Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

The minimum EUAC value of the challenger is

(Round to the nearest dollar.)

(Round to the nearest dollar.)

Part 2

The marginal cost of keeping the defender in service for one more year is

(Round to the nearest dollar.)

(Round to the nearest dollar.)

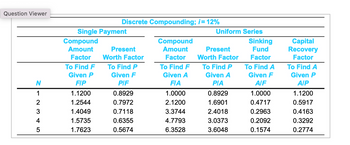

Transcribed Image Text:Question Viewer

Single Payment

Compound

Amount

Present

Present

Discrete Compounding; ¡= 12%

Uniform Series

Compound

Amount

Sinking

Fund

Capital

Recovery

Factor

Worth Factor

Factor

Worth Factor

Factor

To Find F

To Find P

To Find F

To Find P

Given P

Given F

Given A

Given A

Given F

To Find A

Factor

To Find A

Given P

N

FIP

PIF

FIA

ΡΙΑ

A/F

AIP

1

1.1200

0.8929

1.0000

0.8929

1.0000

1.1200

2345

1.2544

0.7972

2.1200

1.6901

0.4717

0.5917

1.4049

0.7118

3.3744

2.4018

0.2963

0.4163

1.5735

0.6355

4.7793

3.0373

0.2092

0.3292

1.7623

0.5674

6.3528

3.6048

0.1574

0.2774

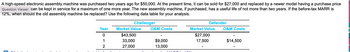

Transcribed Image Text:A high-speed electronic assembly machine was purchased two years ago for $50,000. At the present time, it can be sold for $27,000 and replaced by a newer model having a purchase price

Question Viewer can be kept in service for a maximum of one more year. The new assembly machine, if purchased, has a useful life of not more than two years. If the before-tax MARR is

12%, when should the old assembly machine be replaced? Use the following data table for your analysis.

Challenger

Year

0

Market Value

O&M Costs

$43,500

1

33,000

$9,000

2

27,000

13,000

Defender

Market Value

O&M Costs

$27,000

17,500

$14,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 4 images

Knowledge Booster

Similar questions

- As an Engineer, you are asked to consider two building proposals, which alternative do you deem superior based on the economics? (Assume the money to be used would be borrowed and paid back within the life of the structure). The nominal interest rate is at 21.4% compounding quarterly. State which method you will use and state why. ALTERNATIVE A ALTERNATIVE B Туре Steel Cement Life 20 years 20 years Initial Cost $1089 $2954 Maintenance $486/year $138/year Cost at the end of 8 $57 $64 yearsarrow_forwardConsider the following alternatives below.Based on a 7% interest rate, assuming both alternatives perform the same task and there is a continuing requirement, which alternative should be selected and what is its equivalent uniform annual cost?arrow_forwardA firm is considering two alternatives that have no salvage value. At the end of 4 years, another B may be purchased with the same cost, benefits and so forth. a. Construct a choice table for interest rates from 0% to 100%. b. If the MARR is 10%, which alternative should be selected? Item Initial Cost Uniform Annual Benefits Useful Life, in years A -$10,700 2,100 8 B -$5,500 1,800 4arrow_forward

- 1. Each aiternative has a 10-year useful life and have no salvage value. If the MARR is 8%, which alternative would you select? You must use incremental analysis (incremental internal rate of return). Please show step by step calculations. R Initial Cost 15000 22000 35000 Annual Costs 3500 3100 2750 Annual Revenues 8000 9575 11500arrow_forwardAlternative X has a first cost of 36000 an annual operating cost of 6900, and a salvage value of 11025 after 13 year. Alternative Y has a first cost of 37000 an annual operating cost of 7000, and a salvage value of 16280 after 13 year. If MARR of 13% per year, approximately what is the PW of each alternative? Select one: O a. PW of X= -77518 and PW of Y= -78067 O b. PW of X= -75990 and PW of Y= -76529 O c. PW of X= -76750 and PW of Y= -77294 O d. PW of X= -78293 and PW of Y= -78848arrow_forwardYou have just been offered a contract worth $ 1.15 million per year for 7 years. However, to take the contract, you will need to purchase some new equipment. Your discount rate for this project is 12.4%. You are still negotiating the purchase price of the equipment. What is the most you can pay for the equipment and still have a positive NPV? Question content area bottom Part 1 The most you can pay for the equipment and achieve the 12.4% annual return is $ enter your response here million. Round to two decimal places.)arrow_forward

- 13. ABC manufacturing wants to purchase a new machine that is expected to save $12,000 in annual operating and maintenance costs for the next five years. The machine's price is $32,000, and the installation cost is $3500. With a salvage value of $5,000 and an interest rate of 17%, what is the discounted payback period? a. 4 years b. 6 уears с. 5 years d. 3 yearsarrow_forwardQuestion No. r The following information is provided for five mutually exclusive alternatives that have 20-year useful lives. If the minimum attractive rate of return is 6%, which alternative should be selected using IROR Method? Alternatives B Cost 4,000 2,000 6,000 1,000 9,000 Uniform Annual Benefit 639 410 761 117 785 IROR 15% 20% 11% 10% 6% IROR (B-D) IROR (A-D) IROR (A-B) IROR (C-B) IROR (C-A) IROR (E-C) IROR (E-A) -5% 29% 18% 10% 9% 2% 14%arrow_forward7. What is the payback period? ?arrow_forward

- Answer according to the question pleasearrow_forward2. A construction company must replace a piece of heavy earth-moving equipment. Cat and Volvo are the two best alternatives. Both alternatives are expected to last 8 years. If the company has a minimum attractive rate of return (MARR) of 11%, which alternative should be chosen? Use IRR analysis. Cat Volvo First cost $15,000 $22,500 Annual operating cost Salvage value 3,000 1,500 2,000 4,000arrow_forwardDetermine which alternative, if any, should be chosen based on Annual Worth method using 15% MARR. Use Repeatability Method. Note: Show final answer to the nearest WHOLE NUMBER and show complete solution Answer the following: a. The Annual Worth of Alternative A is = $ Blank 1 b. The Annual Worth of Alternative B is = $ Blank 2 c. Choose Alternative (Type only A or B) = Blank 3arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education