FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

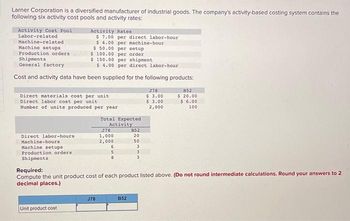

Transcribed Image Text:Larner Corporation is a diversified manufacturer of industrial goods. The company's activity-based costing system contains the

following six activity cost pools and activity rates:

Activity Cost Pool

Labor-related

Machine-related

Machine setups

Production orders.

Shipments

General factory

Activity Rates

$ 7.00 per direct labor-hour

$ 4.00 per machine-hour

$50.00 per setup

$ 100.00 per order

$ 150.00 per shipment

$ 4.00 per direct labor-hour

Cost and activity data have been supplied for the following products:

Direct materials cost per unit

Direct labor cost per unit

378

$ 3.00

$ 3.00

B52

$ 20.00

$ 6.00

2,000

100

Number of units produced per year

Total Expected

Activity

378

B52

Direct labor-hours.

1,000

20

Machine-hours

2,000

50

Machine setups

6

3

Production orders

5

3

8

3

Shipments

Required:

Compute the unit product cost of each product listed above. (Do not round intermediate calculations. Round your answers to 2

decimal places.)

J78

B52

Unit product cost

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Larner Corporation is a diversified manufacturer of industrial goods. The company's activity-based costing system contains the following six activity cost pools and activity rates: Activity Cost Pool Labor-related Machine-related Machine setups Production orders Shipments General factory $ 120.00 per shipment $ 10.00 per direct labor-hour Cost and activity data have been supplied for the following products: Direct labor-hours Machine-hours Machine setups Production orders Shipments Activity Rates $ 6.00 per direct labor-hour $ 10.00 per machine-hour Direct materials cost per unit Direct labor cost per unit Number of units produced per year $50.00 per setup $ 100.00 per order Unit product cost J78 Total Expected Activity 378 1,400 2,400 8 98 6 B52 30 30 1 1 1 Required: Compute the unit product cost of each product listed above. (Do not round intermediate calculations. Round your answers to 2 decimal places.) B52 J78 $ 4.50 $ 5.00 2,000 B52 $26.00 $6.00 100arrow_forwardLion Corporation uses an activity-based costing system to assign overhead costs to products. In the first stage, two overhead costs--equipment depreciation and supervisory expense-are allocated to three activity cost pools--Machining, Order Filling, and Other--based on resource consumption. Data to perform these allocations appear below: Overhead costs: Equipment depreciation Supervisory expense Equipment depreciation Distribution of Resource Consumption Across Activity Cost Pools: Product C9 $ 47,000 Product UO $ 6,000 Total Supervisory expense 0.60 Activity Cost Pools O $18.00 per MH O $5.30 per MH O $2.82 per MH O $3.18 per MH Mac 0.60 In the second stage, Machining costs are assigned to products using machine- hours (MHS) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow: 6,900 Order Filling 3,100 0.10 MHS (Machining) 10,000 b.20 200…arrow_forwardkaran subject-Accountingarrow_forward

- Walsh Corporation uses an activity-based costing system to assign overhead costs to products. In the first stage, two overhead costs- equipment depreciation and supervisory expense-are allocated to three activity cost pools--Mach g. Order Filling, and Other-based on resource consumption. Data to perform these allocations appear below: Overhead costs: Equipment depreciation $47,000 Supervisory expense Distribution of Resource Equipment depreciation Supervisory expense $6,000 Consumption Across Activity Cost Pools: Activity: Activity Cost Pools Machining Order Filling Other 0.60 0.30 0.60 0.20 0.10 0.20 In the second stage, Machining costs are assigned to products using machine-hours (MHS) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow: MHS (Machining) Orders (Order Filling) narrow_forwardChrzan, Incorporated, manufactures and sells two products: Product EO and Product NO. Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below: Product E0 Product Ne Total direct labor-hours Activity Cost Pools Labor-related Production orders Order size The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity: Estimated Overhead Cost Multiple Choice $33.94 per MH $54.20 per MH Direct Expected Labor-Hours Production Per Unit 10.1 410 1,550 9.1 $51.98 per MH $21.40 per MH Activity Measures DLHS orders MHs Total Direct Labor- Hours $ 301,890 61,087 585,366 $948,343 The activity rate for the Order Size activity cost pool under activity-based costing is closest to: 4,141 14, 105 18,246 Product E 4,141 850 5,550 Expected Activity Product NO 14, 105 950 5,250 Total 18,246 1,800 10,800arrow_forwardLarner Corporation is a diversified manufacturer of industrial goods. The company's activity-based costing system contains the following six activity cost pools and activity rates: Activity Cost Pool Labor-related Machine-related Machine setups Production orders Shipments $ 140.00 per shipment General factory $ 7.00 per direct labor-hour Cost and activity data have been supplied for the following products: Direct labor-hours Machine-hours Machine setups Production orders Shipments Activity Rates $7.00 per direct labor-hour Direct materials cost per unit Direct labor cost per unit Number of units produced per year $7.00 per machine-hour $30.00 per setup $200.00 per order Unit product cost Total Expected Activity J78 378 1,200 2,200 6 5 7 B52 30 50 1 1 1 Required: Compute the unit product cost of each product listed above. (Do not round intermediate calculations. Round your answers to 2 decimal places.) B52 378 $5.50 $ 4.75 4,000 B52 $32.00 $9.00 100arrow_forward

