Financial Accounting

15th Edition

ISBN: 9781337272124

Author: Carl Warren, James M. Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Need help with this question

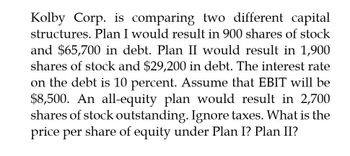

Transcribed Image Text:Kolby Corp. is comparing two different capital

structures. Plan I would result in 900 shares of stock

and $65,700 in debt. Plan II would result in 1,900

shares of stock and $29,200 in debt. The interest rate

on the debt is 10 percent. Assume that EBIT will be

$8,500. An all-equity plan would result in 2,700

shares of stock outstanding. Ignore taxes. What is the

price per share of equity under Plan I? Plan II?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Lamey Company has an unlevered cost of capital of 12.3 percent, a total tax rate of 25 percent, and expected earnings before interest and taxes of $32,840. The company has $60,000 in bonds outstanding that sell at par and have a coupon rate of 7.2 percent. What is the cost of equity? Ans is 13.78%. only post if you get this ans pls. Stepwise show.arrow_forwardJones Soda estimates that its required return on equity is 11.0 percent and the yield to maturity on its debt is 5.0 percent. The company's equity-to-asset ratio is 0.7 and the marginal tax rate is 30%. What is the company's weighted average cost of capital? Enter your answer as a percent and round to two decimals, but don't include the % sign.arrow_forwardJones Soda estimates that its required return on equity is 11.0 percent and the yield to maturity on its debt is 6.0 percent. The company's equity-to-asset ratio is 0.2 and the marginal tax rate is 30%. What is the company's weighted average cost of capital? Enter your answer as a percent and round to two decimals, but don't include the % sign. Numeric Responsearrow_forward

- What is the value of equity and debt?arrow_forwardA firm has a weighted average cost of capital of 8.4%, a cost of equity is 11%, and a pretax cost of debt of 5.8%. The tax rate is 25%. What is the company's target debt-equity ratio, expressed as a percentage? (Please, do not round your intermediate calculations; rou necessary, your final answer, expressed as a percentage, to two decimal places without the % symbol. Example, if your final answer calcula or X/Y, or X+Y, or X-Y, is 0.124556, enter it as 12.46)arrow_forwardPercentages need to be entered in decimal format, for instance 3% would be entered as .03. Ezzell Enterprises has the following capital structure, which it considers to be optimal under present and forecasted conditions: Debt (long-term only) ratio - 45% Common equity - 55% Total liabilities and equity - 100% For the coming year, management expects after-tax earning of $2.5 million. Ezzell's past dividend policy of paying out 60% of earnings will continue. Present commitments from its bankers will allow Ezzell to borrow according to the following schedule: Loan Amount Interest Rate $1 to $500,000 9% on this increment of debt $500,001 to $900,000 11% on this increment of debt $900,001 and above 13% on this increment of debt The company's marginal tax rate is 40%, the current market price of its stock is $22 per share, its last dividend was $2.20 per share, and the expected growth rate is 5%. External equity (new common) can be sold at a flotation cost of 10%.…arrow_forward

- CSH has EBITDA of $5 million. You feel that an appropriate EV/EBITDA ratio for CSH is 7. CSH has $6 million in debt, $3 million in cash, and 750,000 shares outstanding. What is your estimate of CSH's stock price? The estimate of CSH's stock price is (Round to the nearest cent.)arrow_forwardJungle, Inc. has a target debt-equity ratio of 0.72. Its WACC is 11.5 percent and the tax rate is 34 percent. What is the cost of equity if the aftertax cost of debt is 5.5 percent? For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac).arrow_forwardSuppose you are estimating the WACC for Columbus Inc. It has the following data from its balance sheet: total debt = $200 million; total equity=$120 million. It has 20 million shares outstanding, and its stock is trading at $32 per share. Your analysis shows that the company's current borrowing rate is 7%, and that the cost of equity is 13%. If the company marginal tax rate is 30%, what is its WACC?arrow_forward

- Consider a firm that has 15% of debt. The rate of return for debt is 6% and the rate of return for equity is 12%. The corporate tax rate is 40%. What is the weighted average cost of capital? Enter your answer as a percentage and rounded to 2 DECIMAL PLACES. Do not include the percentage sign in your answer. Enter your response below. %arrow_forwardPlease show me the valid approach to solving this financial accounting problem with correct methods.arrow_forwardHilltop Paving has a levered equity cost of capital of 14.92 percent. The debt-to-value ratio is .4, the assumed tax rate is 23 percent, and the pretax cost of debt is 7.2 percent. What is the estimated unlevered cost of equity?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT