ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

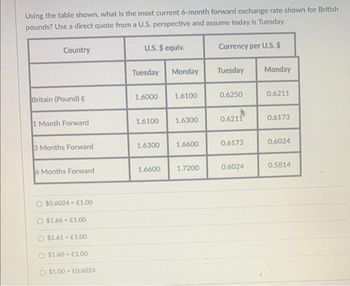

Transcribed Image Text:Using the table shown, what is the most current 6-month forward exchange rate shown for British

pounds? Use a direct quote from a U.S. perspective and assume today is Tuesday.

Country

Britain (Pound) £

1 Month Forward

3 Months Forward

6 Months Forward

O $0.6024-£1.00

$1.66 €1.00

O $1.61-£1.00

$1.60-£1.00

O $1.00-£0.6024

U.S. $ equiv.

Tuesday Monday

1.6000

1.6100

1.6300

1.6100

1.6300

1.6600

1.6600 1.7200

Currency per U.S. $

Tuesday Monday

0.6250

0.6211

0.6173

0.6024

0.6211

0.6173

0.6024

0.5814

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- The figure below illustrates the market for Bahamian dollars, where the price of the Bahamian dollar is valued in U.S. dollars. Assume that the Bahamian government wants to peg its currency to the U.S. dollar at a 1:1 ratio (one U.S. dollar = one Bahamian dollar). But the current exchange rate is at 90 cents (10 cents below the official peg). What must the Bahamian central bank do to return to the $1 exchange rate A. It would need to reduce the demand for the Bahamlan dollar. B. It would need to reduce the supply of the Bahamian dollar. C. It would need to Increase the supply of the Bahamian dollar. D. It would need to Increase the demand for the Bahamlan dollar. Part 2 Suppose you are a U.S. student and are thinking about visiting the Bahamas for spring break. You would rather the central bank intervened ___ (before or after) spring break. Part 3 Suppose that currently, the exchange rate is 1 Bahamian dollar for 1 U.S. dollar. The price of a Big Mac is $5 in the United States and 3.00…arrow_forwardIf the money supply in Mexico is increasing much more rapidly than the money supply in the United States, holding other factors constant, what would you predict will happen to the nominal exchange rate between the Mexican peso and the United States dollar if purchasing-power parity (PPP) holds? Explain.arrow_forwardA box of chocolate candy costs 28.80 Swiss francs in Switzerland and $20 in the United States. Assuming that purchasing power parity (PPP) holds, what is the current exchange rate? Ⓒa 1 U.S. dollar equals 1.44 Swiss francs Ob. 1 U.S. dollar equals 1.21 Swiss francs Oc1 US dollar equals 1.29 Swiss francs d. 1 U.S. dollar equals 0.69 Swiss francs e. 1 U.S. dollar equals 0.85 Swiss francsarrow_forward

- Based on the Exchange rates above, Which of the following is true? A)More pounds are needed to buy a dollar, so the dollar is appreciating B)The dollar is less expensive in pounds and is depreciating C)The dollar is growing stronger against the pound D)The dollar is more expensive in pounds and is appreciating Year 2014 2015 2016 US $ 1$ 1$ 1$ British Pound .85 .70 .60arrow_forwardYou hold $12,000 in cash and the exchange rate of USD (American dollar) to Venezuelan bolivar is 10.15. Calculate how much your $12,000 are worth in Venezuelan bolivars (you will need this number for the calculations below). Now, suppose that you hold as much cash in bolivars, as you found above. But the exchange rate of USD to Venezuelan bolivar goes down to 9.85. How much would your cash amount in bolivars be worth in USD? Question 29 options: A) $120 B) $11,643 $12,000 D) $12,365arrow_forwardFigure 2.3: S$i£ 2.20 2.00 1.90 The Market for British Pounds D E Q5 Q4 Q₁ B Q₂ S₁(£) D₂(£) D₁ (£) D3(£) Q3 Quantities of pound Refer to Figure 2.3. Suppose that the spot exchange rate of British pound is $2.00 per pound. Suppose that the U.S. decreases its taste for imports from the Under a flexible exchange rate system, the Bank of England will: Let the British pound appreciate Let the British pound depreciate Sell pounds and buy dollars in foreign exchange market Sell dollars and buy pounds in foreign exchange marketarrow_forward

- The following currency rate: C$1.2948/$ is .. A direct quote from the perspective of the U.S. An indirect quote from the perspective of Canada A direct quote from the perspective of Canada An indirect quote from the perspective of the U.S. Both c and d are correctarrow_forwardIf one U.S. dollar is traded on the foreign exchange market for about 0.89 euros, then one euro can purchase about U.S. dollars. a) 0.75 b) 1.12 c) 1.75 d) 0.89arrow_forwardOptions are gain or loss. Note : don't use chat gp8arrow_forward

- Number 8arrow_forwardOolong tea is produced in China and sold in many countries. In the province of Fujian, per 100 grams of Oolong tea sells for 50 yuan. In Kuala Lumpur, per 100 grams of the same Oolong tea sells for RM20. Suppose that the exchange rate is RM0.45 1 yuan. Please do the following calculations based on the above information: 1. How much would it cost in Malaysian currency to buy the tea in Fujian? 2. How much would it cost in China currency to buy the tea in Kuala Lumpur?arrow_forwardSuppose Argentina gets inflation under control and the Argentine inflation rate decreases substantially. What would likely happen to the demand for Argentine pesos, the supply of Argentine pesos, and the peso/U.S. dollar exchange rate?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education