- Savitaarrow_forwardShalom Company uses three activity pools to apply overhead to its products. Each activity has a cost driver used to allocate the overhead costs to the product. The activities and related overhead costs are as follows: product design P40,000; machining P300,000; and material handling P100,000. The cost drivers and estimated use are as follows: Activity Cost Pools Activities Product design Number of product changes Machining Machine hours Material handling Number of set-ups X Estimated Use of Cost Driver Per Activity Amounts must be in whole numbers. Example: 88,000 or (88,000) Unit costs be in whole numbers. Example: 88 Format of percentages: 88% Words must be in capital letters. 10 150,000 100 What is the activity-based overhead rate for material handling? Jarrow_forwardA company has provided the following data from its activity-based costing accounting system: Indirect factory wages $552,000 Factory equipment depreciation $332,000 Distribution of Resource Consumption across Activity Cost Pools: 14 Activity Cost Pools Customer Product Orders Processing Other Total Indirect factory wages 55% 35% 10% 100% Factory equipment depreciation 30% 50% 20% 100% The "Other" activity cost pool consists of the costs of idle capacity and organization- sustaining costs, How much indirect factory wages and factory equipment depreciation cost would NOT be assigned to products using the activity-based costing system? Multiple Choice $552,000 $332.000 $121,600 $0arrow_forward

- Maxey & Sons manufactures two types of storage cabinets-Type A and Type B—and applies manufacturing overhead to all units at the rate of $140 per machine hour. Production information follows. Descriptions Anticipated volume (units) Direct-material cost per unit Direct-labor cost per unit Descriptions The controller, who is studying the use of activity-based costing, has determined that the firm's overhead can be identified with three activities: manufacturing setups, machine processing, and product shipping. Data on the number of setups, machine hours, and outgoing shipments, which are the activities' three respective cost drivers, follow. Setups Machine hours Outgoing shipments Туре А 160 56,000 200 Туре А 28,000 $38 43 Required 1 Required 2 Required 3 Туре В Unit manufacturing costs 120 78,750 150 The firm's total overhead of $18,865,000 is subdivided as follows: manufacturing setups, $4,116,000; machine processing, $11,319,000 and product shipping, $3,430,000. Required: 1. Compute…arrow_forwardFoam Products, Inc., makes foam seat cushions for the automotive and aerospace industries. The company’s activity-based costing system has four activity cost pools, which are listed below along with their activity measures and activity rates: Activity Cost Pool Activity Measure Activity Rate Supporting direct labor Number of direct labor-hours $ 12 per direct labor-hour Batch processing Number of batches $ 94 per batch Order processing Number of orders $ 278 per order Customer service Number of customers $ 2,633 per customer The company just completed a single order from Interstate Trucking for 2,300 custom seat cushions. The order was produced in two batches. Each seat cushion required 0.7 direct labor-hours. The selling price was $141.10 per unit, the direct materials cost was $108 per unit, and the direct labor cost was $14.00 per unit. This was Interstate Trucking’s only order during the year. Required: Prepare a report showing the customer margin…arrow_forwardKlumper Corporation Is a diversified manufacturer of Industrial goods. The company's activity-based costing system contalns the following stx activity cost pools and activity rates: Activity Cost Pool Supporting direct labor Machine processing Machine setups Production orders Activity Rates $8 per direct labor-hour $ 3 per machine-hour $ 35 per setup $ 160 per order $ 120 per shipment $ 875 per product Shipments Product sustaining Activity data have been supplied for the following two products: Total Expected Activity K425 M67 Number of units produced per year 2,000 50 200 Direct labor-hours 1,825 3,480 13 Machine-hours 40 Machine setups Production orders Shipments Product sustaining 2 13 2 26 2 Requlred: How much total overhead cost would be assigned to K425 and M67 using the activity-based costing system? Activity Cost Pool K425 M67 Supporting direct labor Machine processing Machine setups Production orders Shipments Product sustaining Total overhead cost 이 $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education