EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Please provide this question solution general accounting

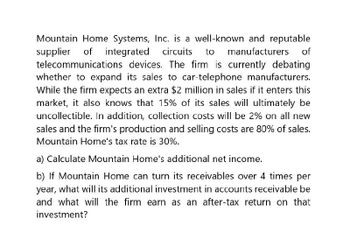

Transcribed Image Text:Mountain Home Systems, Inc. is a well-known and reputable

supplier of integrated circuits to manufacturers of

telecommunications devices. The firm is currently debating

whether to expand its sales to car-telephone manufacturers.

While the firm expects an extra $2 million in sales if it enters this

market, it also knows that 15% of its sales will ultimately be

uncollectible. In addition, collection costs will be 2% on all new

sales and the firm's production and selling costs are 80% of sales.

Mountain Home's tax rate is 30%.

a) Calculate Mountain Home's additional net income.

b) If Mountain Home can turn its receivables over 4 times per

year, what will its additional investment in accounts receivable be

and what will the firm earn as an after-tax return on that

investment?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Phlight Restaurant is considering a delivery service. The firm expects that sales from the new service will be $150,000 per year. Phlight currently offers a sit-down service with annual sales of $100,000. While many of the delivery sales will be to new customers, Phlight estimates that 60% of their current sit-down customers will switch and use the delivery service. The level of incremental sales associated with introducing the delivery service is closest to: Select one: a. $90,000 b. $150,000 c. $60,000 d. $120,000arrow_forwardA large electronic retailer is considering the purchase of software that will minimize shipping expenses in its supply chain network. This software, including installation and training, would be a $10-million investment for the retailer. If the firm’s effective interest rate is 15% per year and the life of the software is four years, what annual savings in shipping expenses must there be to justify the purchase of the software?arrow_forwardUnder pressure from its board of directors, management at Roadside is planning to enter the conventional battery-powered flashlight market. Roadside expects to sell this boring product to wholesalers for $18.16 per unit. Relevant fixed costs will total $343,600, and variable costs to make this product will be $12.15 per unit. Background research estimates the size of the market for conventional flashlights at 1.8 million units per year. If sales of this unit reach breakeven, what market share will Roadside have? Report your answer as a percent. Report 27.5%, for example, as "27.5". Rounding: tenth of a percent. Your Answer: Answerarrow_forward

- Techno Ltd manufactures components for laptop computers. One of its top selling products is the new solid-state drive, the Solix, which will offer improved speed and performance. Earlier this year, a Taiwanese company entered the market offering a similar drive at a price 10% below the Solix price of $400 per unit. Techno Ltd is currently achieving its target profit margin of 30% on all of its products. Required: 1. What target cost would have to be set for the Solix drive to remain competitive and meet the requirements of the company’s target profit margin? 2. Calculate the cost reduction objective. 3. Outline two cost management techniques Techno Ltd could apply to achieve the cost reduction objective.arrow_forwardExpo Lube is interested in producing and selling an industrial line of oil filters. Market research indicates that wholesale customers are currently willing to pay $8 for similar filters, and that Expo Lube could sell 80,000 units per year at that price. a. If Expo Lube requires a 19 percent return on sales, what is its target cost for the proposed industrial line of filters? b. Assume that market research reveals several of Expo Lube’s direct competitors are likely to lower the wholesale price of similar filters to $7 per unit. To remain competitive, what will Expo Lube’s target cost have to be to maintain a 19 percent return on sales? c. At a wholesale price of $7, Expo Lube estimates that it can sell 83,100 industrial filters per year instead of 80,000 units. Assuming its target costs are attainable, how much more or less profit per year will the company earn at the $7 wholesale price compared to the initial wholesale price estimate of $8?arrow_forwardGlobal Reach, Inc., is considering opening a new warehouse to serve the Southwest region. Darnell Moore, controller for Global Reach, has been reading about the advantages of foreign trade zones. He wonders if locating in one would be of benefit to his company, which imports about 90 percent of its merchandise (e.g., chess sets from the Philippines, jewelry from Thailand, pottery from Mexico, etc.). Darnell estimates that the new warehouse will store imported merchandise costing about 16.78 million per year. Inventory shrinkage at the warehouse (due to breakage and mishandling) is about 8 percent of the total. The average tariff rate on these imports is 5.5 percent. Required: 1. If Global Reach locates the warehouse in a foreign trade zone, how much will be saved in tariffs? Why? (Round your answer to the nearest dollar.) 2. Suppose that, on average, the merchandise stays in a Global Reach warehouse for nine months before shipment to retailers. Carrying cost for Global Reach is 6 percent per year. If Global Reach locates the warehouse in a foreign trade zone, how much will be saved in carrying costs? What will the total tariff-related savings be? (Round your answers to the nearest dollar.) 3. Suppose that the shifting economic situation leads to a new tariff rate of 13 percent, and a new carrying cost of 6.5 percent per year. To combat these increases, Global Reach has instituted a total quality program emphasizing reducing shrinkage. The new shrinkage rate is 7 percent. Given this new information, if Global Reach locates the warehouse in a foreign trade zone, how much will be saved in carrying costs? What will the total tariff-related savings be? (Round your answers to the nearest dollar.)arrow_forward

