FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

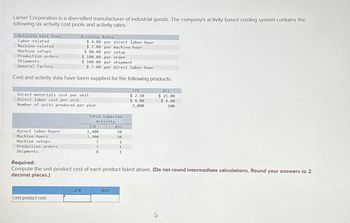

Transcribed Image Text:Larner Corporation is a diversified manufacturer of industrial goods. The company's activity-based costing system contains the

following six activity cost pools and activity rates:

Activity Cost Pool

Labor-related

Machine-related

Machine setups

Production orders

Shipments

General factory

Cost and activity data have been supplied for the following products:

Activity Rates

$ 4.00 per direct labor-hour

$7.00 per machine-hour

Direct labor-hours

Machine-hours

Machine setups

Production orders

Shipments

Direct materials cost per unit

Direct labor cost per unit

Number of units produced per year

Unit product cost

$80.00 per setup

$ 100.00 per order

$ 100.00 per shipment

$7.00 per direct labor-hour

J78

Total Expected

Activity

378

1,400

3,900

7

7

8

B52

50

50

1

1

1

Required:

Compute the unit product cost of each product listed above. (Do not round intermediate calculations. Round your answers to 2

decimal places.)

B52

378

$ 2.50

$ 4.00

2,000

B52

$ 21.00

$8.00

100

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Larner Corporation is a diversified manufacturer of industrial goods. The company's activity-based costing system contains the following six activity cost pools and activity rates: Activity Cost Pool Labor-related Machine-related Machine setups Production orders Shipments General factory Activity Rates $ 7.00 per direct labor-hour $7.00 per nachine-hour $30.00 per setup $ 200.00 per order $140.00 per shipment $7.00 per direct labor-hour Cost and activity data have been supplied for the following products: Direct materials cost per unit Direct labor cost per unit Number of units produced per year Total Expected Activity 378 852 Direct labor-hours 1,200 30 Machine-hours 2,200 50 Machine setups 6 1 Production orders 5 1 7 378 $ 5.50 $ 4.75 4,000 852 $32.00 $ 9.00 100 Shipments Required: Compute the unit product cost of each product listed above. (Do not round intermediate calculations. Round your answers to 2 decimal places.) J78 B52 Unit product costarrow_forwardLarner Corporation is a diversified manufacturer of industrial goods. The company's activity-based costing system contains the following six activity cost pools and activity rates: Activity Cost Pool Labor-related Machine-related Machine setups Production orders Shipments General factory Activity Rates $ 7.00 per direct labor-hour $7.00 per machine-hour $ 30.00 per setup $ 200.00 per order $ 140.00 per shipment $ 7.00 per direct labor-hour Cost and activity data have been supplied for the following products: Direct materials cost per unit Direct labor cost per unit Number of units produced per year Total Expected Activity 378 B52 Direct labor-hours 1,200 30 Machine-hours 2,200 50 Machine setups 6 1 Production orders 1 Shipments 7 1 378 $ 5.50 852 $ 32.00 $ 4.75 $ 9.00 4,000 100 Required: Compute the unit product cost of each product listed above. (Do not round intermediate calculations. Round your answers to 2 decimal places.) J78 B52 Unit product costarrow_forwardKlumper Corporation is a diversified manufacturer of industrial goods. The company's activity-based costing system contains the following six activity cost pools and activity rates: Activity Cost Pool Supporting direct labor Machine processing Machine setups $ 45 per setup $ 160 per order $ 115 per shipment $ 775 per product Activity data have been supplied for the following two products: Production orders. Shipments Product sustaining Number of units produced per year Direct labor-hours. Machine-hours Machine setups Production orders. Shipments Product sustaining Activity Cost Pool Supporting direct labor Machine processing Machine setups Production orders Activity Rates $7 per direct labor-hour $5 per machine-hour Chinmente K425 Total Expected Activity K425 M67 2,000 M67 200 975 2,200 Required: How much total overhead cost would be assigned to K425 and M67 using the activity-based costing system? 11 11 22 2 50 40 2 2 2arrow_forward

- Doede Corporation uses activity-based costing to compute product margins. In the first stage, the activity-based costing system allocates two overhead accounts-equipment depreciation and supervisory expense-to three activity cost pools-Machining. Order Filing, and Other-based on resource consumption, Data to perform these allocations appear below: Overhead costs: Equipment depreciation Supervisory expense $ 30,000 $ 14,800 Distribution of Resource Consumption Across Activity Cost Pools: Equipment depreciation Supervisory expense Activity: Product W1 Product Me Total Machining Order Filling 0.50 0.50 In the second stage, Machining costs are assigned to products using machine-hours (Ms) and Order Filing costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Product W1 Product Me Total Activity Cost Pools MHS (Machining) 5,530 17,000 22,530 0.40 0.30 Show Transcribed Text 5,530 17,000 22,530 Orders (Order Filling)…arrow_forwardOlmo, Incorporated, manufactures and sells two products: Product KO and Product H9. The annual production and sales of Product of KO is 900 units and of Product H9 is 900 units. The company has an activity-based costing system with the following activity cost pools, activity measures, and expected activity: Activity Cost Pools Labor-related Production orders: Order size Activity Measures DLHS orders MHS Estimated Overhead Cost $ 550, 208 53, 219 835,816 $ 1,439, 243 Expected Activity Product Ke Product H 5,400 1,000 3,100 2,700 600 4,000 Total 8,100 1,690 7,100 The overhead applied to each unit of Product H9 under activity-based costing is closest to: (Round your intermediate calculations to 2 decimal places.)arrow_forwardSultan Company uses an activity-based costing system. At the beginning of the year, the company made the following estimates of cost and activity for its five activity cost pools: Activity Cost Pool Labor-related Purchase orders Parts management Board etching General factory Activity Measure Direct labor-hours Number of orders Number of part types Number of boards Machine-hours Expected Overhead Cost $ 284,000 $ 6,790 $ 71,340 $ 57,900 $ 229,900 Product A 3,000 43 22 530 3,600 Expected Activity 35,500 DLHS Required: 1. Compute the activity rate for each of the activity cost pools. 2. The expected activity for the year was distributed among the company's four products as follows: 194 orders 82 part types 1,930 boards 20,900 MHs Expected Activity Product B 22,800 Activity Cost Pool Product C Product D 3,900 5,800 Labor-related (DLHS) Purchase orders (orders) 20 48 83 Parts management (part types) 15 32 13 Board etching (boards) 750 650 0 General factory (MHS) 7,300 3,900 6,100 Using the…arrow_forward

- Larner Corporation is a diversified manufacturer of industrial goods. Ine company's activity-based costing system contains the following six activity cost pools and activity rates: Activity Cost Pool Labor-related Machine-related Machine setups Production orders Shipments General factory Activity Rates $ 9.00 per direct labor-hour $ 4.00 per machine-hour $70.00 per setup $ 200.00 per order $ 130.00 per shipment $ 4.00 per direct labor-hour Cost and activity data have been supplied for the following products: Direct materials cost per unit Direct labor cost per unit Number of units produced per year 378 $ 4.50 B52 $ 46.00 $ 3.25 4,000 $ 4.00 500 Total Expected Activity 378 B52 Direct labor-hours 1,500 50 Machine-hours 2,400 50 Machine setups 3 2 Production orders 4 2 Shipments 9 2 Required: Compute the unit product cost of each product listed above. (Do not round intermediate calculations. Round your answers to 2 decimal places.) Prev 3 of 6 Novt Carrow_forwardDeemer Corporation has an activity-based costing system with three activity cost pools--Processing, Supervising, and Other. In the first stage allocations, costs in the two overhead accounts, equipment expense and indirect labor, are allocated to the three activity cost pools based on resource consumption. Data used in the first stage allocations follow: Overhead costs: $ 59,000 $ 12,700 Equipment expense Indirect labor Distribution of Resource Consumption Across Activity Cost Pools: Activity Cost Pools Processing Supervising Other Equipment expense 0.30 0.50 0.20 Indirect labor 0.30 0.50 0.20 Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow: Activity: MHs Batches (Processing) (Supervising) Product F6 17, 200 1,190 Product Xo 1,620 1,330 Total 18,820 2,520 The activity…arrow_forwardFletes Corporation manufactures two products: Product O95C and Product M31N. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-based costing (ABC) system that allocates its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products O95C and M31N. Activity Cost Pool Activity Measure Total Cost Total Activity Machining Machine-hours $ 207,000 9,000 MHs Machine setups Number of setups $ 140,000 350 setups Product design Number of products $ 98,000 2 products Order size Direct labor-hours $ 340,000 10,000 DLHs Activity Measure Product O95C Product M31N Machine-hours 6,000 3,000 Number of setups 190 160 Number of products 1 1 Direct labor-hours 4,000 6,000 Using the ABC system, how much total manufacturing overhead cost would be assigned to Product O95C?arrow_forward

- Hakara Company has been using direct labor costs as the basis for assigning overhead to its many products. Under this allocation system, product A has been assigned overhead of $24.82 per unit, while product B has been assigned $13.58 per unit. Management feels that an ABC system will provide a more accurate allocation of the overhead costs and has collected the following cost pool and cost driver information: Cost Pools Activity Costs Cost Drivers Activity Driver Consumption Machine setup $ 158,000 Setup hours 2,000 Materials handling 112,000 Pounds of materials 16,000 Electric power 25,000 Kilowatt-hours 25,000 The following cost information pertains to the production of A and B, just two of Hakara's many products: A B Number of units produced 5,000 10,000 Direct materials cost $ 32,000 $ 41,000 Direct labor cost $ 41,000 $ 38,000 Number of setup hours 100 200 Pounds of materials used 1,000 1,000 Kilowatt-hours 2,000 4,000 Required: 1. Use…arrow_forwardXYZ Ltd. is a manufacturing company that follows the cost allocation approach for overhead allocation. The company uses three cost pools for allocating overhead costs: Material Handling, Machine Maintenance, and Factory Utilities. Each cost pool has its own cost driver. For the current accounting period, the company incurred the following costs and activity levels: Material Handling Costs: $150,000 Cost Driver: Number of Material Orders - 2,500 orders Machine Maintenance Costs: $250,000 Cost Driver: Machine Hours - 10,000 hours Factory Utilities Costs: $200,000 Cost Driver: Direct Labor Hours - 5,000 hours Calculate the overhead allocation rate for each cost pool based on the given information. A) Material Handling: $60 per order, Machine Maintenance: $25 per hour, Factory Utilities: $40 per direct labor hour. B) Material Handling: $30 per order, Machine Maintenance: $25 per hour, Factory Utilities: $40 per direct labor hour. C) Material Handling: $60 per order, Machine…arrow_forwardLarner Corporation is a diversified manufacturer of industrial goods. The company's activity-based costing system contains the following six activity cost pools and activity rates: Activity Cost Pool Labor-related Machine-related Machine setups Production orders Shipments General factory $ 120.00 per shipment $ 10.00 per direct labor-hour Cost and activity data have been supplied for the following products: Direct labor-hours Machine-hours Machine setups Production orders Shipments Activity Rates $ 6.00 per direct labor-hour $ 10.00 per machine-hour Direct materials cost per unit Direct labor cost per unit Number of units produced per year $50.00 per setup $ 100.00 per order Unit product cost J78 Total Expected Activity 378 1,400 2,400 8 98 6 B52 30 30 1 1 1 Required: Compute the unit product cost of each product listed above. (Do not round intermediate calculations. Round your answers to 2 decimal places.) B52 J78 $ 4.50 $ 5.00 2,000 B52 $26.00 $6.00 100arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education