ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

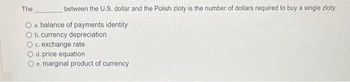

Transcribed Image Text:between the U.S. dollar and the Polish zloty is the number of dollars required to buy a single zloty.

O a. balance of payments identity

O b. currency depreciation

O c. exchange rate

The

d. price equation

O e. marginal product of currency

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- U.S. firms involved in international trade have to a. ignore U.S. inflation and ignore value of the dollar relative to foreign currencies. b. ignore U.S. inflation and guess value of the dollar relative to foreign currencies. Oc. International transactions are not affected by inflation or foreign exchange. O d. anticipate U.S. inflation and guess value of the dollar relative to foreign currencies. e. anticipate U.S. inflation and ignore value of the dollar relative to foreign currencies.arrow_forwardA short-run increase in government spending causes the currency to and output to O appreciate; increase O appreciate; decrease O depreciate; increase O depreciate; decreasearrow_forwardIn the U.S. balance of payments, foreign purchases of assets in the United States are a O debit, or outpayment. current account item. O foreign currency outflow. O foreign currency inflow.arrow_forward

- What does it mean to describe the foreign-exchange market as an "over-the-counter market"? O A. The market consists of customers buying and selling in the foreign-exchange market directly. O B. The market consists of market makers linked together by computers. OC. The market consists of customers linked together by computers. O D. The market is a physical place where currencies are traded.arrow_forwardAs the value of the American dollar increases relative to the Mexican peso, we expect that international demand for American corn output relative to Mexican corn may а. increase decrease b. stay the same as international corn demand is independent of the exchange rates С. we cannot tell Od.arrow_forwardIn the foreign exchange market, an increase in the U.S. interest rate leads to in the exchange rate because the supply of dollars a fall; increases O b. no change; does not change Ос a rise; decreases O d. a rise; increases O . a fall; decreasesarrow_forward

- Identify each transaction by whether it belongs in the US current account or financial account: An American professor buys a laptop computer from a firm in Taiwan. O Financial Account O Current Accountarrow_forwardUnder standard assumptions, in the short run, currency devaluation causes a country's output to O rise. O fall. O remain unchanged.arrow_forwardQUESTION 2 In the long run, an increase in the nominal exchange rate is likely to lead to Note: Multiple answers are possible. O A. an increase in exports ) B. a decrease in exports C. an increase in imports D. a decrease in importsarrow_forward

- What does interest rate parity refer to? Inflation rates in all countries are identical O a. O b. Real exchange rates in all countries are identical None of the answers is correct O d. Nominal interest rates in all countries are identicalarrow_forwardThe Federal reserve can directly intervene in the foreign exchange markets by: a. lowering interest rates. O b. exchanging dollars for foreign currency. O c. imposing barriers on international trade O d. increasing the inflation rate. CLEAR MY CHOICEarrow_forwardIf the forecast UK inflation rate is 5% and the forecast European inflation rate is 2% and the spot exchange rate is €1.20/£1. Then according to relative PPP which of the following statements is correct? Select one: a. O b. The euro is forecast to appreciate by 3% to approximately €1.236/£1 O c. The pound is forecast to depreciate by 3% to approximately €1.1650/£1 O d. The euro is forecast to depreciate by 3% to approximately €1.1650/£1 The pound is forecast to appreciate by 3% to approximately €1.236/£1arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education