EBK CFIN

6th Edition

ISBN: 9781337671743

Author: BESLEY

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Provide correct answer

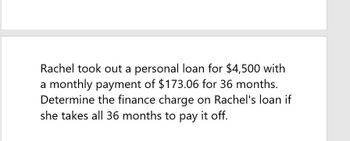

Transcribed Image Text:Rachel took out a personal loan for $4,500 with

a monthly payment of $173.06 for 36 months.

Determine the finance charge on Rachel's loan if

she takes all 36 months to pay it off.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- mary, a college student, needs to borrow $8000 today for her tuition. She agrees to pay back the loan in a lump-sum payment upon graduationg, 4 years from today. The lender agrees to lending at a fixed 3.85% interest rate during the loan period. what the total cost of Mary's student loan?arrow_forwardJessica borrows $1,000.00 from a credit card company at 25% annually for two years. Determine Jessica’s monthly payment. Show your work.arrow_forwardJanet borrows $3500 from a credit card company at 22.5% annually for 3 years. Determine Janet’s monthly payment. Show your work.arrow_forward

- Jasper purchased a car for 47,500. He paid a 20% down payment and financed the rest at 2.88 % for 6 years. Find the amount of down payment the monthly payment and the total interest jasper will have paid at the end of his loan.arrow_forwardLiz borrowed $52,500 to purchase a home. The bank offered her an APR of 3.49% for a term length of 15 years. Excel calculates the monthly payment to be $375.06. If she were to pay only the minimum payment for the lifetime of the loan, how much will Liz be paying in interest?arrow_forwardMarisol finances a sports car for $27,500 by taking out an installment loan for 36 months. The payments were $998.61 per month and the total finance charge was $8,449.96 After 21 months, Marisol decided to pay off the loan. After calculating the finance charge rebate, find her loan payoff amount.arrow_forward

- Megan takes out a car loan for $13,000. She intends to make monthly payments for 5 years to pay off her loan. If the bank charges her an annual interest rate of 4.2% computed monthly on the loan balance, how much will her monthly payments be?arrow_forwardJodi takes out a loan to buy a car for $29,000. If her monthly payment is $500 and the annual interest rate of the loan is 8%, how many payments must she make to pay off the loan? 73.57 (months) 49.19 (months) 105.49 (months) 85.49 (months)arrow_forwardAnna does not use her credit card for anything else and she pays off the $100 cash advance plus in six months by making payments of $19.83. Her credit card company charges 18% APR. Create an amortization schedule for her six payments. How much will Anna end up paying in interest and fees for her $100 cash in advance?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you