Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

full fill this accounts requirements

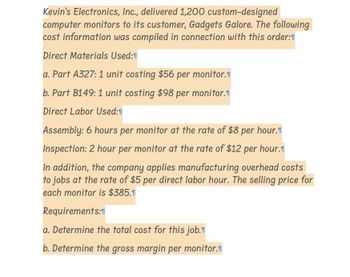

Transcribed Image Text:Kevin's Electronics, Inc., delivered 1,200 custom-designed

computer monitors to its customer, Gadgets Galore. The following

cost information was compiled in connection with this order:1

Direct Materials Used:1

a. Part A327: 1 unit costing $56 per monitor.

b. Part B149: 1 unit costing $98 per monitor.

Direct Labor Used:

Assembly: 6 hours per monitor at the rate of $8 per hour.

Inspection: 2 hour per monitor at the rate of $12 per hour.

In addition, the company applies manufacturing overhead costs

to jobs at the rate of $5 per direct labor hour. The selling price for

each monitor is $385.1

Requirements:1

a. Determine the total cost for this job.

b. Determine the gross margin per monitor.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Ivanhoe, Inc. manufactures two products: missile range instruments and space pressure gauges. During April, 50 range instruments and 200 pressure gauges were produced, and overhead costs of $87,970 were estimated. An analysis of estimated overhead costs reveals the following activities. Activities Cost Drivers Total Cost 1. Materials handling Number of requisitions $37,800 2. Machine setups Number of setups 28,320 3. Quality inspections Number of inspections 21.850 $87,970 The cost driver volume for each product was as follows. Cost Drivers Instruments Gauges Total Number of requisitions 405 645 1.050 Number of setups 190 290 480 Number of inspections 230 245 475arrow_forwardCrane, Inc. manufactures two products: missile range instruments and space pressure gauges. During April, 50 range instruments and 200 pressure gauges were produced, and overhead costs of $88,010 were estimated. An analysis of estimated overhead costs reveals the following activities. 1. M Materials handling Machine setups Quality inspections 2. 3. Activities (a) The cost driver volume for each product was as follows. Cost Drivers Number of requisitions Number of setups Number of inspections Materials handling Cost Drivers Machine setups Number of requisitions Number of setups Number of inspections Quality inspections $ Instruments Gauges 390 200 240 640 Determine the overhead rate for each activity. 295 265 Total Cost $37,080 28,710 22,220 $88,010 Total 1,030 495 505 Overhead Rate per requisition per setup per inspectionarrow_forwardAir United, Inc. manufactures two products: missile range instruments and space pressure gauges. During April, 50 range instruments and 300 pressure gauges were produced, and overhead costs of $94,500 were estimated. An analysis of estimated overhead costs reveals the following activities. Activities Cost Drivers Total Cost 1. Materials handling Number of requisitions $40,000 2. Machine setups Number of setups 21,500 3. Quality inspections Number of inspections 33,000 $94,500 The cost driver volume for each product was as follows. Cost Drivers Instruments Gauges Total Number of requisitions 400 600 1,000 Number of setups 200 300 500 Number of inspections 200 400 600 (a) Determine the overhead rate for each activity. Overhead Rate Materials handling $enter a dollar amount per requisition per requisition Machine setups…arrow_forward

- Primary Co. makes two products, benches, and chairs. Several activities are required to produce each product. Activity Activity Rate Fabrication $30 per machine hour Assembly $35 per direct labor hour Inspection $20 per inspection A. Production of benches required 600 machine hours, 190 direct labor hours, and 15 inspections. Calculate the total cost to be allocated to the production of benches. B. Production of chairs required 400 machine hours, 223 direct labor hours, and 25 inspections. Calculate the total cost to be allocated to the production of chairs.arrow_forwardAdvanced Miniature Development manufactures computer graphics cards (GPUs). Standard costs and actual costs for direct materials, direct labor, and factory overhead incurred for the manufacture of 4,160 GPUs were as follows: Cost Driver Direct materials Direct labor Factory overhead Instructions Determine the: Each GPU requires 0.5 hour of direct labor. f. Standard Costs 110,000 lbs. at $6.30 2,080 hours at $15.80 Rates per direct labor hr., based on 100% of normal capacity of 2,000 direct labor hrs.: Variable cost, $4.25 Fixed cost, $6.00 a. direct materials price variance b. direct materials quantity variance c. total direct materials cost variance d. direct labor rate variance direct labor time variance total direct labor cost variance g. the variable factory overhead controllable variance h. fixed factory overhead volume variance i. total factory overhead cost variance. Actual Costs 115,000 lbs. at $6.50 2,000 hours at $15.40 $8,200 variable cost $12,000 fixed costarrow_forwardHuron Company produces a commercial cleaning compound known as Zoom. The direct materials and direct labor standards for one unit of Zoom are given below: Standard Quantity or Hours 6.40 pounds 0.40 hours During the most recent month, the following activity was recorded: Direct materials Direct labor a. 18,500.00 pounds of material were purchased at a cost of $1.40 per pound. b. All of the material purchased was used to produce 2.500 units of Zoom c. 800 hours of direct labor time were recorded at a total labor cost of $13,600 Required: 1 Compute the materials price and quantity variances for the month. 2. Compute the labor rate and efficiency variances for the month. Standard Price or Rate $1.70 per pound $14.00 per hour (For all requirements, Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values. Round your intermediate calculations to the nearest whole dollar.)…arrow_forward

