ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

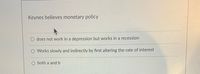

Transcribed Image Text:Keynes believes monetary policy

O does not work in a depression but works in a recession

O Works slowly and indirectly by first altering the rate of interest

O both a and b

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Consider the AD/AS model with a constant inflation rate. It is possible that the money supply is rising while interest rates are unchanged because... a. Declining interest rates cause the investment demand curve to shift to the left, which causes interest rates to rise back to their original level. b. The rising price level increases money demand, offsetting the impact of the rising money supply. c. The rising price level decreases money demand which pushes up interest rates. d. Declining interest rates cause the investment demand curve to shift to the right, which causes interest rates to rise back to their original leve. e. The money transmission mechanism does not apply in a situation of sustained inflation.arrow_forwardwhat is the impact of a contractionary policy on the U.S. economy from a new keynesian point of view? Show the impact using graphs and formulas of Taylor Rule.arrow_forwardAssume an economy is currently operating at point A. Illustrate using the IS-LM model how the policy recommendations you provide in c) will impact the economy. On your diagram indicate the new point that the policy takes the economy to and label this as point B.arrow_forward

- There are the three reasons why aggregate demand is downward slope: real wealth effect, interest rate effect, exchange rate effect. In a case scenario the market saw an increase in consumer spending when there is a boom in economy. Or the economic crisis makes the public bit shy to buy or consume any product. In the above two situations: the transfer payment does not make the part of government spending as the public will spend the money given as self-security and unemployment. Export situation gets worse as the foreigners are reluctant to buy expensive goods and the government will make some imports. The borrowing has become easy and loans are issued at a cheaper rate to buy car. Following the equation: Y = C + I + G + NX will the below examples increase or decrease the aggregate demand in Pakistan? What will be the shift in position for below situations? Widespread fear of recession The appreciation in the Pakistani Rupee rate A boom in the stock market An increase in transfer…arrow_forwardUse the Keynesian model to explain the procyclical behavior of Use the Keynesian model to explain the procyclical behavior of employment, money, inflation, and investment. Use the Keynesian model to explain the procyclical behavior ofarrow_forwardA country's central bank is engaging in monetary contraction, with M going from M0=40 to M1=20. Its economy is as follows. Goods: slc = 3 MPC = 0.7 G = 10 T = 9 Before the policy, the goods market equilibrium is at Y0 = 54. Financial: I = 18-200r Before the policy, the loans market equilibrium is at r = 4.25% and I = 9.5 Money: M0 = 40 P0 = 2 M/P = 0.02 / (r - Y/5000)^2 and finally, Labor: w = MPL = 0.5 * 4.5 * 16^0.5 / L^0.5 w = EP / P0 * L^0.5 Where workers currently expect the price level of EP=2. How does the monetary contraction directly and immediately affect the goods market? There are four endogenous variables that adjust in response to shock/policy: Y, I, r, P. The policy variable of interest is M. Therefore, let's approach our solution by first recognizing that all other letters are just constants and plug them in. For example: Y = 2 + 0.5(Y-6)+7+I becomes Y = 12 + 2*I First, express the goods market as expenditure being a linear function of investment I of the form: Y = a…arrow_forward

- Combination Policy (a) Graph an AD/AS model with sticky wages and show graphically and ex- plain with words how the Australian government with the help of the Reserve Bank could increase government spending while keeping the economy at full employment without eausing changes in the price level. (b) If they pursue this policy, what happens to the amount of investment in the economy?arrow_forwardConsidering how monetary policy affects the market, which of the following statements is most accurate? There is an indirect impact on aggregate demand by monetary policies. O There is more of an impact on consumption than investments by monetary policies. There is a direct impact on aggregate demand by monetary policies.arrow_forwardIn the goods-and-services market actual inventories have started to rise above optimal inventories. What could have happened to autonomous money demand to bring this about? Explain and diagrammatically represent your answer. In doing so, be sure to explain and diagrammatically represent what happens to the rate of interest, investment, and Y. In explaining what happens to Y, be sure to fully explain the equilibrium process in the simple Keynesian modelarrow_forward

- 50. Why is the Keynesian "Paradox of Thrift ” actually no paradox at all ?arrow_forwardIn the classical model, equilibrium occurs at full employment, whereas in the Keynesian model, unemployment may exist in equilibrium. O True O Falsearrow_forwarddid keynes believe that wages/prices were sticky in general-up and down? or just down?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education