- Shimada Products Corporation of Japan is anxious to enter the electronic calculator market. Management believes that in order to be competitive in world markets, the price of the electronic calculator that the company is developing cannot exceed $15. Shimada’s required rate of return is 12% on all investments. An investment of $5,000,000 would be required to purchase the equipment needed to produce the 300,000 calculators that management believes can be sold each year at the $15 price.Required:Compute the target cost of one calculator.arrow_forwardEastern Auto Supply Limited produces and distributes auto supplies. The company is anxious to enter the rapidly growing market for long-life batteries that is based on lithium technology. Management believes that to be full competitive the new battery that the company is planning can’t be priced at more than Tk. 130. At this price management is confident that the company can sell 100,000 batteries per year. The batteries would require an investment of Tk. 5,000,000 and the desired ROI is 20%. Required: Compute the target cost of one battery.arrow_forwardRG Motors has been approached by a new customer with an offer to purchase 5,000 units of its hand-free, Wi-Fi-enabled automotive model – the SMART, at a price of RM18,000 per automobile. RG’s other sales would not be affected by this new customer offer. RG normally produces 100,000 units of its SMART model per year but only plans to produce and sell 90,000 units in the coming year. The normal sales price is RM35,000 per SMART. Unit cost information for the normal level of activity is as follows: Total CostDirect materials 10,000Direct labor 2,000Variable overhead 4,000Fixed overhead 8,000Total 24,000 Fixed overhead will not be affected by whether or not the special order is accepted. requird (i) List the relevant costs and benefits of the two alternatives of the special order. (ii) Propose whether operating income increase or decrease if the order is accepted with calculation details.arrow_forward

- RG Motors has been approached by a new customer with an offer to purchase 5,000 units of its hand-free, Wi-Fi-enabled automotive model – the SMART, at a price of RM18,000 per automobile. RG’s other sales would not be affected by this new customer offer. RG normally produces 100,000 units of its SMART model per year but only plans to produce and sell 90,000 units in the coming year. The normal sales price is RM35,000 per SMART. Unit cost information for the normal level of activity is as follows: Table 7: Production Costs Total Cost RM Direct materials 10,000 Direct labor 2,000 Variable overhead 4,000 Fixed overhead 8,000 Total 24,000 Fixed overhead will not be affected by whether or not the special order is accepted. Required: (i) List the relevant costs and benefits of the two alternatives of the special order. (ii) Propose whether operating income increase or decrease if the order is accepted with calculation details.arrow_forwardB&B has a new baby powder ready to market. If the firm goes directly to the market with the product, there is only a 55 percent chance of success. However, the firm can conduct customer segment research, which will take a year and cost $1.18 million. By going through research, the company will be able to better target potential customers and will increase the probability of success to 70 percent. If successful, the baby powder will bring a present value profit (at time of initial selling) of $18.8 million. If unsuccessful, the present value payoff is only $5.8 million. The appropriate discount rate is 15 percent. Calculate the NPV for the firm if it goes to market immediately and if it conducts customer segment research. (Do not round intermediate calculations and enter your answers in dollars, not millions of dollars, rounded to 2 decimal places, e.g., 1,234,567.89.)arrow_forwardHair Zone manufactures a brand of hair-styling gel. It is considering adding a modified version of the product – a foam that provides stronger hold. Hair Zone’s variable costs and prices to wholesalers are: Hair Zone expects to sell 1 million units of the new styling foam in the first year after introduction, but it expects that 60 per cent of those sales will come from buyers whonormally purchase Hair Zone’s styling gel. Hair Zone estimates that it would sell 1.5 million units of the gel if it did not introduce the foam. If the fixed cost of launching the new foam will be €100,000 during the first year, should Hair Zone add the new product to its line? Why or why not?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning