Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

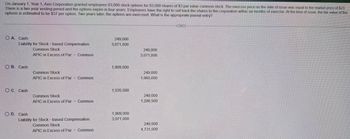

Transcribed Image Text:On January 1, Year 1, Axis Corporation granted employees 83,000 stock options for 83,000 shares of $3 par value common stock. The exercise price on the date of issue was equal to the market price of $23.

There is a two year vesting period and the options expire in four years. Employees have the right to sell back the shares to the corporation within six months of exercise. At the time of issue, the fair value of the

options is estimated to be $37 per option. Two years later, the options are exercised. What is the appropriate journal entry?

A. Cash

Liability for Stock-based Compensation

249,000

3,071,000

Common Stock

APIC in Excess of Par

Common

249,000

3,071,000

OB. Cash

1,909,000

Common Stock

APIC in Excess of Par

Common

249,000

1,660,000

OC. Cash

1,535,500

Common Stock

APIC in Excess of Par

-

Common

249,000

1,286,500

OD. Cash

Liability for Stock-based Compensation

Common Stock

APIC in Excess of Par - Common

1,909,000

3,071,000

249,000

4,731,000

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- On January 2, 2021, the Life Science Corporation granted 9,000 stock options allowing employees to purchase 9,000 shares of the company’s common stock at $50 per share. A third of the options vest at the end of each of the next three years (i.e., a third will vest at the end of 2021). The company treats each tranche as a separate award based on the vesting date. The fair values of the options that vest at the end of 2021-2023 are $5.00, $6.00, and $8.00, respectively. REQUIRED: 1. Calculate compensation expense for Life Science during 2021-2023. 2. Prepare the journal entries for 2021-2023.arrow_forwardOn January 1, 2020, AllClear Company issues 2,000 shares of restricted stock to its CEO, Jason Skyline. AllClear’s stock has a fair value of $30 per share on January 1, 2020. Additional information is as follows. The service period related to the restricted stock is five years. Vesting occurs if Skyline stays with the company for a five-year period. The par value of the stock is $10 per share. Prepare journal entries relating to the restricted stock in 2020. Assume that Jason Skyline leaves the company on April 1, 2021 (before any expense has been recorded during 2021). Prepare journal entry relating to the restricted stock in 2021, if necessary.arrow_forwardOn January 1,2020, V Co. issued 100 share options to each of its 15 executive officers. The options vest at the end of a 4-year period. On the date of grant, each share option had a fair value of P 10. V expects that all 1,500 options will vest. After the 4 year period, all executives are still in the employ of V Co. and 7 executives exercised their option and purchased the shares for P 17 each. The par value of each share is P 15. 1. How much is the compensation expense for the 3rd year in the vesting period if 5 of the executives left in the 3rd year of the vesting period? 2. How much is the compensation expense for the 3rd year in the vesting period if 2 of the executives left in the 3rd year of the vesting period?arrow_forward

- FIU Inc granted 25,000 stock options to its top management team on January 1, 2022. The options vest at the end of 5 years (cliff vesting). The grant-date fair value of each option is $100. No forfeitures are expected to occur. The company is expensing the cost of the options on a straight-line basis over the 5-year period. On January 1, 2023, the fair value of each option is $95. On January 1, 2024, the fair value is $98. On January 1, 2024 the fair value of each option is $96. Determine the amount to be recognized as compensation expense for each of the 5 years under (a) IFRS, and (b) US GAAP.arrow_forwardthe dusty corporation began business on January 1, 2020. the corporate charter authorizes issuance of 100,000 shares of .01 par value common stock and 10,000 shares of $1 par value, 10% cumulative preferred stock. on july 1, 2020, dusty issued 30,000 shares of common stock in exchange for three years of rent on a retail location. the cash rental price is $4,200 per month and the rental period begins july 1. How should dusty adjust its financial statement for the issuance of the shares on July 1?arrow_forwardOn November 1, 2020, Tamarisk Company adopted a stock-option plan that granted options to key executives to purchase 38,400 shares of the company’s $9 par value common stock. The options were granted on January 2, 2021, and were exercisable 2 years after the date of grant if the grantee was still an employee of the company. The options expired 6 years from date of grant. The option price was set at $30, and the fair value option-pricing model determines the total compensation expense to be $576,000.All of the options were exercised during the year 2023: 25,600 on January 3 when the market price was $64, and 12,800 on May 1 when the market price was $75 a share.Prepare journal entries relating to the stock option plan for the years 2021, 2022, and 2023. Assume that the employee performs services equally in 2022 and 2023.arrow_forward

- 18arrow_forwardOn January 1, 2020, ABC Company granted share options to each of the 300 employees working in the Accounting department. The options price is P90 and the par value is P70 per share.The share options vest at the end of a three-year period provided that the employees remain in the entity’s employ and provided the volume of sales will increase by 10% per year.The fair value of each share option on grant date is P35.The share will vest as follows: If the sales increase by 10%, each employee will receive 200 share options; If the sales increase by 15%, each employee will receive 300 share options.· On December 31, 2020, the sales increased by 10%, and no employees have left the entity· On December 31, 2021, sales increased by 15% and no employees have left.On December 31, 2022, the sales increased by 15% and 50 employees left the entityWhat is the share premium upon exercise of the share options on December 31, 2022?arrow_forwardOn November 1, 2025, Kingbird Company adopted a stock-option plan that granted options to key executives to purchase 25,500 shares of the company's 59 par value common stock. The options were granted on January 2, 2026, and were exercisable 2 years after the date of grant if the grantee was still an employee of the company. The options expired 6 years from date of grant. The option price was set at $50, and the fair value option-pricing model determines the total compensation expense to be $382.500. All of the options were exercised during the year 2028: 17,000 on January 3 when the market price was $65, and 8,500 on May 1 when the market price was $76 a share. Prepare journal entries relating to the stock option plan for the years 2026, 2027, and 2028. Assume that the employee performs services equally in 2026 and 2027. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is…arrow_forward

- Pastore Incorporated granted options for 1 million shares of its $1 par common stock at the beginning of the current year. The exercise price is $31 per share, which was also the market value of the stock on the grant date. The fair value of the options was estimated at $9.00 per option. What would be the total compensation indicated by these options?arrow_forwardOn November 1, 2020, Sweet Company adopted a stock-option plan that granted options to key executives to purchase 31,800 shares of the company’s $9 par value common stock. The options were granted on January 2, 2021, and were exercisable 2 years after the date of grant if the grantee was still an employee of the company. The options expired 6 years from date of grant. The option price was set at $40, and the fair value option-pricing model determines the total compensation expense to be $477,000.All of the options were exercised during the year 2023: 21,200 on January 3 when the market price was $68, and 10,600 on May 1 when the market price was $78 a share.Prepare journal entries relating to the stock option plan for the years 2021, 2022, and 2023. Assume that the employee performs services equally in 2022 and 2023. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and…arrow_forwardDate May 1, 2028 Account Titles and Explanation Debit Creditarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning