Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Don't use

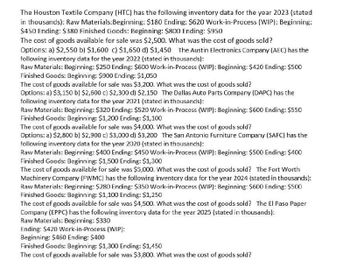

Transcribed Image Text:The Houston Textile Company (HTC) has the following inventory data for the year 2023 (stated

in thousands): Raw Materials: Beginning: $180 Ending: $620 Work-in-Process (WIP): Beginning:

$450 Ending: $380 Finished Goods: Beginning: $800 Ending: $950

The cost of goods available for sale was $2,500. What was the cost of goods sold?

Options: a) $2,550 b) $1,600 c) $1,650 d) $1,450 The Austin Electronics Company (AEC) has the

following inventory data for the year 2022 (stated in thousands):

Raw Materials: Beginning: $250 Ending: $600 Work-in-Process (WIP): Beginning: $420 Ending: $500

Finished Goods: Beginning: $900 Ending: $1,050

The cost of goods available for sale was $3,200. What was the cost of goods sold?

Options: a) $3,150 b) $2,500 c) $2,300 d) $2,150 The Dallas Auto Parts Company (DAPC) has the

following inventory data for the year 2021 (stated in thousands):

Raw Materials: Beginning: $320 Ending: $520 Work-in-Process (WIP): Beginning: $600 Ending: $550

Finished Goods: Beginning: $1,200 Ending: $1,100

The cost of goods available for sale was $4,000. What was the cost of goods sold?

Options: a) $2,800 b) $2,900 c) $3,000 d) $3,200 The San Antonio Furniture Company (SAFC) has the

following inventory data for the year 2020 (stated in thousands):

Raw Materials: Beginning: $400 Ending: $450 Work-in-Process (WIP): Beginning: $500 Ending: $400

Finished Goods: Beginning: $1,500 Ending: $1,300

The cost of goods available for sale was $5,000. What was the cost of goods sold? The Fort Worth

Machinery Company (FWMC) has the following inventory data for the year 2024 (stated in thousands):

Raw Materials: Beginning: $280 Ending: $350 Work-in-Process (WIP): Beginning: $600 Ending: $500

Finished Goods: Beginning: $1,100 Ending: $1,250

The cost of goods available for sale was $4,500. What was the cost of goods sold? The El Paso Paper

Company (EPPC) has the following inventory data for the year 2025 (stated in thousands):

Raw Materials: Beginning: $330

Ending: $420 Work-in-Process (WIP):

Beginning: $460 Ending: $400

Finished Goods: Beginning: $1,300 Ending: $1,450

The cost of goods available for sale was $3,800. What was the cost of goods sold?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Similar questions

- Calculate the cost of goods sold dollar value for A67 Company for the month, considering the following transactions under three different cost allocation methods and using perpetual inventory updating. Provide calculations for weighted average (AVG).arrow_forwardUse the following information to compute cost of goods sold under the FIFO and LIFO inventory methods. The firm sold 200 units.arrow_forwardAssume your company uses the periodic inventory costing method, and the inventory count left out an entire warehouse of goods that were in stock at the end of the year, with a cost value of $222,000. How will this affect your net income in the current year? How will it affect next years net income?arrow_forward

- Calculate the cost of goods sold dollar value for A65 Company for the month, considering the following transactions under three different cost allocation methods and using perpetual inventory updating. Provide calculations for first-in, first-out (FIFO).arrow_forwardCalculate the cost of goods sold dollar value for A66 Company for the month, considering the following transactions under three different cost allocation methods and using perpetual inventory updating. Provide calculations for last-in, first-out (LIFO).arrow_forwardTrini Company had the following transactions for the month. Calculate the cost of goods sold dollar value for the period for each of the following cost allocation methods, using periodic inventory updating. Provide your calculations. A. first-in, first-out (FIFO) B. last-in, first-out (LIFO) C. weighted average (AVG)arrow_forward

- Calculate the cost of goods sold dollar value for A74 Company for the sale on March 11, considering the following transactions under three different cost allocation methods and using perpetual inventory updating. Provide calculations for (a) first-in, first-out (FIFO); (b) last-in, first-out (LIFO); and (c) weighted average (AVG).arrow_forwardCalculate the cost of goods sold dollar value for B74 Company for the sale on November 20, considering the following transactions under three different cost allocation methods and using perpetual inventory updating. Provide calculations for (a) first-in, first-out (FIFO); (b) last-in, first-out (LIFO); and (c) weighted average (AVG).arrow_forwardTrini Company had the following transactions for the month. Calculate the ending inventory dollar value for each of the following cost allocation methods, using periodic inventory updating. Provide your calculations. A. first-in, first-out (FIFO) B. last-in, first-out (LIFO) C. weighted average (AVG)arrow_forward

- Bleistine Company had the following transactions for the month. Calculate the gross margin for the period for each of the following cost allocation methods, using periodic inventory updating. Assume that all units were sold for $50 each. Provide your calculations. A. first-in, first-out (FIFO) B. last-in, first-out (LIFO) C. weighted average (AVG)arrow_forwardDeForest Company had the following transactions for the month. Calculate the ending inventory dollar value for the period for each of the following cost allocation methods, using periodic inventory updating. Provide your calculations. A. first-in, first-out (FIFO) B. last-in, first-out (LIFO) C. weighted average (AVG)arrow_forwardAkira Company had the following transactions for the month. Calculate the ending inventory dollar value for the period for each of the following cost allocation methods, using periodic inventory updating. Provide your calculations. A. first-in, first-out (FIFO) B. last-in, first-out (LIFO) C. weighted average (AVG)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning