FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:k

Rory Company has an old machine with a book value of $77,000 and a remaining five-year useful life. Rory is considering purchasing a

new machine at a price of $106,000. Rory can sell its old machine now for $73,000. The old machine has variable manufacturing costs

of $32,000 per year. The new machine will reduce variable manufacturing costs by $12,800 per year over its five-year useful life.

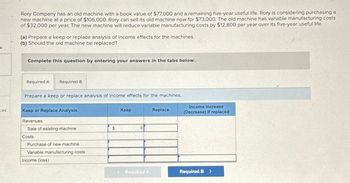

(a) Prepare a keep or replace analysis of income effects for the machines.

(b) Should the old machine be replaced?

Complete this question by entering your answers in the tabs below.

Required A

Required B

Prepare a keep or replace analysis of income effects for the machines.

ces

Keep or Replace Analysis

Keep

Revenues

Sale of existing machine

$

0

Costs

Purchase of new machine

Variable manufacturing costs

Income (loss)

Replace

Income Increase

(Decrease) if replaced

<Required A

Required B >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- You are considering adding a new item to your company’s line of products. The machine required to manufacture the item costs $200000, and it depreciates straight-line over 4 years. The new item would require a $30000 increase in inventory and a $15000 increase in accounts payable. You plan to market the items for four years and then sell the machine for $40000. You expect to sell 2000 items per year at a price of $300. You expect manufacturing costs to be $220 per item and the fixed cost to be $3,000 per year. If the tax rate is 30% and your weighted average cost of capital is 12% per year, what is the net present value of selling the new item? ) $159,744 2) $73,903 3) $191,692 4) -$159,744 5) -$191,692arrow_forwardPlease tutor help me with this questionarrow_forwardConsider a machine purchased one year ago for $18,000. The machine is being depreciated $3,000 per year throughout a six-year period. Its current market value is $6,000, and the expected market value of the machine one year from now is $4,000. If the interest rate is 10%, the expected cost of holding the machine during the next year is $___.arrow_forward

- Lopez Company is considering replacing one of its old manufacturing machines. The old machine has a book value of $46,000 and a remaining useful life of five years. It can be sold now for $56,000. Variable manufacturing costs are $43,000 per year for this old machine. Information on two alternative replacement machines follows. The expected useful life of each replacement machine is five years. Purchase price Variable manufacturing costs per year Machine A $ 123,000 19,000 Machine B $136,000 15,000 (a) Compute the income increase or decrease from replacing the old machine with Machine A. (b) Compute the income increase or decrease from replacing the old machine with Machine B. (c) Should Lopez keep or replace its old machine? (d) If the machine should be replaced, which new machine should Lopez purchase? Complete this question by entering your answers in the tabs below. Req A Req B Req C and D Compute the income increase or decrease from replacing the old machine with Machine B. Note:…arrow_forwardProblem 1: You are considering the purchase of one of two machines used in your manufacturing plant. Machine A has a life of two years, costs $80 initially, and then $125 per year in maintenance costs. Machine B costs $150 initially, has a life of three years, and requires $100 in annual maintenance costs. Either machine must be replaced at the end of its life with an equivalent machine. Which is the better machine for the firm? The discount rate is 12 percent, and the tax rate is zero.arrow_forwardVeerarrow_forward

- 2. Super Apparel wants to replace an old machine with a new one. The new machine would increase annual revenue by $200,000 and annual operating expenses by $80,000. The new machine would cost $400,000. The estimated useful life of the machine is 10 years with zero salvage value. i. Compute Accounting Rate of Return (ARR) of the machine using above information. ii. Should Super Apparel purchase the machine if management wants an Accounting Rate of Return of 19% on all capital investments? Hint: Use Average Income or Profit after deducting tax, depreciation, and operating expenses.arrow_forwardFULL QUESTION: Kinky Copies may buy a high-volume copier. The machine costs $100,000 and this cost can be fully depreciated immediately. Kinky anticipates that the machine actually can be sold in 5 years for $30,000. The machine will save $20,000 a year in labor costs but will require an increase in working capital, mainly paper supplies, of $10,000. The firm’s marginal tax rate is 21%, and the discount rate is 8%. (Assume the net working capital will be recovered at the end of Year 5.) What is the NPV of this project? (Negative amount should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to 2 decimal places.)arrow_forwardVijay shiyalarrow_forward

- Do not give answer in imagearrow_forward(engineering economic) a company considers purchasing a machine for $3000. The tool is planned to be used for 10 years and after that it will be sold for 25% of its purchase price. With the purchase of the tool, the company must incur operating costs of $ 400 per year. If the owner of the company wants a return of 10% annually on the investment made, what is the uniform annual income for at least 10 years that must be obtained from the heavy equipment so that the wishes of the owner of the company are fulfilled?arrow_forwardJanko Wellspring Incorporated has a pump with a book value of $26,000 and a four-year remaining life. A new, more efficient pump is available at a cost of $47,000. Janko can receive $8,200 for trading in the old pump. The old machine has variable manufacturing costs of $27,000 per year. The new pump will reduce variable costs by $11,100 per year over its four-year life. Should the pump be replaced? Multiple Choice No, because the company will be $5,600 worse off in total. Yes, because income will increase by $5.500 per year No, because income wit decrease by $100 per year. Yes, because income will increase by $5.600 in total No, Janko will record a loss of $16,400 r they replace the pumparrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education