Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

Kneller Co. Manufactures and sells medals for winners of athletics and other events. Please provide answer the general accounting question

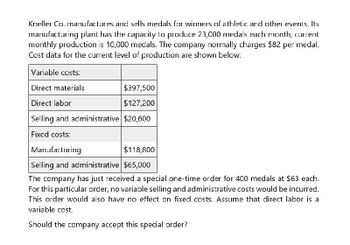

Transcribed Image Text:Kneller Co. manufactures and sells medals for winners of athletic and other events. Its

manufacturing plant has the capacity to produce 23,000 medals each month; current

monthly production is 10,000 medals. The company normally charges $82 per medal.

Cost data for the current level of production are shown below:

Variable costs:

Direct materials

Direct labor

$397,500

$127,200

Selling and administrative $20,600

Fixed costs:

Manufacturing

$118,800

Selling and administrative $65,000

The company has just received a special one-time order for 400 medals at $63 each.

For this particular order, no variable selling and administrative costs would be incurred.

This order would also have no effect on fixed costs. Assume that direct labor is a

variable cost.

Should the company accept this special order?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Krouse Company produces two products, forged putter heads and laminated putter heads, which are sold through specialty golf shops. The company is in the process of developing itsoperating budget for the coming year. Selected data regarding the companys two products areas follows: Manufacturing overhead is applied to units using direct labor hours. Variable manufacturing overhead Ls projected to be 25,000, and fixed manufacturing overhead is expected to be15,000. The estimated cost to produce one unit of the laminated putter head is: a. 42. b. 46. c. 52. d. 62.arrow_forwardCarltons Kitchens makes two types of pasta makers: Strands and Shapes. The company expects to manufacture 70,000 units of Strands, which has a per-unit direct material cost of $10 and a per-unit direct labor cost of $60. It also expects to manufacture 30.000 units of Shapes, which has a per-unit material cost of $15 and a per-unit direct labor cost of $40. It is estimated that Strands will use 140,000 machine hours and Shapes will require 60,000 machine hours. Historically, the company has used the traditional allocation method and applied overhead at a rate of $21 per machine hour. It was determined that there were three cost pools, and the overhead for each cost pool is shown: The cost driver for each cost pool and its expected activity is shown: A. What is the per-unit cost for each product under the traditional allocation method? B. What is the per-unit cost for each product under ABC costing?arrow_forwardRoper Furniture manufactures office furniture and tracks cost data across their process. The following are some of the costs that they incur. Classify these costs as fixed or variable costs, and as product costs or period costs. Wood used to produce desks ($125,00 per desk) Production labor used to produce desks ($15 per hour) Production supervisor salary ($45,000 per year) Depreciation on factory equipment ($60,000 per year) Selling and administrative expenses ($45,000 per year) Rent on corporate office ($44,000 per year) Nails, glue, and other materials required to produce desks (varies per desk) Utilities expenses for production facility Sales staff commission (5% of gross sales)arrow_forward

- Hatch Manufacturing produces multiple machine parts. The theoretical cycle time for one of its products is 65 minutes per unit. The budgeted conversion costs for the manufacturing cell dedicated to the product are 12,960,000 per year. The total labor minutes available are 1,440,000. During the year, the cell was able to produce 0.6 units of the product per hour. Suppose also that production incentives exist to minimize unit product costs. Required: 1. Compute the theoretical conversion cost per unit. 2. Compute the applied conversion cost per minute (the amount of conversion cost actually assigned to the product). 3. Discuss how this approach to assigning conversion cost can improve delivery time performance. Explain how conversion cost acts as a performance driver for on-time deliveries.arrow_forwardFive Card Draw manufactures and sells 24,000 units of Diamonds, which retails for $180, and 27,000 units of Clubs, which retails for $190. The direct materials cost is $25 per unit of Diamonds and $30 per unit of Clubs. The labor rate is $25 per hour, and Five Card Draw estimated 180,000 direct labor hours. It takes 3 direct labor hours to manufacture Diamonds and 4 hours for Clubs. The total estimated overhead is $720,000. Five Card Draw uses the traditional allocation method based on direct labor hours. A. What is the gross profit per unit for Diamonds and Clubs? B. What is the total gross profit for the year?arrow_forwardBox Springs. Inc., makes two sizes of box springs: queen and king. The direct material for the queen is $35 per unit and $55 is used in direct labor, while the direct material for the king is $55 per unit, and the labor cost is $70 per unit. Box Springs estimates it will make 4,300 queens and 3,000 kings in the next year. It estimates the overhead for each cost pool and cost driver activities as follows: How much does each unit cost to manufacture?arrow_forward

- Box Springs, Inc., makes two sizes of box springs: twin and double. The direct material for the twin is $25 per unit and $40 s used in direct labor, while the direct material for the double is $40 per unit, and the labor cost is $50 per unit. Box Springs estimates it will make 5,000 twins and 9,000 doubles in the next year. It estimates the overhead for each cost pool and cost driver activities as follows: How much does each unit cost to manufacture?arrow_forwardRemarkable Enterprises requires four units of part A for every unit of Al that it produces. Currently, part A is made by Remarkable, with these per-unit costs in a month when 4,000 units were produced: Variable manufacturing overhead is applied at $1.60 per unit. The other $0.50 of overhead consists of allocated fixed costs. Remarkable will need 8,000 units of part A for the next years production. Altoona Corporation has offered to supply 8,000 units of part A at a price of $8.00 per unit. If Remarkable accepts the offer, all of the variable costs and $2,000 of the fixed costs will be avoided. Should Remarkable accept the offer from Altoona Corporation?arrow_forwardGent Designs requires three units of part A for every unit of Al that it produces. Currently, part A is made by Gent, with these per-unit costs in a month when 4.000 units were produced: Variable manufacturing overhead is applied at $1.00 per unit. The other $0.30 of overhead consists of allocated fixed costs. Gent will need 6,000 units of part A for the next years production. Cory Corporation has offered to supply 6,000 units of part A at a price of $7.00 per unit. It Gent accepts the offer, all of the variable costs and $1,200 of the fixed costs will be avoided. Should Gent Designs accept the offer from Cory Corporation?arrow_forward

- Carsen Company produces handcrafted pottery that uses two inputs: materials and labor. During the past quarter, 24,000 units were produced, requiring 96,000 pounds of materials and 48,000 hours of labor. An engineering efficiency study commissioned by the local university revealed that Carsen can produce the same 24,000 units of output using either of the following two combinations of inputs: The cost of materials is 8 per pound; the cost of labor is 12 per hour. Required: 1. Compute the output-input ratio for each input of Combination F1. Does this represent a productivity improvement over the current use of inputs? What is the total dollar value of the improvement? Classify this as a technical or an allocative efficiency improvement. 2. Compute the output-input ratio for each input of Combination F2. Does this represent a productivity improvement over the current use of inputs? Now, compare these ratios to those of Combination F1. What has happened? 3. Compute the cost of producing 24,000 units of output using Combination F1. Compare this cost to the cost using Combination F2. Does moving from Combination F1 to Combination F2 represent a productivity improvement? Explain.arrow_forwardPlata Company has identified the following overhead activities, costs, and activity drivers for the coming year: Plata produces two models of microwave ovens with the following activity demands: The companys normal activity is 21,000 machine hours. Calculate the total overhead cost that would be assigned to Model X using an activity-based costing system: a. 230,000 b. 240,000 c. 280,000 d. 190,000arrow_forwardCrystal Pools estimates overhead will utilize 250,000 machine hours and cost $750,000. It takes 2 machine hours per unit, direct material cost of $14 per unit, and direct labor of $20 per unit. What is the cost of each unit produced?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning