FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

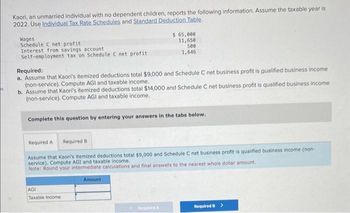

Transcribed Image Text:Kaori, an unmarried individual with no dependent children, reports the following information. Assume the taxable year is

2022. Use Individual Tax Rate Schedules and Standard Deduction Table.

Wages

Schedule C net profit

Interest from savings account

Self-employment tax on Schedule C net profit

Required:

a. Assume that Kaori's itemized deductions total $9,000 and Schedule C net business profit is qualified business income

(non-service). Compute AGI and taxable income.

b. Assume that Kaori's itemized deductions total $14,000 and Schedule C net business profit is qualified business income

(non-service). Compute AGI and taxable income.

Complete this question by entering your answers in the tabs below.

$ 65,000

11,650

500

1,646

Required A Required B

Assume that Kaori's itemized deductions total $9,000 and Schedule C net business profit is qualified business income (non-

service). Compute AGI and taxable income.

Note: Round your intermediate calculations and final answers to the nearest whole dollar amount.

AGI

Taxable Income

Amount

Required A

Required B >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Determine the amount of taxable income that should be reported by a cash-basis taxpayer in 2022 in each of the following independent cases: Required: a. A taxpayer completes $700 of accounting services in December 2022 for a client who pays for the accounting work in January 2023. b. A taxpayer is in the business of renting computers on a short-term basis. On December 1, 2022, she rents a computer for a $260 rental fee and receives a $650 deposit. The customer returns the computer and is refunded the deposit on December 20, 2022. c. Same facts as (b) except that the computer is returned on January 5, 2023. d. On December 18, 2022, a landlord rents an apartment for $625 per month and collects the first and last months' rent up front. It is customary that tenants apply the security deposit to their last month's rent upon moving out. e. An accountant agrees to perform $395 of tax services for an auto mechanic who has agreed to perform repairs on the car of the accountant's wife. The…arrow_forwardIn 2022, Landon has self-employment earnings of $210,000. Required: Compute Landon's self-employment tax liability and the allowable income tax deduction of the self-employment tax paid. Note: Round your intermediate computations and final answers to the nearest whole dollar value. Answer is complete but not entirely correct. Amounts Total self-employment tax liability Self-employment tax deduction $ $ 23,797 X 11,899 xarrow_forwardIn 2022, Miranda records net earnings from self-employment of $195,200. She has no other gross income. Determine the amount of Miranda's self-employment tax and her AGI Income tax deduction. In your computations, for the tax liability, round interim amounts to two decimal places and the final answer to the nearest whole dollar. For the AGI deduction, if necessary, use amounts that have been rounded to the nearest dollar. Miranda's self-employment tax is s 28,650 X and she has as 28,650 X deduction for AGI.arrow_forward

- Yanni, who is single, provides you with the following information for 2023: Salary State income taxes Mortgage interest expense on principal residence Charitable contributions Interest income a. Yanni's taxable income: Click here to access the exemption table. If required, round your answers to the nearest do Compute the following: b. Yanni's AMT base: c. Yanni's tentative minimum tax: LA $ SA $103,000 10,300 9,270 S 2,060 1,545 10,370 X 0 Xarrow_forward: If an individual whose filing status is single earns $256,000 during the year, what portion of the earnings are subject to Additional Medicare Tax, and what is the total (standard and Additional) Medicare Tax rate that will be applied to these earnings? Answer: A. $6,000 and 0.9% B. $6,000 and 2.35% C. $56,000 and 0.9% D. $56,000 and 2.35%arrow_forwardHaresharrow_forward

- Jared Goff, of Los Angeles, determined the following tax information: gross salary, $85,000; interest earned, $2,500; IRA contribution, $4,500; and standard deduction, $12,200. Filing single, calculate Jared's taxable income and tax liability.arrow_forwardA-4arrow_forwardThe table below shows a certain state's income tax rates for individuals filing a return. Complete parts (A) through (D below. SINGLE, MARRIED FILING SEPERATELY, OR HEAD OF HOUSEHOLD SINGLE, MARRIED FILING SEPERATELY, OR HEAD OF HOUSEHOLD Over $0 $12,500 $50,000 But Not Over $12,500. $50,000 Tax Due Is 4% of taxable income $500.00 plus 6.25% of excess over $12,500 $2843.75 plus 6.5% of excess over $50,000 (A) Write a piecewise definition for T(x), the tax due on a taxable income of x dollars. if 0≤x≤12,500 T(x)= if 12,500 x≤50,000 if 50,000 < x (Use integers or decimals for any numbers in the expressions.)arrow_forward

- Dogarrow_forwardSuppose you made $85,776 of income from wages and $830 of taxable interest. You also made contributions of $3700 to a tax deferred retirement account. You have 2 dependents and file as single. The standard deduction is 11900 and the exemption amount is 3100 per exemption. What is your Adjusted Gross Income? Answer to the nearest dollar.arrow_forwardThe Chungs are married with one dependent child. They report the following information for 2022: Schedule C net profit $ 66,650 Interest income from certificate of deposit (CD) 2,100 Self-employment tax on Schedule C net profit 9,418 Dividend eligible for 15% rate 12,000 Lila Chung's salary from Brants Company 75,000 Dependent care credit 500 Itemized deductions 27,000 Required: Compute AGI, taxable income, and total tax liability (including self-employment tax). Assume that Schedule C net profit is qualified business income (non-service income) under Section 199A. Assume the taxable year is 2022. Use Individual Tax Rate Schedules and Standard Deduction Table. Note: Do not round intermediate computations. Round your final answers to the nearest whole dollar amount.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education