FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

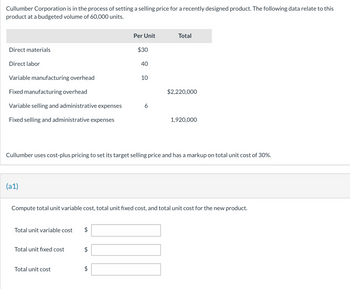

Transcribed Image Text:Cullumber Corporation is in the process of setting a selling price for a recently designed product. The following data relate to this

product at a budgeted volume of 60,000 units.

Direct materials

Direct labor

Variable manufacturing overhead

Fixed manufacturing overhead

Variable selling and administrative expenses

Fixed selling and administrative expenses

(a1)

Total unit variable cost $

Total unit fixed cost

Total unit cost

Per Unit

$

$30

$

40

Cullumber uses cost-plus pricing to set its target selling price and has a markup on total unit cost of 30%.

10

6

Compute total unit variable cost, total unit fixed cost, and total unit cost for the new product.

Total

$2,220,000

1,920,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Adams, Inc. has the following cost data for Product X, and unit product cost using absorption costing when production is 2,000 units, 2,500 units, and 5,000 units. (Click on the icon to view the cost data.) (Click on the icon to view the unit product cost data.) Product X sells for $175 per unit. Assume no beginning inventories. Read the requirements. Data table Begin by selecting the labels and computing the gross profit for scenario a. and then compute the gross profit for scenario b. and c. Absorption costing a. b. C. Gross Profit Reference 2,000 units 2,500 units 5,000 units 42 $ 42 52 52 11 11 Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Total unit product cost Print $ $ 42 S 52 11 10 115 $ Done 8 113 $ 4 109 Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Print Done $42 per unit 52 per unit 11 per unit 20,000 per yeararrow_forwardDogarrow_forwardThe following information relates to Everstream Ltd: Variable manufacturing cost 500 Applied fixed manufacturing cost 160 Variable selling and administrative cost 130 Allocated fixed selling and administrative cost ? To achieve the target price of $1,035 per unit, the mark-up percentage based on total unit cost is 15%. Required: Calculate the allocated fixed selling and administrative cost per unit. Develop a cost-plus pricing formula that will result in the target price for each of the following bases: Variable manufacturing cost Absorption manufacturing cost Total variable costarrow_forward

- Martin Company uses the absorption costing approach to cost-plus pricing. It is considering the introduction of a new product. To determine a selling price, the company gathered the following information: Number of units to be produced and sold each year Unit product cost Estimated annual selling and administrative expenses Estimated investment required by the company Desired return on investment (ROI) Required: 1. Compute the markup percentage on absorption cost required to achieve the desired ROI. 2. Compute the selling price per unit. Note: Do not round intermediate calculations. Round your answer to 2 decimal places. 1. Markup percentage on absorption cost 2. Selling price per unit 12,000 $26.00 $ 26,400 $ 300,000 12% %arrow_forwardSmart Stream Inc. uses the total cost method of applying the cost-plus approach to product pricing. The costs of producing and selling 5,500 units of cell phones are as follows: Variable costs per unit: Fixed costs: Direct materials $ 92 Factory overhead $256,400 Direct labor 42 Selling and administrative expenses 90,100 Factory overhead 28 Selling and administrative expenses 22 Total variable cost per unit $184 Smart Stream desires a profit equal to a 14% return on invested assets of $756,880. a. Determine the total costs and the total cost amount per unit for the production and sale of 5,500 cellular phones. Round the cost per unit to two decimal places. Total cost $ Total cost amount per unit $ b. Determine the total cost markup percentage for cellular phones. Round your answer to two decimal places. % c. Determine the selling price of cellular phones. Round to the nearest cent.$ per cellular phonearrow_forwardBridgeport Company manufactures and sells two products. Relevant per-unit data concerning each product follow: Selling price Variable costs Machine hours Product Basic $43.00 $19.00 0.50 Show Transcribed Text Calculate the contribution margin per machine hour for each product. Question Part Score Contribution margin per machine hour $ Basic eTextbook and Media Deluxe Deluxe $52.00 $23.30 Bridgeport should manufacture the Basic 0.70 If 1,800 additional machine hours are available, which product should Bridgeport manufacture? - Show Transcribed Text Total contribution margin $ Basic Prepare an analysis showing the total contribution margin if 1,800 additional hours are: (1) Divided equally between the products. product. $ Deluxe Total contribution margin $ (2) Allocated entirely to the product identified in part (b).arrow_forward

- Brindle Arts uses Variable Costing for internal purposes, but uses Absorption Costing for their financial reports. The following information is for Quarter 4, 2021 and Quarter 1, 2022. Calculate unit product costs for Quarters 4 and 1 for Variable and Absorption Costing. Prepare an income statement for each method, then show why there is a difference between the two. Selling price per unit $ 150 Quarter 4 Quarter 1 Variable costs per unit Units in beginning inventory - 1,750 Direct materials $ 45.00 Production (in units) 15,000 10,750 Direct labor $ 20.00 Sales (in units) 13,250 12,500 Variable overhead $ 15.00 Ending inventory 1,750 - Variable S&A $ 10.00 Fixed Costs in total per quarter Fixed manufacturing overhead…arrow_forwardCullumber Corporation is in the process of setting a selling price for a recently designed product. The following data relate to this product at a budgeted volume of 60,000 units. Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Variable selling and administrative expenses Fixed selling and administrative expenses (a1) Your answer is correct. Total unit variable cost $ Total unit fixed cost Total unit cost eTextbook and Media (a2) Cullumber uses cost-plus pricing to set its target selling price and has a markup on total unit cost of 30%. Per Unit $ Desired ROI per unit $ $30 Compute total unit variable cost, total unit fixed cost, and total unit cost for the new product. $ 40 10 6 86 Total 69 $2,220,000 155 1,920,000 Compute desired ROI per unit for the new product. (Round answer to 2 decimal places, e.g. 5.27.) Attempts: 1 of 5 usedarrow_forwarda) Classify each cost as fixed, variable or mixed, using production volume as the cost driver. b) Use the high-low method to separate mixed costs into their fixed and variable components and prepare the cost formula for each of the mixed costs. C. If Green Corridor Company expects a production volume of 30,000 bicycles in the coming quarter, prepare the production cost formula for the quarter and predict the total production cost.arrow_forward

- Jarvis Company uses the total cost concept of applying the cost-plus approach to product pricing. The costs and expenses of producing and selling 35,000 units of Product E are as follows: Variable costs: Direct materials $3.00 Direct labor 1.25 Factory overhead 0.75 Selling and administrative expenses 3.00 Total $8.00 Fixed costs: Factory overhead $50,000 Selling and administrative expenses 20,000 Jarvis desires a profit equal to a 14% rate of return on invested assets of $450,000. a. Determine the amount of desired profit from the production and sale of Product E. $ 63,000 b. Determine the total costs and the cost amount per unit for the production and sale of 35,000 units of Product E. Total manufacturing costs 350,000 V Cost amount per unit 10 c. Determine the markup percentage for Product E. 18 V % d. Determine the selling price of Product E. Round your answer to two decimal places.arrow_forwardCherokee Manufacturing Company established the following standard price and cost data: Sales price $ 12.00 per unit Variable manufacturing cost $ 7.20 per unit Fixed manufacturing cost $ 3,600 total Fixed selling and administrative cost $ 1,200 total Cherokee planned to produce and sell 2,000 units. Actual production and sales amounted to 2,200 units. Assume that the actual sales price is $11.76 per unit and that the actual variable cost is $6.90 per unit. The actual fixed manufacturing cost is $3,000, and the actual selling and administrative costs are $1,230. Required a.&b. Determine the flexible budget variances and classify the variances by selecting favorable (F) or unfavorable (U). (Select "None" if there is no effect (i.e., zero variance).)arrow_forwardAl Ziyabi Company, a leading textile manufacturer is required to prepare a cost-volume-profit analysis report for the two products being produced in its company. Product A Price per unit (RO) Particulars Sales price Material Direct wages Variable expenses Fixed expenses 17 8 100% of direct wages RO 1100 The following scenarios are predicted by the Management: Scenario 1: 200 units of product A and 100 units of product B Scenario 2: 150 units of product A and 150 units of product B Scenario 3: 250 units of product A and 50 units of product B Product B Price per unit (RO) 4 100% of direct wages RO 1100 Ïarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education