FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Need answer do fast and correct for this accounting question

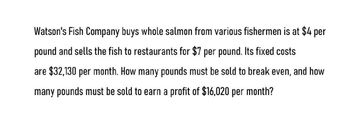

Transcribed Image Text:Watson's Fish Company buys whole salmon from various fishermen is at $4 per

pound and sells the fish to restaurants for $7 per pound. Its fixed costs

are $32,130 per month. How many pounds must be sold to break even, and how

many pounds must be sold to earn a profit of $16,020 per month?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Preston products produces a disinfecting liquid. The liquid is sold in one gallon containers and has the following price and cost characteristics. Sales Price: $36.00 per gallon Variable costs: $12.00 per gallon Fixed costs: 504,000 per month Preston products is subject to an income tax rate of 21 percent. a. How many gallons must Preston products sell every month to break even? b. How many gallons must Preston products sell to earn a monthly operating profit of $75,840 after taxes?arrow_forwardRolf's Golf store sells golf balls for $27 per dozen. The store's overhead expenses are 26% of cost and the owners require a profit of 18% of cost. a. How much does Rolf's Golf store buy the golf balls for? _____per dozen b. What is the price needed to cover all the costs and expenses? c. What is the highest rate of markdown at which the store will still break even? d. What markdown rate would price the golf balls at cost?arrow_forwardMaple Inc. manufactures a product that costs $25 per unit plus $43,000 in fixed costs each month. Maple currently sells 6,000 of these units per month for $47 each. If Maple leased a machine for $12,000 a month, it could add features to the product that would allow it to sell for $53 each. It would cost an additional $9 per unit to add these features. How much would Maple's profit be affected if it leased the machine and added features to its product? Multiple Choice Increase $252,000 Decrease $252,000 Increase $6,000 Decrease $30,000arrow_forward

- Rolf's Golf store sells golf balls for $32 per dozen. The store's overhead expenses are 30% of cost and the owners require a profit of 19% of cost. a. How much does Rolf's Golf store buy the golf balls for? b. What is the price needed to cover all the costs and expenses? c. What is the highest rate of markdown at which the store will still break even? d. What markdown rate would price the golf balls at cost? Anna sells a certain pair of earrings at her store for $46.40 per pair. Her overhead expenses are $6.00 per pair and she makes 55.00% operating profit on selling price.Round to the nearest cent. a. What is her amount of markup per pair of earrings? b. How much does it cost her to purchase each pair of earrings?arrow_forward1. You have a small business selling cans of HuntBi, a reasonably nasty-tasting energy drink. You sell each can of HuntBi for $12.00. Each can costs you $5.00 to purchase from the manufacturer. You pay your salesperson a 20% commission on all sales on top of a base salary of $1,800 per month. Your rent is $1,000 per month. Other miscellaneous costs (insurance, utilities, etc.) average $512 per month. You are pretty sure you can sell 1,000 cans per month at the $12.00 price point. A. How many cans do you need to sell to breakeven each month (round up to the nearest whole can)? B. How much monthly operating income will you have if you sell 1,000 cans per month? C. If tax rates are 24%, how much net income will you make if you sell 1,000 cans? You are considering offering a $1.00 off coupon for each can to increase sales. You think sales will increase to 1,500 cans per month (assuming each can will be purchased with a coupon). A fixed coupon processing fee of $288 will be incurred each…arrow_forwardCarondelet Coffee has begun making and selling pastries. The fixed costs of making the pastry are $4,000, and the company estimates that the variable costs are $.75 per pastry. How many pastries does Carondelet have to sell to earn net income of $5,000 if it sells each pastry for $3 apiece?arrow_forward

- Rolf's Golf store sells golf balls for 27 per dozen. The store's overhead expenses are 28% of cost and the owners require a profit of 22% of cost. a. How much does Rolf's Golf store buy the golf balls for? b. What is the price needed to cover all the costs and expenses? c. What is the highest rate of markdown at which the store will still break even?arrow_forwardJuniper Enterprises sells handmade clocks. Its variable cost per clock is $6, and each clock sells for $24. The company’s fixed costs total $6,660.How many units must Juniper sell to earn a profit of at least $5,400?arrow_forwardHealthy Foods Inc. sells 50-pound bags of grapes to the military for $10 a bag. The fixed costs of this operation are $92,000, while the variable costs of grapes are $0.10 per pound. a. What is the break-even point in bags? (Round your answer to 2 decimal places.) Break-even point bags b. Calculate the profit or loss (EBIT) on 16,000 bags and on 34,000 bags. Bags Profit/Loss Amount 16,000 34,000 c. What is the degree of operating leverage at 26,000 bags and at 34,000 bags? (Round your answers to 2 decimal places.) Bags Degree of Operating Leverage 26,000 34,000 d. If Healthy Foods has an annual interest expense of $10,000, calculate the degree of financial leverage at both 26,000 and 34,000 bags. (Round your answers to 2 decimal places.) Bags Degree of Financial Leverage 26,000 34,000 e. What is the degree of combined leverage at both 26,000 and 34,000 bags? (Round your answers to 2 decimal places.) Bags Degree of…arrow_forward

- Can you please solve this accounting question ?arrow_forwardRecord 1-2-3 is a top-selling electronic spreadsheet product. Record is about to release version 5.0. It divides its customers into two groups: new customers and upgrade customers (those who previously purchased Record 1-2-3, 4.0 or earlier versions). Although the same physical product is provided to each customer group, sizable differences exist in selling prices and variable marketing costs: (Click the icon to view the price and cost information.) The fixed costs of Record 1-2-3 5.0 are $13,500,000. The planned sales mix in units is 60% new customers and 40% upgrade customers. Read the requirements. Requirement 1. What is the Record 1-2-3 5.0 breakeven point in units, assuming that the planned 60% / 40% sales mix is attained? The breakeven point is units for new customers and units for upgrade customers. Requirements 1. 2. 3. What is the Record 1-2-3 5.0 breakeven point in units, assuming that the planned 60% / 40% sales mix is attained? If the sales mix is attained, what is the…arrow_forwardHealthy Foods Inc. sells 50-pound bags of grapes to the military for $10 a bag. The fixed costs of this operation are $102,000, while the variable costs of grapes are $0.10 per pound. a. What is the break-even point in bags? (Round your answer to 2 decimal places.) b. Calculate the profit or loss (EBIT) on 11,000 bags and on 30,000 bags. c. What is the degree of operating leverage at 25,000 bags and at 30,000 bags? (Round your answers to 2 decimal places.) d. If Healthy Foods has an annual interest expense of $12,000, calculate the degree of financial leverage at both 25,000 and 30,000 bags. (Round your answers to 2 decimal places.) e. What is the degree of combined leverage at both 25,000 and 30,000 bags? (Round your answers to 2 decimal places.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education