FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

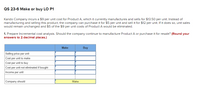

QS 23-6 Make or buy LO P1

Kando Company incurs a $9 per unit cost for Product A, which it currently manufactures and sells for $13.50 per unit. Instead of manufacturing and selling this product, the company can purchase it for $5 per unit and sell it for $12 per unit. If it does so, unit sales would remain unchanged and $5 of the $9 per unit costs of Product A would be eliminated.

1. Prepare Incremental cost analysis. Should the company continue to manufacture Product A or purchase it for resale? (Round your answers to 2 decimal places.)

Transcribed Image Text:QS 23-6 Make or buy LO P1

Kando Company incurs a $9 per unit cost for Product A, which it currently manufactures and sells for $13.50 per unit. Instead of

manufacturing and selling this product, the company can purchase it for $5 per unit and sell it for $12 per unit. If it does so, unit sales

would remain unchanged and $5 of the $9 per unit costs of Product A would be eliminated.

1. Prepare Incremental cost analysis. Should the company continue to manufacture Product A or purchase it for resale? (Round your

answers to 2 decimal places.)

Make

Buy

Selling price per unit

Cost per unit to make

Cost per unit to buy

Cost per unit not eliminated if bought

Income per unit

Company should

Make

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Dinesharrow_forwardQS 23-18 Product pricing using variable costs LO P6 GoSnow sells snowboards. Each snowboard requires direct materials of $110, direct labor of $35, and variable overhead of $45. The company expects fixed overhead costs of $265,000 and fixed selling and administrative costs of $211,000 for the next year. The company has a target profit of $200,000. It expects to produce and sell 10,000 snowboards in the next year. Compute the selling price using the variable cost method. (Do not round your intermediate calculations. Round your final answer to 2 decimal places.)arrow_forwardM2arrow_forward

- Required Information Problem 18-4A (Algo) Break-even analysis, different cost structures, and income calculations LO C2, A1, P2 [The following information applies to the questions displayed below.] Henna Company produces and sells two products, Carvings and Mementos. It manufactures these products in separate factories and markets them through different channels. They have no shared costs. This year, the company sold 42,000 units of each product. Income statements for each product follow. Sales Variable costs Contribution margin Fixed costs Income Problem 18-4A (Algo) Part 3 Contribution margin 3. Assume that the company expects sales of each product to increase to 56,000 units next year with no change in unit selling price. Prepare a contribution margin Income statement for the next year (as shown above with columns for each of the two products). (Rour "per unit" answers to 2 declmal places.) Fixed costs Sales Variable cost Carvings $ 47,600 523,320 224,280 108,280 $ 116,000 Mementos…arrow_forwardEX 22arrow_forwardpter 11 Assignment i Requlred Informatlon The following information applies to the questions displayed below.] Cane Company manufactures two products called Alpha and Beta that sell for $225 and $175, respectively. Each product uses only one type of raw material that costs $6 per pound. The company has the capacity to annually produce 130,000 units of each product Its average cost per unit for each product at this level of activity are given below. Alpha $ 42, vて $ 24 Direct labor Variable manufacturing overhead Traceable fFixed manufacturing overhead Variable selling expenses Common fixed expenses 42. 34 31. 34 Total cost per unit $173 The company considers its traceable fixed manufacturing overhead to be avoidable, whereas its common fixed expenses are unavoidable and have been allocated to products based on sales dollars. 15. Assume that Cane's customers would buy a maximum of99,000 units of Alpha and 79,000 units of Beta. Also assume that the raw material available for production…arrow_forward

- Question 3 Set 1arrow_forwardExercise 18-9 (Algo) Contribution margin and break-even LO P2 Sunn Company manufactures a single product that sells for $190 per unit and whose variable costs are $133 per unit. The company's annual fixed costs are $735,300. (a) Compute the company's contribution margin per unit. Contribution margin (b) Compute the company's contribution margin ratio. 1 1 Numerator: (c) Compute the company's break-even point in units. 1 Numerator: Denominator: Numerator: Denominator: (d) Compute the company's break-even point in dollars of sales. 1 1 Denominator: = Contribution Margin Ratio Contribution margin ratio = = = = Break-Even Units Break-even units Break-Even Dollars Break-even dollarsarrow_forwardussions Question 10 --/1 erences View Policies aborations Current Attempt in Progress eyPLUS Support Mussatto Corporation produces snowboards. The following per unit cost information is available: direct materials $18, direct labor $14, variable manufacturing overhead $9, fixed manufacturing overhead $11, variable selling and administrative expenses $6, and fixed selling and administrative expenses $12. Using a 35% markup percentage on total per unit cost, compute the target selling price. (Round answer to 2 decimal places, e g. 10.50.) Central ce 365 dges zza Target selling price $ 845 PM 11/18/2019 hp foll ins prt sc n2 home delete end 144 + num backspace lock P 7 homearrow_forward

- %23 Requlred Information The following information applies to the questions displayed below.] Cane Company manufactures two products called Alpha and Beta that sell for $225 and $175, respectively. Each product uses only one type of raw material that costs $6 per pound. The company has the capacity to annually produce 130,000 units of each product. Its average cost per unit for each product at this level of activity are given below. Alpha $ 42 42 Beta $ 24 Direct materials Direct labor Variable manufacturing overhead Traceable fixed manufacturing overhead Variable selling expenses Common fixed expenses 32. 24 27. 34. Total cost per unit The company considers its traceable fixed manufacturing overhead to be avoidable, whereas its common fixed expenses. are unavoidable and have been allocated to products based on sales dollars. 9. Assume that Cane expects to produce and sell 99,000 Alphas during the current year. A supplier has offered to manufacture and deliver 99,000 Alphas to Cane for…arrow_forwardExercise 23-3 Sell or process P2 lagerial Decisions Cobe Co. has manufactured 200 partially finished cabinets at a cost of $50,000. These can be sold as is for $60,000. Instead, the cabinets can be stained and fitted with hardware to make finished cabinets. Further processing costs would be $12,000, and the finished cabinets could be sold for $80,000. (a) Prepare a sell as is or process further analysis of income effects. (b) Should the cabinets be sold as is or processed further and then sold?arrow_forwardExercise 18-22 (Algo) CVP analysis with two products LO P3 Handy Home sells windows (80% of sales) and doors (20% of sales). The selling price of each window is $330 and of each door is $760. The variable cost of each window is $190 and of each door is $480. Fixed costs are $940,800. (1) Compute the weighted-average contribution margin (2) Compute the break-even point in units using the weighted-average contribution margin (3) Compute the number of units of each rpoduct that will be sold at the break-even pointarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education