FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Please given correct answer general accounting

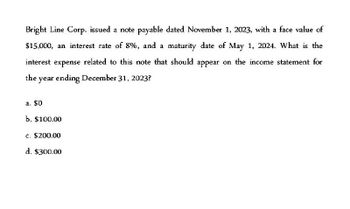

Transcribed Image Text:Bright Line Corp. issued a note payable dated November 1, 2023, with a face value of

$15,000, an interest rate of 8%, and a maturity date of May 1, 2024. What is the

interest expense related to this note that should appear on the income statement for

the year ending December 31, 2023?

a. $0

b. $100.00

c. $200.00

d. $300.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Florenda Quino Forwarders borrowed P600,000 from the bank on Sept. 1, 2019. The note carried an 8% annual rate of interest and was set to mature on Feb. 29, 2020. Interest and principal were paid in cash on the maturity date. Required: 1. What was the amount of interest expense paid in cash in 2019? 2. What was the amount of interest expense recognized on the 2019 income statement? 3. What was the amount of total liabilities shown on the 2019 balance sheet? 4. What was the total amount of cash that was paid to the bank on Feb. 29, 2020 for principal and interest? 5. What was the amount of interest expense shown on the 2020 income statement?arrow_forwardCompany A received a 5-year Non-interest bearing note payable to Company A on December 31, 2024, P 5,000,000. The market interest rate for this type of transaction is 12%. What is the amount that shall be reported on the statement of financial position on December 31, 2022, as Notes Receivable (net of discount or premium)?arrow_forwardJanuary 1, 2022, Abel Co. exchanged services for a $200,000 noninterest-bearing note due on January 1, 2027. The prevailing rate of interest for a note of this type at January 1, 2022 was 10%. The present value of $1 at 10% for five periods is 0.621. What amount of interest revenue should be included in Abel's 2023 income statement? a. $0 b. $12,420 c. $13,662 d. $20,000arrow_forward

- On December 31, 2022, the lender on a $5,400, 120-day, 12% note dated November 5, 2022, will recognize : A) interest receivable, $213 B) interest payable, $99 C) interest payable, $213 D) interest receivable, $99arrow_forwardOn August 1, 2021, Avonette, Inc., sold equipment and accepted a six-month, 9%, $50,000 note receivable. Avonette's year-end is December 31. Which of the following accounts will Avonette credit in the journal entry at maturity on February 1, 2022, assuming collection in full? O A. Interest Receivable B. Cash OC. Interest Payable O D. Note Payablearrow_forwardXYZ Company lent $9,000 at 10% interest on December 1, 2019. The amount plus all interests accrued will be collected after 1 year. At the end of December, which of the following journal entry is required to take up the interest income? Select one: a. Debit Cash $900; Credit Interest Revenue $900 b. Debit Interest Revenue $75; Credit Interest Receivable $75 c. Debit Interest Receivable $900; Credit Unearned Revenue $900 d. Debit Interest Receivable $75; Credit Interest Revenue $75arrow_forward

- Mango Co. issued a 6%, interest-bearing note payable on October 1, 2023. The note matures on April 1, 2025. Interest and principal will be paid at the maturity date. What is the adjusting entry?arrow_forwardOn August 15, 2022, Pharoah Company signs a $248000, 7%, twelve-month note payable. Which of the following entries correctly records the accrued interest on December 31, 2022? Dr Interest Expense $5786.67 Cr Interest Payable $5786.67 Dr Interest Expense $10850.00 Cr Interest Payable $10850.00 Dr Interest Expense $17360.00 Cr Interest Payable $17360.00 Dr Interest Expense $6510.00 Cr Interest Payable $6510.00arrow_forwardFINANCIAL ACCOUNTING (a) Compute the amount of interest during 2020, 2021, and 2022 for the following notes receivable; on april 30, 2020, BCDE lent $170,000 to Abbot on a two-years 7% note. (b) Which party has a (an) a. notes receivable b. notes payable c. interest revenue d. interest expense (c) How much total would BCDE collect if Abbot paid off early, say on November 30, 2020?arrow_forward

- Frame company has an 8% note receivable dated June 30, 2021, in the original amount of P1,500,000. Payments of P500,000 in principal plus accrued interest are due annually on July 1, 2022, 2023 and 2024. What is the balance of note receivable on July 1, 2022?On june 30,2023, what amount should be reported as accrued interest receivable on the note receivable? arrow_forwardKinsella Seed borrowed $207,000 on October 1, 2023, at 10% interest. The interest and principal are due on October 1, 2024. In addition to a debit to Note Payable for $207,000, what should the journal entry for repayment on October 1, 2024 include? Oa, Debit Interest Expense $5,175; debit Interest Payable $15,525; credit Cash $227,700 Ob. Debit Interest Expense $15,525; credit Cash $222.525. Oc. Debit Interest Expense $20,700, credit Cash $227,700. Od. Debit Interest Expense $15,525, debit Interest Payable $5,175, credit Cash $20,700arrow_forwardMCM Company issued a note receivable to a customer on September 1, 2020. The face value of the note was $20,000 at 5% interest for 7 months. What would be included in the journal entry on March 30, 2021? A credit to Interest Income for $250.00 A debit to Interest Income for $583.33 A credit to Interest Receivable for $250.00 A debit to Interest Receivable for $583.33arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education