FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

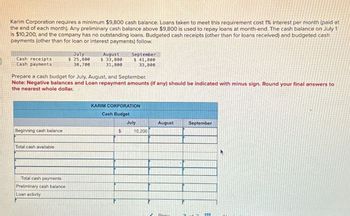

Transcribed Image Text:Karim Corporation requires a minimum $9,800 cash balance. Loans taken to meet this requirement cost 1% interest per month (paid at

the end of each month). Any preliminary cash balance above $9,800 is used to repay loans at month-end. The cash balance on July 1

is $10,200, and the company has no outstanding loans. Budgeted cash receipts (other than for loans received) and budgeted cash

payments (other than for loan or interest payments) follow.

Cash receipts

Cash payments

July

$ 25,800

30,700

August

$ 33,800

31,800

September

$ 41,800

33,800

Prepare a cash budget for July, August, and September.

Note: Negative balances and Loan repayment amounts (if any) should be indicated with minus sign. Round your final answers to

the nearest whole dollar.

Beginning cash balance

Total cash available

Total cash payments

Preliminary cash balance

Loan activity

KARIM CORPORATION

Cash Budget

July

August

September

$

10,200

Prov

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Rainier Company borrowed $780,000 for five months. The annual interest rate on the loan was 11 percent. Rainiers fiscal year ends on December 31. Rainier borrowed the $780,000 one month prior to the start of its current fiscal year and paid back the $780,000 plus interest four months into its current fiscal year. How much interest expense, if any, would Rainier report at the end of its last fiscal year and at the end of its current fiscal year? Last year Current year Interest Expensearrow_forwardA firm has the following monthly pattern of sales: January $ 200 February 300 March 600 April 1,200 May 600 June 300 Sixty percent of the sales are on credit and are collected after a month. The company pays wages each month that are 60 percent of sales and has fixed disbursements (for example, rent) of $150 a month. In March it receives $250 from a bond that matures; in April and June it makes a tax payment of $150. Management maintains a cash balance of $200 at all times. Construct a cash budget that indicates the firm’s monthly needs for short-term financing. Its beginning cash position is $200. Round your answers to the nearest dollar. Enter the disbursements values in Part 2 and desired level of cash in Part 3 as positive values. Use a minus sign to enter cash outflows, shortage of cash values, negative initial and ending cash positions in Part 3, if any. Do not leave any cells blank. If the answer is zero, enter "0". Part 1 January February…arrow_forwardSchedule of Cash Payments for a Service Company SafeMark Financial Inc. was organized on February 28. Projected selling and admin istrative expenses for each of the first three months of operations are as follows: March $154,900 April 144,100 131,100 May Depreciation, insurance, and property taxes represent $33,000 of the estimated monthly expenses. The annual insurance premium was paid on February 28, and property taxes for the year will be paid in June. 64% of the remainder of the expenses are expected to be paid in the month in which they are incurred, with the balance to be paid in the following month Prepare a schedule indicating cash payments for selling and administrative expenses for March, April, and May. SafelMark Financial Inc. Schedule of Cash Payments for Selling and Administrative Expenses For the Three Months Ending May 31 March April May March expenses Paid in March Paid in April April expenses: Paid in April Paid in May May expenses Paid in May Total cash paymentsarrow_forward

- Matsumoto construction has a 100,000 line of credit at Bank of America. The annual percentage rate is the current prime rate plus 3%. The balance on October 1 was 22,500.00 On October 10, Matsumoto borrowed 15,000 to pay for a shipment of plants & on October 20 be borrowed another 32,500 for equipment repairs. On October 25 Matsumoto made a 25,000 payment on the account. The billing cycle for October has 31 days. The current prime rate is 6%. Use the average daily method to determine the finance charge? What is Matsumotos new balance?arrow_forwardCompany is considering to establish a line of credit with a local bank to make up for the cash deficit for the next three months. The company expects a 60% chance for a $240,938 deficit and a 40% chance for no deficit at all. The line of credit charges 0.59% of interest rate per month on the amount borrowed plus a commitment fee of $2,500 for a quarter. It also requires a 7% compensation balance for outstanding loans. The company can reinvest any excess cash at an annual rate of 8%. What will the expected cost of establishing a line of credit be? Round your answer to the nearest dollar. (Hint: Refer to a numerical example in short-term financing choices.) Group of answer choices: $5,255 $5,240 $5,251 $5,260 $5,246arrow_forwardSchedule of Cash Payments for a Service Company SafeMark Financial Inc. was organized on February 28. Projected selling and administrative expenses for each of the first three months of operations are as follows: March $78,400 April 83,500 May 96,900 Depreciation, insurance, and property taxes represent $10,000 of the estimated monthly expenses. The annual insurance premium was paid on February 28, and property taxes for the year will be paid in June. Seventy percent of the remainder of the expenses are expected to be paid in the month in which they are incurred, with the balance to be paid in the following month. Prepare a schedule indicating cash payments for selling and administrative expenses for March, April, and May. SafeMark Financial Inc. Schedule of Cash Payments for Selling and Administrative Expenses For the Three Months Ending May 31 March April May March expenses: Paid in March Paid in April April expenses: Paid in April Paid in May May expenses: Paid in May Total cash…arrow_forward

- The cash balance on March 31 will be $146000, but waterways has decided it would like to maintain a cash balance of at least $400,000 beginning on April 30. The company has an open line of credit with its bank. the terms of the agreement require borrowing to be in $1000 increments at 4% interest. Borrowing is considered to be on the first day of the month and repayments and interest payments are on the last day of the month. What do i have to borrow? and what is the repayments? and then what are the repayments with interest?arrow_forwardABC Company has a cash balance of $75,000 at the beginning of March and having regard to the following information: Creditors give l-month credit ii. Salaries are paid in the current month iii. Fixed overheads are paid one month in arrears and include a charge for depreciation of $5,000 per month iv. Variable overheads are paid two months in arrears v. Credit sales are settled as follows: 40% in the month of sale, 45% in the next month and 12% in the following month. The balance represents bad debts. i. Month Cash Sales Credit Sales Purchases $ $ 74,000 82,000 80,000 $ 55,200 January February March 20,000 22,000 25,000 61,200 60,000 69,000 75,000 April Мay 90,00 0 100,000 Salaries Fixed Overheads Variable Overhead 進 推 調 January February March 9,000 9,000 9,500 30,000 30,000 30,000 45,000 50,000 55,000 April Мay 9,500 10 ,000 32,000 32,000 60,000 70,000 АССТ3603 Required: А. Prepare the Debtors Collection Schedule for ABC company for March to May. В. Prepare the Cash Budget for April…arrow_forwardSchedule of Cash Payments for a Service Company Horizon Financial Inc. was organized on February 28. Projected selling and administrative expenses for each of the first three months of operations are as follows: March $52,400 April 64,200 May 68,900 Depreciation, insurance, and property taxes represent $9,000 of the estimated monthly expenses. The annual insurance premium was paid on February 28, and property taxes for the year will be paid in June. Seventy percent of the remainder of the expenses are expected to be paid in the month in which they are incurred, with the balance to be paid in the following month. Prepare a schedule of cash payments for selling and administrative expenses for March, April, and May.arrow_forward

- Schedule of Cash Payments for a Service Company Oakwood Financial Inc. was organized on February 28. Projected selling and administrative expenses for each of the first three months of operations are as follows: March $59,600 April 66,400 May 72,300 Depreciation, insurance, and property taxes represent $7,000 of the estimated monthly expenses. The annual insurance premium was paid on February 28, and property taxes for the year will be paid in June. Sixty percent of the remainder of the expenses are expected to be paid in the month in which they are incurred, with the balance to be paid in the following month. Prepare a schedule indicating cash payments for selling and administrative expenses for March, April, and May. Oakwood Financial Inc. Schedule of Cash Payments for Selling and Administrative Expenses For the Three Months Ending May 31 March April May March expenses: Paid in March $fill in the blank 1 Paid in April $fill in the blank 2…arrow_forwardA company has accounts payable of P5,000,000 with terms of 2% discount within 15 days, net 30 days (2/15, net 30). It can borrow funds from a bank at an annual rate of 12%, or it can wait until the 30th day when it will receive revenues to cover the payment. If it borrows funds on the last day of the discount period in order to obtain the discount, its total cost will bearrow_forwardA. What are the expected revenues for S2BU for each month, April through September? Revenues are recorded in the month of the occasion. B. What are the expected cash receipts for each month, April through July?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education