SWFT Comprehensive Vol 2020

43rd Edition

ISBN: 9780357391723

Author: Maloney

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Hi expert please give me answer general accounting

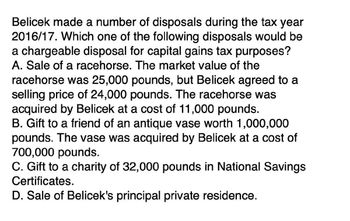

Transcribed Image Text:Belicek made a number of disposals during the tax year

2016/17. Which one of the following disposals would be

a chargeable disposal for capital gains tax purposes?

A. Sale of a racehorse. The market value of the

racehorse was 25,000 pounds, but Belicek agreed to a

selling price of 24,000 pounds. The racehorse was

acquired by Belicek at a cost of 11,000 pounds.

B. Gift to a friend of an antique vase worth 1,000,000

pounds. The vase was acquired by Belicek at a cost of

700,000 pounds.

C. Gift to a charity of 32,000 pounds in National Savings

Certificates.

D. Sale of Belicek's principal private residence.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- On August 15, 2021, Ms. Mones sold a 500-square meter residential house and lot for P3,000,000. The house was acquired in 2006 at P2,000,000. The Assessor's fair market values of the house and lot, respectively, wer P1,500,000 and P1,000,000. The zonal value of the lot was P5,000 per square meter. What is the capital gains tax? a.P150,000 b.P240,000 c.P180,000 d.P120,000arrow_forwardHaresharrow_forwardJoaquin purchased a $235,000 crane for a construction business. The crane was sold for $175,000 after taking $115,000 of depreciation. Assume Joaquin is in the 35% tax rate bracket. Required: a. On what form would the gain or loss originally be reported? b. What is the amount of gain or loss on the sale? c. What amount of the gain or loss is subject to ordinary tax rates? Complete this question by entering your answers in the tabs below. Required a Required b Required c PS What is the amount of gain or loss on the sale?arrow_forward

- Craig and Karen Conder purchased a new home on May 1 of year 1 for $200,000. At the time of the purchase, it was estimated that the real property tax rate for the year would be 1 percent of the property's value. How much in property taxes on the new home are the Conders allowed to deduct under each of the following circumstances? Assume the Conders' itemized deductions exceed the standard deduction before considering property taxes and the property tax is the only deductible tax they pay during the year. Note: Do not round intermediate calculations. Round your final answer to the nearest whole dollar amount. Required: The property tax estimate proves to be accurate. The seller and the Conders paid their share of the tax. The full property tax bill is paid to the taxing jurisdiction by the end of the year. The actual property tax bill was 1.05 percent of the property's value. The Conders paid their share of the estimated tax bill and the entire difference between the 1 percent estimate…arrow_forwardDerek purchases a small business from Art on September 1, 2020. He paid the following amounts for the business: Fixed assets $238,600 Goodwill 47,720 Covenant not to compete 59,650 Total $345,970 a. How much of the $345,970 purchase price is for Section 197 intangible assets? $4 b. What amount can Derek deduct on his 2020 tax return as Section 197 intangible amortization? If required, round the final answer to the nearest dollar. Use months, not days, in your computations. $arrow_forwardDuring the current year, Hom donates a sculpture that cost $1,000 to a museum for exhibition. The sculpture's fair market value was $1,700 on the date of the donation, and Hom's adjusted gross income is $40,000. Assume Hom held the sculpture for 4 months and the $700 ($1,700 − $1,000) of appreciation is a short-term capital gain. Calculate the amount of his itemized deduction for the contribution. Assume Hom held the sculpture for 2 years and the $700 appreciation is a long-term capital gain. Calculate the amount of his itemized deduction for the contribution.arrow_forward

- Devon purchased a small business from Art on August 30, 2023, and paid the following amounts for the business: Line Item Description Amount Fixed assets $303,400 Goodwill 60,680 Covenant not to compete 75,850 Total $439,930 b. What amount can Devon deduct on his 2023 tax return as Section 197 intangible amortization? If required, round the final answer to the nearest dollar. Use months, not days, in your computations.arrow_forwardWhich of the following are subjected to Value Added Tax (VAT)? A Sale by a real estate dealer of residential lot with a selling price or P800,000. B Sale by a real estate dealer of residential lot with a selling price of P3,500,000. C Sale by a real estate dealer of commercial lot with a selling price of P2,800,000. D Sale of residential lot classified as capital asset. E Sale by a real estate dealer of residential house and lot with a selling price of P3,000,000 F Sale by a real estate dealer of condominium unit with a selling price of P3,250,000 G Sale by a real estate dealer of parking lot in a condominium unit with a selling price of P850,000. H Sale of residential house and lot classified as capital asset with a selling price of P8,000,000.arrow_forwardDerek purchases a small business from Art on August 30, 2022. He paid the following amounts for the business: Fixed assets Goodwill Covenant not to compete Total $256,600 51,320 64,150 $372,070 a. How much of the $372,070 purchase price is for Section 197 intangible assets? b. What amount can Derek deduct on his 2022 tax return as Section 197 intangible amortization? If required, round the final answer to the nearest dollar. Use months, not days, in your computations.arrow_forward

- 1. George, a cash basis taxpayer, sells equipment for $200,000. The equipment originally cost $70,000 and George deducted $10,000 of tax depreciation as of the date of sale (assume no other depreciation is allowed or allowable). The equipment is subject to a $50,000 loan which the purchaser assumes. George incurred $13,000 of selling expenses related to the sale. The purchaser pays $10,000 at the time of sale and agrees to pay $20,000 per year for the next 7 years. Assume the note provides for adequate stated interest. A. Gross profit on the sale is . B. The contract price is _. C. The gross profit percentage is _. D. Income and the character of such to be reported in the year of sale is_…arrow_forwardIn 2021, LM distributes an office building to Laura. At the time of this distribution, the office building had a FMV of $500,000 and an adjusted basis of $100,000. At the time of the distribution, the Laura's outside basis was $400,000. How much (if any) gain or loss must Laura recognize from this distribution?arrow_forwardShun Li sold a capital property on July 31, 2019 for $400,000. She received $100,000 at the time of sale with the balance of $300,000 payable on July 31, 2021. The adjusted cost base of the property was $160,000. The minimum taxable capital gain that Shun Li can report in the 2019 taxation year is: $30,000. $60,000. $120,000. $180,000.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT