FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

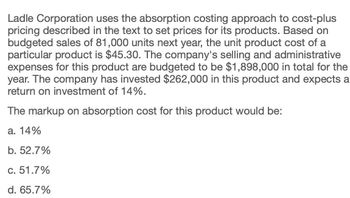

Transcribed Image Text:Ladle Corporation uses the absorption costing approach to cost-plus

pricing described in the text to set prices for its products. Based on

budgeted sales of 81,000 units next year, the unit product cost of a

particular product is $45.30. The company's selling and administrative

expenses for this product are budgeted to be $1,898,000 in total for the

year. The company has invested $262,000 in this product and expects a

return on investment of 14%.

The markup on absorption cost for this product would be:

a. 14%

b. 52.7%

c. 51.7%

d. 65.7%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Cotton Company produces and sells socks. Variable costs are budgeted at $2 per pair, and fixed costs for the year are expected to total $140,000. The selling price is expected to be $4 per pair. The sales units required for Cotton Company to make an after-tax profit (πA) of $21,000, given an income tax rate of 50%, are: Group of answer choices 81,000 units. 90,000 units. 99,161 units. 93,500 units. 91,000 units.arrow_forwardCullumber Corporation is in the process of setting a selling price for a recently designed product. The following data relate to this product at a budgeted volume of 60,000 units. Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Variable selling and administrative expenses Fixed selling and administrative expenses (a1) Your answer is correct. Total unit variable cost $ Total unit fixed cost Total unit cost eTextbook and Media (a2) Cullumber uses cost-plus pricing to set its target selling price and has a markup on total unit cost of 30%. Per Unit $ Desired ROI per unit $ $30 Compute total unit variable cost, total unit fixed cost, and total unit cost for the new product. $ 40 10 6 86 Total 69 $2,220,000 155 1,920,000 Compute desired ROI per unit for the new product. (Round answer to 2 decimal places, e.g. 5.27.) Attempts: 1 of 5 usedarrow_forwardOcean Sails manufactures sailing boats in two models: the Wave Rider and the Stress Killer. The company currently uses a variable costing system for internal reporting purposes. Its budgeted profit statement for the year ended 31 March 2021 is provided in the following table: Wave Rider (£) Stress Killer (£) Total (£) Sales revenues 52,500,000 105,000,000 157,500,000 Variable cost of goods sold 39,343,750 79,800,000 119,143,750 Variable marketing & admin costs 6,300,000 12,600,000 18,900,000 Contribution margin 6,856,250 12,600,000 19,456,250 Fixed manufacturing overhead 3,500,000 Fixed marketing & admin costs 16,000,000 Profit (Loss) (43,750) The following information from the budget is also available: Wave Rider Stress Killer (Units) (Units) Opening inventory 5 8 Units produced 20 25 Closing inventory 15 5 Units…arrow_forward

- In the current year, Becker Sofa Company expected to sell 12,000 leather sofas. Fixed costs for the year were expected to be $8,400,000; unit sales price was budgeted at $4,600; and unit variable costs were expected to be $2,200.Becker Sofa Company's margin of safety (MOS) in sales dollars is:arrow_forwardBraile Gear Works sells a single gear for a price of $55.00 per unit. The variable costs of the gear are $23.00 per gear and annual fixed costs are $448,000. The cost analyst tells you that, based on the price and cost information of the gear and the marketing department's sales projection for next year, the margin of safety percentage is 30 percent. How many units does marketing expect to sell next year? Note: Do not round intermediate calculations.arrow_forwardIn the current year, Becker Sofa Company expected to sell 12,900 leather sofas. Fixed costs for the year were expected to be $8,404,500; unit sales price was budgeted at $5,050; and unit variable costs were expected to be $2,650.Becker Sofa Company's margin of safety (MOS) in units is: Multiple Choice 9,698. 8,898. 10,798. 9,998. 9,398.arrow_forward

- Cleaning Care Inc. expects to sell 9,000 mops. Fixed costs (for the year) are expected to be $13,000, unit sales price is expected to be $11, and unit variable costs are budgeted at $7. Cleaning Care's margin of safety (MOS) in units is:arrow_forwardAccording to its original plan, Thornton Consulting Services Company plans to charge its customers for service at $127 per hour in Year 2. The company president expects consulting services provided to customers to reach 49,000 hours at that rate. The marketing manager, however, argues that actual results may range from 44,000 hours to 54,000 hours because of market uncertainty. Thornton's standard variable cost is $44 per hour, and its standard fixed cost is $1,320,000. Required Develop flexible budgets based on the assumptions of service levels at 44,000 hours, 49,000 hours, and 54,000 hours. Flexible Budget 44,000 Hours Flexible Budget Flexible Budget 49,000 Hours 54,000 Hoursarrow_forwardDuring the current year, OutlyTech Corp. expected to sell 22,500 telephone switches. Fixed costs for the year were expected to be $12,142,500, the unit sales price was budgeted at $3,250, and unit variable costs were budgeted at $1,400. OutlyTech's margin of safety (MOS) in units is (rounded up to nearest whole number): Multiple Choice 17,106. 15,936. 19,716. 15,806. 21,026.arrow_forward

- Based on a predicted level of production and sales of 22,000 units, a company anticipates total variable costs of $99,000, fixed costs of $30,000, and operating income of $36,000. Based on this information, the budgeted amount of variable costs for 20,000 units would be:arrow_forwardRequired information Eckert Company uses the absorption costing approach to cost plus pricing to set prices for its products. Based on budgeted sales of 18.000 units next year, the unit product cost of a particular product is $60.40. The company's selling general, and administrative expenses for this product are budgeted to be $370.800 in total for the year. The company has invested $260.000 in this product and expects a return on investment of T (Appendix 12A) The markup on absorption cost for this product would be closest to which of the following O O O M4T 36.74 ALIK HON 3 Save & Submitarrow_forwardGiven help with this problem is solutionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education