FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

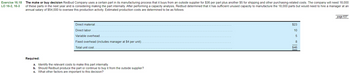

Transcribed Image Text:Exercise 16.18

LO 16-2, 16-3

The make or buy decision Redbud Company uses a certain part in its manufacturing process that it buys from an outside supplier for $36 per part plus another $5 for shipping and other purchasing-related costs. The company will need 18,000

of these parts in the next year and is considering making the part internally. After performing a capacity analysis, Redbud determined that it has sufficient unused capacity to manufacture the 18,000 parts but would need to hire a manager at an

annual salary of $54,000 to oversee this production activity. Estimated production costs are determined to be as follows:

Direct material..

Direct labor.

Variable overhead.

Fixed overhead (includes manager at $4 per unit).

Total unit cost..

Required:

a. Identify the relevant costs to make this part internally.

b. Should Redbud produce the part or continue to buy it from the outside supplier?

c. What other factors are important to this decision?

$23

10

5

8

$46

page 637

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Exercise 21.12 (Static) Pricing a Special Order (LO21-1, LO21-2, LO21-3) Mazeppa Corporation sells relays at a selling price of $28 per unit. The company's cost per unit, based on full capacity of 160,000 units, is as follows: Direct materials $ 6 Direct labor 4 Overhead (2/3 of which is variable) 9 Mazeppa has been approached by a distributor in Montana offering to buy a special order consisting of 30,000 relays. Mazeppa has the capacity to fill the order. However, it will incur an additional shipping cost of $2 for each relay it sells to the distributor. a-1. Assume that Mazeppa is currently operating at a level of 100,000 units. Show the calculation for the unit price to charge the distributor which will generate an increase in operating income of $2 per unit? a-2. What is your interpretation of the changes to the contribution margin per unit and the operating income on account of the unit price charged to the distributor? b-1. Assume that Mazeppa is currently operating at full…arrow_forwardQuestion One A company has developed a new product that has a short life cycle. Information about the product is as follows: Selling price and product life cycle The product will have a life cycle of 4,000 units. It is estimated that the first 3,500 units will be sold for $215 each. The product will then enter the “decline” stage of its life cycle when the selling price will be reduced. Production and costs The product will be produced in batches of 100 units. Labour will be paid at $24 per hour. Other variable costs will be $6,000 per batch. Fixed costs will total $130,000. These costs will apply throughout the product’s life. Learning curve The first batch will take 500 labour hours to produce. There will be a 90% learning curve that will continue until 32 batches have been produced. Every batch produced above this level of output will take the same amount of labour time as the 32nd batch. Note: The learning index for a 90% learning curve = -0.152 Required: (a) Calculate the time…arrow_forwardQS 22-17B Determining transfer prices with excess capacity LO C2 The Windshield division of Fast Car Co. makes windshields for use in Fast Car’s Assembly division. The Windshield division incurs variable costs of $200 per windshield and has capacity to make 500,000 windshields per year. The market price is $450 per windshield. The Windshield division incurs total fixed costs of $3,000,000 per year.If the Windshield division has excess capacity, what is the range of possible transfer prices that could be used on transfers between the Windshield and Assembly divisions?arrow_forward

- EX 22arrow_forwardDogarrow_forwardQuestion 16 Direct Labor Order Allocation Rate Machine Time Allocation Rate Request (Easy-Medium) Use the information below to answer the questions that follow. $ $ $ 38.00 per hour 46.55 $ of OH / order 2.83 $ of OH / machine hour Place the answer to each part of the question in the box provided. Under job costing, how much overhead will be applied to a unit that takes 0.5 hours to produce and is part of an order for 100 units? Under job costing, how much overhead will be applied to a unit that takes 2 hours to produce and is part of an order for 10 units? What is the total cost of the first product if materials are $2.50 and a person must be present to run the machines? What is the total cost of the second product if materials are $1 and a person must be present to run the machines for half the total time?arrow_forward

- Exercise 23-3 Sell or process P2 lagerial Decisions Cobe Co. has manufactured 200 partially finished cabinets at a cost of $50,000. These can be sold as is for $60,000. Instead, the cabinets can be stained and fitted with hardware to make finished cabinets. Further processing costs would be $12,000, and the finished cabinets could be sold for $80,000. (a) Prepare a sell as is or process further analysis of income effects. (b) Should the cabinets be sold as is or processed further and then sold?arrow_forwardExercise 13-9A (Static) Using the contribution margin approach for a special order decision LO 13-2 Hensely Company, which produces and sells a small digital clock, bases its pricing strategy on a 25 percent markup on total cost. Based on annual production costs for 25,000 units of product, computations for the sales price per clock follow. Unit-level costs Fixed costs Total cost (a) Markup (a x 0.25) Total sales (b) Sales price per unit (b÷ 25,000) Required $240,000 60,000 300,000 75,000 $375,000 $15 a. Hensely has excess capacity and receives a special order for 8,000 clocks for $12 each. Calculate the contribution margin per unit. Based on this, should Hensely accept the special order? b. Prepare a contribution margin income statement for the special order. Complete this question by entering your answers in the tabs below. Required A Required B Hensely has excess capacity and receives a special order for 8,000 clocks for $12 each unit. Based on this, should Hensely accept the…arrow_forwardKnowledge Check 02 Potomac Backpacks, Incorporated manufactures regular backpacks. The company is considering processing these backpacks further to produce hiking backpacks. A summary of the expected costs and revenues for both of these options follows: Activity Estimated sales price Estimated manufacturing cost per unit Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Unit manufacturing cost Additional development cost Ordinary Backpacks $ 50 $72,000 $65,000 ($15,000) $20,000 $15 10 5 5 $ 35 Hiking Backpacks $75 If the company can sell 8,000 units of either product, what is the expected incremental profit or loss from processing the backpacks further? 20 $15 10 5 $ 50 8,000 Knowledge Check 03 Which of the following should be ignored when deciding whether to sell a product as is or process it further? The cost incurred in producing the product so far The cost of processing products further The revenue from processing products further The…arrow_forward

- 10 part 1arrow_forwardExercise 23-10 (Algo) Keep or replace LO P5 Lopez Company is considering replacing one of its old manufacturing machines. The old machine has a book value of $49,000 and a remaining useful life of five years. It can be sold now for $59,000. Variable manufacturing costs are $49,000 per year for this old machine, Information on two alternative replacement machines follows. The expected useful life of each replacement machine is five years. Purchase price Variable manufacturing costs per year (a) Compute the income increase or decrease from replacing the old machine with Machine A (b) Compute the income increase or decrease from replacing the old machine with Machine B. (c) Should Lopez keep or replace its old machine? (d) if the machine should be replaced, which new machine should Lopez purchase? Req A Complete this question by entering your answers in the tabs below. Revenues Machine A: Keep or Replace Analysis Req B Compute the income increase or decrease from replacing the old machine…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education