- Zee-Drive Ltd. is a computer manufacturer. One of the items they make is monitors. Zee-Drive has the opportunity to purchase 19,000 monitors from an outside supplier for $211 per unit. One of the company's cost-accounting interns prepared the following schedule of Zee-Drive's cost to produce 19,000 monitors: Total cost of producing 19,000 monitors Unit cost Direct materials $ 2,204,000 $116 Direct labor 1,330,000 70 Variable factory overhead 665,000 35 Fixed manufacturing overhead 570,000 30 Fixed non-manufacturing overhead 722,000 38 $ 5,491,000 $ 289 You are asked to look over the intern's estimate before the information is shared with members of management who will decide to continue to make the monitors or buy them. The company's controller believes that the estimate may be incorrect because it includes costs that are not relevant. If Zee-Drive buys the monitors, the direct labor force currently employed in producing the monitors will be terminated and there would be no termination…arrow_forwardSand Castle Manufacturing produces concrete yard art. Recently, 2,500 concrete seahorses were produced in a production run. The run required 1,250 machine hours, and also required five "set-ups" of mixing equipment. Final inspection required 50 hours of inspection activity. Overhead is estimated at $30 per machine hour, plus $2,750 per "set-up," and $25 per inspection hour. Direct materials and direct labor total $75 per seahorse. (A) Apply activity-based costing and determine the amount assigned to a concrete seahorse. (B) For GAAP purposes, Sand Castle applies traditional costing methods, and allocates overhead at $50 per machine hour. How much cost would be assigned to the 2,500 seahorses? What is the per unit cost of a seahorse under the traditional approach? What might explain the higher cost assignment, and how could this influence business decision making?arrow_forwardPhono Company manufactures a plastic toy cell phone. The following standards have been established for the toy’s materials and labor inputs: During the first week of July, the company had the following results:Units produced 90,000Actual labor costs $138,000Actual labor hours 13,400Materials purchased and used 44,250 lbs. @ $1.55 per lb.The purchasing agent located a new source of slightly higher-quality plastic, and this materialwas used during the first week in July. Also, a new manufacturing layout was implemented ona trial basis. The new layout required a slightly higher level of skilled labor. The higher-qualitymaterial has no effect on labor utilization. Similarly, the new manufacturing approach has noeffect on material usage. (Note: Round all variances to the nearest dollar.)Required:1. CONCEPTUAL CONNECTION Compute the materials price and usage variances.Assuming that the materials variances are essentially attributable to the higher quality ofmaterials, would you recommend…arrow_forward

- Harbour Company makes two models of electronic tablets, the Home and the Work. Basic production information follows: Direct materials cost per unit Direct labor cost per unit Sales price per unit Expected production per month Harbour has monthly overhead of $168,340, which is divided into the following activity pools: Setup costs Quality control Maintenance Total Number of setups Number of inspections Number of machine hours $86,400 54,940 27,000 $ 168,340 The company also has compiled the following information about the chosen cost drivers: Home 37 340 1,600 Required 1 Home Required 2 Required 3 $ 41 16 360 770 units Work 71 330 1,100 Home Model Work Model Total Overhead Cost Required: 1. Suppose Harbour uses a traditional costing system with machine hours as the cost driver. Determine the amount of overhead assigned to each product line. 2. Calculate the production cost per unit for each of Harbour's products under a traditional costing system. 3. Calculate Harbour's gross margin per…arrow_forwardHammer Company produces a variety of electronic equipment. One of its plants produces two laser printers: the deluxe and the regular. At the beginning of the year, the following data were prepared for this plant: Deluxe Regular Quantity 100,000 800,000 Selling price $900 $750 Unit prime cost $529 $483 In addition, the following information was provided so that overhead costs could be assigned to each product: Activity Name Activity Driver Deluxe Regular Activity Cost Setups Number of setups 300 200 $2,200,000 Machining Machine hours 100,000 300,000 56,000,000 Engineering Engineering hours 50,000 100,000 9,000,000 Packing Packing orders 100,000 400,000 400,000 Calculate the per-unit product cost for each product. Round your answers to the nearest whole dollar. Deluxe $____per unit Regular $____per unitarrow_forwardXYZ Corporation manufactures and sells electronic gadgets. The company uses a standard cost system to analyze its manufacturing costs. The standard cost of producing one gadget is as follows: Direct materials: 3 units @ $15 per unit Direct labor: 2 hours @ $20 per hour Variable overhead: $10 per gadget Fixed overhead: $5,000 per month During the month of June, the company produced 5,000 gadgets and incurred the following actual costs: Direct materials: 14,500 units purchased at $14.50 per unit Direct labor: 9,800 hours worked at an average rate of $21 per hour Variable overhead: $52,000 Fixed overhead: $5,200 Answer the following questions and show all calculations: a) Compute the direct materials price and efficiency variances. b) Compute the direct labor rate and efficiency variances. c) Compute the variable overhead spending and efficiency variances. d) Compute the fixed overhead budget and volume variances. e) Prepare a cost variance analysis table to summarize the results.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning