the U.S. dollard) there will be no effect on the Japanese yen relative to the U.S. dollararrow_forwardQUESTION 6 From 1980 to 2000, the dollar-yen exchange rate fell from 240 yen/dollar to 102 yen/dollar, while the pound-dollar exchange rate fell from 2.22 dollars/pound to 1.62 dollars/pound. As a result, O A. the dollar appreciated relative to the yen, but depreciated relative to the pound O B. the dollar depreciated relative to the yen, but appreciated relative to the pound OC. the dollar appreciated relative to both the yen and the pound O D. the dollar depreciated relative to both the yen and the poundarrow_forwardThe theory of purchasing power parity cannot fully explain exchange rate movements because Select one: O a. fiscal policy differs across countries O b. some goods are not traded between countries O c. monetary policy differs across countries O d. all goods are identical even if produced in different countries O e. both b andcarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Macroeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506756Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Macroeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506756Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning Economics: Private and Public Choice (MindTap Cou...EconomicsISBN:9781305506725Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Economics: Private and Public Choice (MindTap Cou...EconomicsISBN:9781305506725Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning

Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning

Macroeconomics: Private and Public Choice (MindTa...

Economics

ISBN:9781305506756

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:Cengage Learning

Economics: Private and Public Choice (MindTap Cou...

Economics

ISBN:9781305506725

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:9781337617383

Author:Roger A. Arnold

Publisher:Cengage Learning

Managerial Economics: Applications, Strategies an...

Economics

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:Cengage Learning