Financial Accounting

15th Edition

ISBN: 9781337272124

Author: Carl Warren, James M. Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Please help solve this question

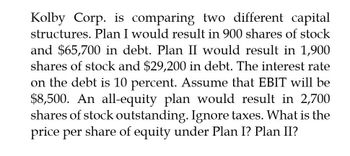

Transcribed Image Text:Kolby Corp. is comparing two different capital

structures. Plan I would result in 900 shares of stock

and $65,700 in debt. Plan II would result in 1,900

shares of stock and $29,200 in debt. The interest rate

on the debt is 10 percent. Assume that EBIT will be

$8,500. An all-equity plan would result in 2,700

shares of stock outstanding. Ignore taxes. What is the

price per share of equity under Plan I? Plan II?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Kolby Corp. is comparing two different capital structures. Plan I would result in 900 shares of stock and $65,700 in debt. Plan II would result in 1,900 shares of stock and $29,200 in debt. The interest rate on the debt is 10 percent. Assume that EBIT will be $8,500. An all-equity plan would result in 2,700 shares of stock outstanding. Ignore taxes. What is the price per share of equity under Plan I? Plan II?arrow_forwardNeed answer pleasearrow_forwardColdstream Corp. is comparing two different capital structures. Plan I would result in 10,000 shares of stock and $64,000 in debt. Plan II would result in 5,625 shares of stock and $120,000 in debt. The interest rate on the debt is 10 percent. Assume that EBIT will be $70,000. An all-equity plan would result in 15,000 shares of stock outstanding. Ignore taxes. What is the price per share of equity under Plan I? Plan II? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Price of equity Plan I $ per share Plan II $ per sharearrow_forward

- Coldstream Corp. is comparing two different capital structures. Plan I would result in 8,000 shares of stock and $80,000 in debt. Plan II would result in 6,000 shares of stock and $120,000 in debt. The interest rate on the debt is 6 percent. Assume that EBIT will be $50,000. An all-equity plan would result in 12,000 shares of stock outstanding. Ignore taxes. What is the price per share of equity under Plan I? Plan II? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.)arrow_forwardNikularrow_forwardProvide answerarrow_forward

- Give true answerarrow_forwardDickson Corporation is comparing two different capital structures. Plan I would result in 26,000 shares of stock and $85,500 in debt. Plan II would result in 20,000 shares of stock and $256,500 in debt. The interest rate on the debt is 6 percent. Assume that EBIT will be $95,000. An all-equity plan would result in 29,000 shares of stock outstanding. Ignore taxes. What is the price per share of equity under Plan I? Plan II?arrow_forwardXYZ is comparing two different capital structures. Plan I would result in 13,000 shares of stock and $130,500 in debt. Plan II would result in 10,000 shares of stock $243,600 in debt. The interest rate on the debt is 10%. a). Ignoring taxes, compare plans I and II to an all equity plan assuming that EBIT will be $56,000. The all equity plan will result in 16,000 shares of stock OUTSTANDING. Which of the 3 plans has the highest EPS? And which has the lowest? b). In part A, what are the break-even levels of EBIT for plan I compared to an all equity plan? What about for plan II I compared to an all equity plan? Is one higher than the other? Why (explain). c). Ignoring taxes, when will EPS be identical for plans I and II?arrow_forward

- Bellwood Corp. is comparing two different capital structures. Plan I would result in 24,000 shares of stock and $82,500 in debt. Plan II would result in 18,000 shares of stock and $247,500 in debt. The interest rate on the debt is 4 percent. a. Ignoring taxes, compare both of these plans to an all-equity plan assuming that EBIT will be $85,000. The all-equity plan would result in 27,000 shares of stock outstanding. What is the EPS for each of these plans? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) b. In part (a), what are the break-even levels of EBIT for each plan as compared to that for an all-equity plan? (Do not round intermediate calculations.) c. Ignoring taxes, at what level of EBIT will EPS be identical for Plans I and II? (Do not round intermediate calculations.) d-1. Assuming that the corporate tax rate is 25 percent, what is the EPS of the firm? (Do not round intermediate calculations and round your…arrow_forwardDickson Corporation is comparing two different capital structures. Plan I would result in 36,000 shares of stock and $103,500 in debt. Plan II would result in 30,000 shares of stock and $310,500 in debt. The interest rate on the debt is 4 percent. Assume that EBIT will be $145,000. An all-equity plan would result in 39,000 shares of stock outstanding. Ignore taxes. What is the price per share of equity under Plan I? Plan II? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Plan I Plan IIarrow_forwardDickson Corporation is comparing two different capital structures. Plan I would result in 39,000 shares of stock and $108,000 in debt. Plan II would result in 33,000 shares of stock and $ 324,000 in debt. The interest rate on the debt is 7 percent. Assume that EBIT will be $160,000. An all-equity plan would result in 42, 000 shares of stock outstanding. Ignore taxes. What is the price per share of equity under Plan I? Plan II? (Do not round intermediate calculations and round your answers to 2 decimal places, e. g., 32.16.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT