FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

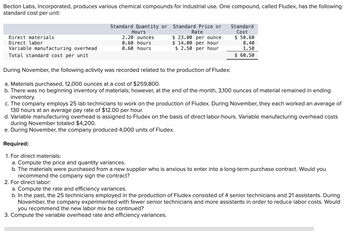

Transcribed Image Text:Becton Labs, Incorporated, produces various chemical compounds for industrial use. One compound, called Fludex, has the following

standard cost per unit:

Direct materials

Direct labor

Variable manufacturing overhead

Total standard cost per unit

Standard Quantity or

Hours

2.20 ounces

0.60 hours

0.60 hours

Standard Price or

Rate

$23.00 per ounce

$14.00 per hour

$ 2.50 per hour

Standard

Cost

$50.60

8.40

1.50

$ 60.50

During November, the following activity was recorded related to the production of Fludex:

a. Materials purchased, 12,000 ounces at a cost of $259,800.

b. There was no beginning inventory of materials; however, at the end of the month, 3,100 ounces of material remained in ending

inventory.

c. The company employs 25 lab technicians to work on the production of Fludex. During November, they each worked an average of

130 hours at an average pay rate of $12.00 per hour.

d. Variable manufacturing overhead is assigned to Fludex on the basis of direct labor-hours. Variable manufacturing overhead costs

during November totaled $4,200.

e. During November, the company produced 4,000 units of Fludex.

Required:

1. For direct materials:

a. Compute the price and quantity variances.

b. The materials were purchased from a new supplier who is anxious to enter into a long-term purchase contract. Would you

recommend the company sign the contract?

2. For direct labor:

a. Compute the rate and efficiency variances.

b. In the past, the 25 technicians employed in the production of Fludex consisted of 4 senior technicians and 21 assistants. During

November, the company experimented with fewer senior technicians and more assistants in order to reduce labor costs. Would

you recommend the new labor mix be continued?

3. Compute the variable overhead rate and efficiency variances.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Haggstrom, Inc., manufactures steel fittings. Each fitting requires both steel and an alloy that allows the fitting to be used under extreme conditions. The following data apply to the production of the fittings. Direct materials per unit 3 pounds of steel at $0.55 per pound 0.5 pounds of alloy at $1.90 per pound Direct labor per unit 0.02 hours at $30 per hour Overhead per unit Indirect materials Indirect labor Utilities Plant and equipment depreciation Miscellaneous $0.60 0.75 0.55 0.90 0.70 Total overhead per unit $3.50 The plant and equipment depreciation and miscellaneous costs are fixed and are based on production of 250,000 units annually. All other costs are variable. Plant capacity is 300,000 units annually. All other overhead costs are variable. The following are forecast for year 2. Contract negotiations with the union are expected to lead to an increase in hourly direct labor costs of 4 percent, mostly in the form of additional benefits. Commodity prices, including steel,…arrow_forwardHaving trouble with prior chapter work still and we are moving on to another chapter.arrow_forwardRequired information [The following information applies to the questions displayed below.] Performance Products Corporation makes two products, titanium Rims and Posts. Data regarding the two products follow: Rims Posts: Direct Labor- Hours per unit 0.40 0.60 Additional information about the company follows: a. Rims require $20 in direct materials per unit, and Posts require $18. b. The direct labor wage rate is $18 per hour. c. Rims are more complex to manufacture than Posts and they require special equipment. d. The ABC system has the following activity cost pools: Activity Cost Pool Machine setups Special processing General factory Annual Production 26,000 units 88,000 units Unit product cost of Rims Unit product cost of Posts Activity Measure Number of setups Machine-hours Direct labor-hours. Estimated Overhead Cost $28,160 $ 164,560 $ 780,000 Estimated Activity Rims 110 2,000 10,400 Posts 90 0 52,800 Total 200 2,000 63,200 2. Determine the unit product cost of each product…arrow_forward

- Snapware Systems produces commercial strength cleansing supplies. Two of its main products are window cleaner that uses ammonia, and floor cleaner that uses bleach. Information for the most recent period follows: Product Names Window Cleaner (ammonia) Floor Cleaner (bleach) Direct materials information: Standard ounces per unit 16 oz. 24 oz. Standard price per ounce $0.75 ? Actual quantity used per unit 20 oz. 22 oz. Actual price paid for material $1.00 $0.90 Actual quantity purchased and used 1,500 oz. 2,800 oz.. Price variance ? $300 U Quantity variance $1,500 U ? Total direct materials variance ? $678 F Number of units produced 500 600 What is the standard price for bleach? Select one: a. $0.88/oz. b. $1.09/oz. c. $1.14/oz. d. $0.79/oz. e. $0.92/oz.arrow_forwardRequired information [The following information applies to the questions displayed below.] Performance Products Corporation makes two products, titanium Rims and Posts. Data regarding the two products follow: Rims Posts Direct Labor- Hours per unit 0.70 0.80 Annual Production Additional information about the company follows: a. Rims require $14 in direct materials per unit, and Posts require $10. b. The direct labor wage rate is $20 per hour. Activity Cost Pool Machine setups Special processing General factory 26,000 units 90,000 units c. Rims are more complex to manufacture than Posts and they require special equipment. d. The ABC system has the following activity cost pools: Unit product cost of Rims Unit product cost of Posts Activity Measure Number of setups Machine-hours Direct labor-hours Estimated Overhead Cost $ 33,300 $ 172,800 $ 858,000 Estimated Activity Rims 70 3,000 18,200 Posts 230 0 72,000 Total 300 3,000 90,200 2. Determine the unit product cost of each product…arrow_forwardBecton Labs, Incorporated, produces various chemical compounds for industrial use. One compound, called Fludex, has the following standard cost per unit: Standard Quantity or Hours Standard Price or Rate Standard Cost Direct materials 2.40 ounces $ 18.00 per ounce $ 43.20 Direct labor 0.70 hours $ 14.00 per hour 9.80 Variable manufacturing overhead 0.70 hours $ 3.00 per hour 2.10 Total standard cost per unit $ 55.10 During November, the following activity was recorded related to the production of Fludex: Materials purchased, 12,000 ounces at a cost of $198,000. There was no beginning inventory of materials; however, at the end of the month, 3,200 ounces of material remained in ending inventory. The company employs 20 lab technicians to work on the production of Fludex. During November, they each worked an average of 160 hours at an average pay rate of $12.00 per hour. Variable manufacturing overhead is assigned to Fludex on the basis of direct labor-hours.…arrow_forward

- Becton Labs, Incorporated, produces various chemical compounds for industrial use. One compound, called Fludex, is prepared using an elaborate distilling process. The company has developed standard costs for one unit of Fludex, as follows: Direct materials Direct labor Variable manufacturing overhead Total standard cost per unit Standard Quantity or 2.50 Hours ounces 0.90 hours Standard Price or Rate $ 22.00 per ounce $ 16.00 per hour 0.90 hours $ 2.00 per hour Standard Cost $ 55.00 14.40 1.80 $ 71.20 During November, the following activity was recorded related to the production of Fludex: a. Materials purchased, 14,000 ounces at a cost of $289,800. b. There was no beginning inventory of materials; however, at the end of the month, 4,050 ounces of material remained in ending inventory. c. The company employs 26 lab technicians to work on the production of Fludex. During November, they each worked an average of 150 hours at an average pay rate of $15.00 per hour. d. Variable…arrow_forwardPetrillo Company produces engine parts for large motors. The company usesa standard cost system for production costing and control. The standard costsheet for one of its higher volume products (a valve) is as follows: Direct materials (7 lbs @$5,4) $37,80 Direct labor (1,75 lbs @$18) $31,50 Variable overhead (1,75 lbs @$4) $7 Fixed overhead (1,75 lbs @$3) $5,25 Standard unit cost $81,55 During the year, Petrillo had the following activity related to valve production:a. Production of valves totaled 20,600 units.b. A total of 135,400 pounds of direct materials was purchased at $5.36per pound.c. There were 10,000 pounds of direct materials in beginning inventory(carried at $5.40 per pound). There was no ending inventory. d. The company used 36,500 direct labor hours at a total cost of $656,270.e. Actual fixed overhead totaled $110,000.f. Actual variable overhead totaled $168,000.Petrillo produces all of its valves in a single plant. Normal activity is 20,000units per year. Standard…arrow_forwardMickley Corporation produces two products, Alpha6s and Zeta7s, which pass through two operations, Sintering and Finishing. Each of the products uses two raw materials—X442 and Y661. The company uses a standard cost system, with the following standards for each product (on a per unit basis): Product Raw Material Standard Labor Time X442 Y661 Sintering Finishing Alpha6 1.8 kilos 2.0 liters 0.20 hours 0.80 hours Zeta7 3.0 kilos 4.5 liters 0.35 hours 0.90 hours Information relating to materials purchased and materials used in production during May follows: Material Purchases Purchase Cost Standard Price Used in Production X442 14,500 kilos $ 52,200 $ 3.50 per kilo 8,500 kilos Y661 15,500 liters $ 20,925 $ 1.40 per liter 13,000 liters The following additional information is available: The company recognizes price variances when materials are purchased. The standard labor rate is $19.80 per hour in Sintering and $19.20 per hour in Finishing. During…arrow_forward

- Cane Company manufactures two products called Alpha and Beta that sell for $155 and $115, respectively. Each product uses only one type of raw material that costs $6 per pound. The company has the capacity to annually produce 110,000 units of each product. Its average cost per unit for each product at this level of activity are given below: Alpha Beta Direct materials $ 24 $ 12 Direct labor 23 26 Variable manufacturing overhead 22 12 Traceable fixed manufacturing overhead 23 25 Variable selling expenses 19 15 Common fixed expenses 22 17 Total cost per unit $ 133 $ 107 The company considers its traceable fixed manufacturing overhead to be avoidable, whereas its common fixed expenses are unavoidable and have been allocated to products based on sales dollars. Required: 1. What is the total amount of traceable fixed manufacturing overhead for each of the two products? what is the alpha and betaarrow_forwardLynwood, Inc. produces two different products (Product A and Product X) using two different activities: Machining, which uses machine hours as an activity driver, and Inspection, which uses number of batches as an activity driver. The activity rate for Machining is $180 per machine hour, and the activity rate for Inspection is $580 per batch. The activity drivers are used as follows: Product A: (machine hours= 1,200) (number of batches 55) Product X: (mahine hours= 3,200) (number of batches 18) Totals: (Machine hours= 4,400) (number of batches 73) What is the amount of Machining cost assigned to Product X?arrow_forwardCane Company manufactures two products called Alpha and Beta that sell for $155 and $115, respectively. Each product uses only one type of raw material that costs $6 per pound. The company has the capacity to annually produce 110,000 units of each product. Its average cost per unit for each product at this level of activity are given below: Alpha Beta Direct materials $ 24 $ 12 Direct labor 23 26 Variable manufacturing overhead 22 12 Traceable fixed manufacturing overhead 23 25 Variable selling expenses 19 15 Common fixed expenses 22 17 Total cost per unit $ 133 $ 107 The company considers its traceable fixed manufacturing overhead to be avoidable, whereas its common fixed expenses are unavoidable and have been allocated to products based on sales dollars. 2. What is the company’s total amount of common fixed expenses? 3. Assume that Cane expects to produce and sell 87,000 Alphas during the current year. One of Cane's sales representatives has found a…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education