FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:ussions

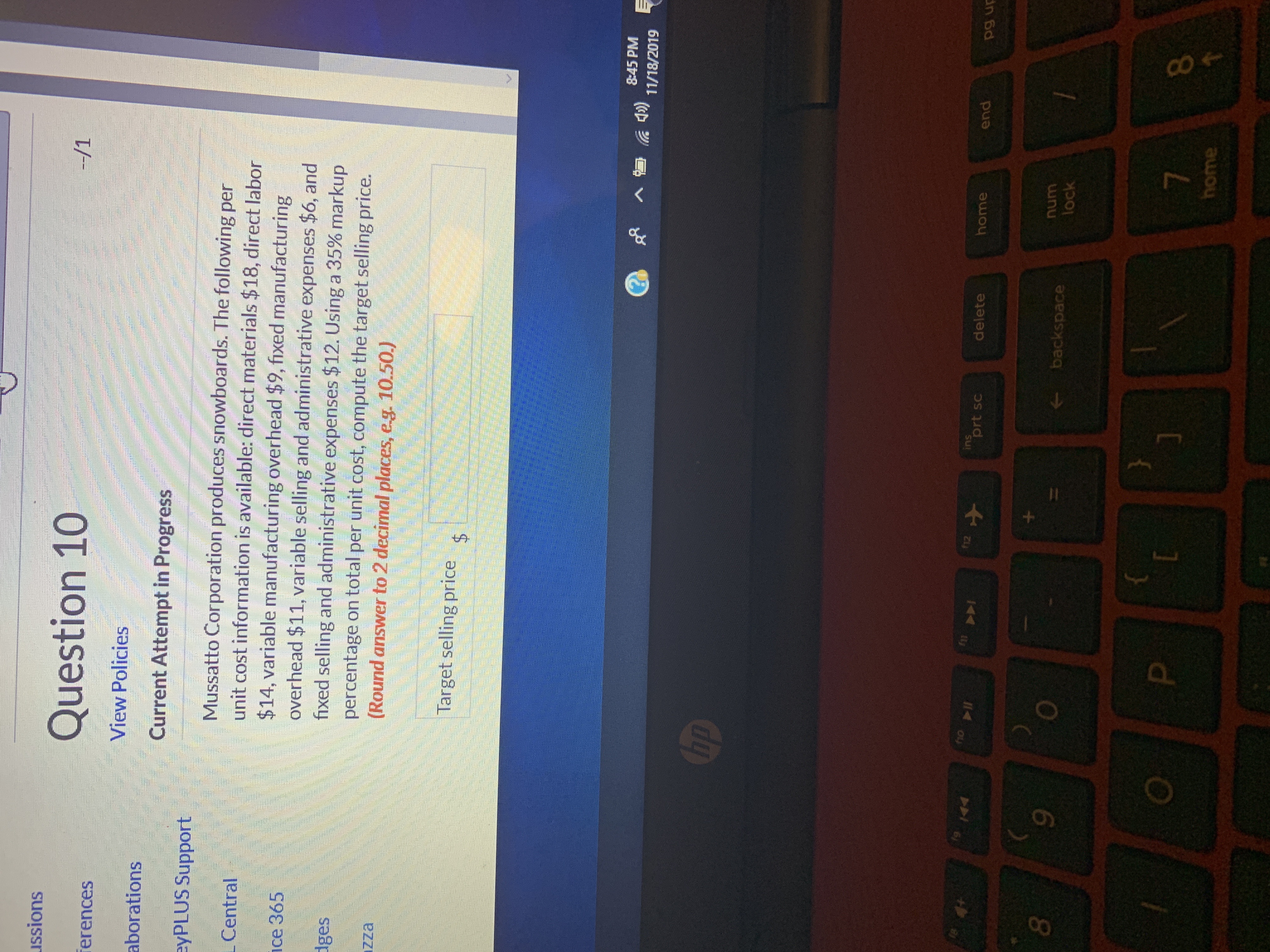

Question 10

--/1

erences

View Policies

aborations

Current Attempt in Progress

eyPLUS Support

Mussatto Corporation produces snowboards. The following per

unit cost information is available: direct materials $18, direct labor

$14, variable manufacturing overhead $9, fixed manufacturing

overhead $11, variable selling and administrative expenses $6, and

fixed selling and administrative expenses $12. Using a 35% markup

percentage on total per unit cost, compute the target selling price.

(Round answer to 2 decimal places, e g. 10.50.)

Central

ce 365

dges

zza

Target selling price

$

845 PM

11/18/2019

hp

foll

ins

prt sc

n2

home

delete

end

144

+

num

backspace

lock

P

7

home

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Similar questions

- Relevant Range and Fixed and Variable Costs Vogel Inc. manufactures memory chips for electronic toys within a relevant range of 100,800 to 165,600 memory chips per year. Within this range, the following partially completed manufacturing cost schedule has been prepared: Components produced 100,800 128,800 165,600 Total costs: Total variable costs . . . . . . . . . $41,328 (d) (j) Total fixed costs . . . . . . . . . . . . 46,368 (e) (k) Total costs . . . . . . . . . . . . . . . . . $87,696 (f) (l) Cost per unit: Variable cost per unit . . . . . . . (a) (g) (m) Fixed cost per unit . . . . . . . . . . (b) (h) (n) Total cost per unit . . . . . . . . . . (c) (i) (o) Complete the cost schedule below. When computing the cost per unit, round to two decimal places. Round all other values to the nearest dollar. Cost Report Components produced 100,800 128,800 165,600 Total costs: Total variable costs…arrow_forwardPlease help me with calculationarrow_forward7 Skipped Pedregon Corporation has provided the following information: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Sales commissions Variable administrative expense Fixed selling and administrative expense If 6,500 units are sold, the total variable cost is closest to: Multiple Choice $93,600 $112,450 $83,525 $75,400 Cost per Unit $ 6.60 $ 3.60 $ 1.40 $ 0.60 $ 0.65 Cost Per $23 $ 3arrow_forward

- t 0 ences Mc Graw Hill Required information [The following information applies to the questions displayed below.] Diego Company manufactures one product that is sold for $75 per unit in two geographic regions-the East and West regions. The following information pertains to the company's first year of operations in which it produced 46,000 units and sold 42,000 units. Variable costs per unit: Manufacturing: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative Fixed costs per year: Fixed manufacturing overhead Fixed selling and administrative expense Break even point $ 25 $ 20 The company sold 31,000 units in the East region and 11,000 units in the West region. It determined that $200,000 of its fixed selling and administrative expense is traceable to the West region, $150,000 is traceable to the East region, and the remaining $38,000 is a common fixed expense. The company will continue to incur the total amount of its fixed manufacturing…arrow_forwardEXERCISE 1-11 Cost Behavior; Contribution Format Income Statement L01-4, L01-6 Harris Company manufactures and sells a single product. A partially completed schedule of the com- pany's total costs and costs per unit over the relevant range of 30,000 to 50,000 units is given below: Vist Jumsch Total costs: Variable cost. Fixed cost Total cost. Costs per unit: Variable cost. Fixed cost Total cost per unit. Units Produced and Sold 40,000 30,000 $180,000 300,000 $480,000 ? ? ? ? ? ? ? ? ? 50,000 ? ? ? ? ? ? Required: 1. Complete the above schedule of the company's total costs and costs per unit. 2. Assume that the company produces and sells 45,000 units during the year at a selling price of $16 per unit. Prepare a contribution format income statement for the year. 6 107arrow_forwardRelevant Range and Fixed and Variable Costs Vogel Inc. manufactures memory chips for electronic toys within a relevant range of 100,800 to 158,400 memory chips per year. Within this range, the following partially completed manufacturing cost schedule has been prepared: Components produced 100,800 123,200 158,400 Total costs: Total variable costs . . . . . . . . . $40,320 (d) (j) Total fixed costs . . . . . . . . . . . . 44,352 (e) (k) Total costs . . . . . . . . . . . . . . . . . $84,672 (f) (l) Cost per unit: Variable cost per unit . . . . . . . (a) (g) (m) Fixed cost per unit . . . . . . . . . . (b) (h) (n) Total cost per unit . . . . . . . . . . (c) (i) (o) Complete the cost schedule below. When computing the cost per unit, round to two decimal places. Round all other values to the nearest dollar. Cost Report Components produced 100,800 123,200 158,400 Total costs: Total variable costs $40,320 (d)…arrow_forward

- Exercises 4 Event Company produces a single product with the following characteristics: price per unit, $30.00; variable material cost per unit, $9.20; variable labor cost per unit, $4.40; variable overhead cost per unit, $2.20; and fixed overhead cost per unit, $3.00. Event Company's manufacturing fixed costs are $5 million, and selling, general, and administration fixed costs are $1.5 million. What dollar sales are required for Event Company to earn a target profit of $600,000? Exercises 5 The following information pertains to Torasic Company's budgeted income statement for the month of June: Sales (1,500 units at $300) $450,000 Variable cost 200,000 250,000 280,000 $(30,000) Contribution margin Fixed cost Net loss Required a) Determine the company's breakeven point in both units and dollars. b) The sales manager believes that a $25,000 increase in the monthly advertising expenses will result in a considerable increase in sales. How much of an increase in sales must result from…arrow_forwardQuestion Content Area Multiple-Product Break-Even and Target Profit Vandenberg, Inc., produces and sells two products: a ceiling fan and a table fan. Vandenberg plans to sell 40,000 ceiling fans and 70,000 table fans in the coming year. Product price and cost information includes: Ceiling Fan Table Fan Price $62 $14 Unit variable cost $11 $8 Direct fixed cost $25,200 $47,000 Common fixed selling and administrative expenses total $70,000. Required: Question Content Area 1. What is the sales mix estimated for next year (calculated to the lowest whole number for each product)?Sales mix of ceiling fans to table fans = fill in the blank 614f11ff0fb7fcb_1 : fill in the blank 614f11ff0fb7fcb_2 2. Using the sales mix from Requirement 1, form a package of ceiling fans and table fans. How many ceiling fans and table fans are sold at break-even? Round your intermediate calculations and final answers to the nearest whole number.…arrow_forwardRelevant Range and Fixed and Variable Costs Vogel Inc. manufactures memory chips for electronic toys within a relevant range of 61,600 to 100,800 memory chips per year. Within this range, the following partially completed manufacturing cost schedule has been prepared: Components produced 61,600 79,200 100,800 Total costs: Total variable costs . . . . . . . . . $19,712 (d) (j) Total fixed costs . . . . . . . . . . . . 22,176 (e) (k) Total costs . . . . . . . . . . . . . . . . . $41,888 (f) (l) Cost per unit: Variable cost per unit . . . . . . . (a) (g) (m) Fixed cost per unit . . . . . . . . . . (b) (h) (n) Total cost per unit . . . . . . . . . . (c) (i) (o) Complete the cost schedule below. When computing the cost per unit, round to two decimal places. Round all other values to the nearest dollar. Cost Report Components produced 61,600 79,200 100,800 Total costs: Total variable costs $19,712 (d)…arrow_forward

- Nonearrow_forwardProblem Set: Module 4 1. EX.06.01 2. PR.06.02A.ALGO 3. BE.06.02.ALGO 4. BE.06.03.ALGO engagenow.com + 40 Contribution Margin Harry Company sells 36,000 units at $40 per unit. Variable costs are $34.00 per unit, and fixed costs are $103,700. Determine (a) the contribution margin ratio, (b) the unit contribution margin, and (c) operating income. a. Contribution margin ratio (Enter as a whole number.) b. Unit contribution margin (Round to the nearest cent.) c. Operating income $ : % per unit ?arrow_forwardPlease do not give solution in image format thankuarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education