FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

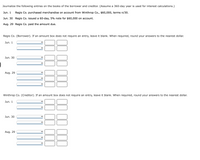

Transcribed Image Text:Journalize the following entries on the books of the borrower and creditor. (Assume a 360-day year is used for interest calculations.)

Jun. 1

Regis Co. purchased merchandise on account from Winthrop Co., $60,000, terms n/30.

Jun. 30 Regis Co. issued a 60-day, 5% note for $60,000 on account.

Aug. 29 Regis Co. paid the amount due.

Regis Co. (Borrower). If an amount box does not require an entry, leave it blank. When required, round your answers to the nearest dollar.

Jun. 1

Jun. 30

Aug. 29

Winthrop Co. (Creditor). If an amount box does not require an entry, leave it blank. When required, round your answers to the nearest dollar.

Jun. 1

Jun. 30

Aug. 29

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Answer with in 30 Minutes to get upvotes?arrow_forwardFollowing are transactions for Vitalo Company. 1 Accepted a $3,000, 180-day, 5% note from Kelly White in granting a time extension on her past-due account receivable. Nov. Dec. 31 Adjusted the year-end accounts for the accrued interest earned on the White note. Apr. 30 White honored her note when presented for payment. Complete the table to calculate the interest amounts at December 31s and April 30" and use those calculated values to prepare your journal entries. (Do not round intermediate calculations. Use 360 days a year.) Complete this question by entering your answers in the tabs below. Interest General Journal Amounts Complete the table to calculate the interest amounts at December 31st and April 30th. November 1 January 1 Total Through Through Through Maturity December 31 April 30 Principal Rate (%) Time Total interestarrow_forwardComputing Accrued Interest Compute the interest accrued on each of the following notes receivable held by Northland, Inc., on December 31: (Use 360 days for interest calculation. Round to the nearest dollar.) Maker Date ofNote Principal InterestRate Term Maple November 21 $180,000 6% 120 days Wyman December 13 140,000 7% 90 days Nahn December 19 210,000 5% 60 days Maple: Answer Wyman: Answer Nahn: Answerarrow_forward

- Entries for Notes Receivable Valley Designs issued a 90-day, 8% note for $78,000, dated April 22, to Bork Furniture Company on account. Assume 360 days in a year when computing the interest. a. Determine the due date of the note. b. Determine the maturity value of the note. c1. Journalize the entry to record the receipt of the note by Bork Furniture. If an amount box does not require an entry, leave it blank. c2. Journalize the entry to record the receipt of payment of the note at maturity. If an amount box does not require an entry, leave it blank.arrow_forwardComputing Accrued Interest Compute the interest accrued on each of the following notes receivable held by Northland, Inc., on December 31: (Use 360 days for interest calculation. Round to the nearest dollar.) Date of Note Maker Maple November 21 Wyman December 13 Nahn December 19 Maple: $ Wyman: Nahn: Principal $25,000 21,000 28,000 Interest Rate 3% 4% 5% Term. 120 days 90 days 60 daysarrow_forwardneed help with 1D, Feb 14.! Received Todd’s payment of principal and interest on the note dated December 16. The following transactions are from Ohlm Company. (Use 360 days a year.) Year 1 Dec. 16 Accepted a $10,700, 60-day, 8% note in granting Danny Todd a time extension on his past-due account receivable. 31 Made an adjusting entry to record the accrued interest on the Todd note. Year 2 Feb. 14 Received Todd’s payment of principal and interest on the note dated December 16. Mar. 2 Accepted a(n) $6,600, 8%, 90-day note in granting a time extension on the past-due account receivable from Midnight Co. 17 Accepted a(n) $3,300, 30-day, 7% note in granting Ava Privet a time extension on her past-due account receivable. Apr. 16 Privet dishonored her note. May 31 Midnight Co. dishonored its note. Aug. 7 Accepted a(n) $7,900, 90-day, 10% note in granting a time extension on the past-due account receivable of Mulan Co. Sep. 3…arrow_forward

- 4. AB company receives $10,000 for a 6 month, 8% note on 11/1/20. Prepare the journal entry for the receipt. Account Debit Credit 5. Prepare the journal entry to accrue interest on the above note at 12/31/20. Account Debit Credit 6. Prepare the entry to record payment of the above note in full on it's due date of 5/1/21. Account Debit Credit 7. AB Company purchases a truck in the amount of $15,000. Additional costs include sales tax of $1500, painting of $2500, license of $150 and a 1 year auto insurance policy of $1200. Complete the journal entry for the auto purchase. Account Debit Creditarrow_forwardCalculate the missing information on the revolving credit account. Interest is calculated on the unpaid or previous month's balance. (Round dollars to the nearest cent.) Monthly Annual Finance Purchases Payments and New Previous Periodic Percentage Rate (APR) Charge (in $) and Cash Balance Balance Rate Advances Credits (in $) (as a %) $1,027.61 % 1% $322.20 $400.00arrow_forwardEntries for notes payable A business issued a 60-day, 15% note for $85,000 to a creditor on account. Journalize the entries to record (a) the issuance of the note and (b) the payment of the note at maturity, including interest. Assume a 360 days in a year. If an amount box does not require an entry, leave it blank. If required, round yours answers to whole dollar.arrow_forward

- Round answers to nearest dollararrow_forwardon november 1, 2018, Downtown Jewelers accepted a 3-month, 15% note for $6,000 in sttlement of an averdue account receivable. the account period ends on december 31. prepare the journal entry to record the accrued interest at the year end.arrow_forwardCalculate the missing information on the revolving credit account. Interest is calculated on the unpaid or previous month's balance. PreviousBalance AnnualPercentageRate (APR) MonthlyPeriodicRate(as a %) FinanceCharge(in $) Purchasesand CashAdvances PaymentsandCredits NewBalance(in $) $1,026.61 1.75% $322.20 $300.00 Step 1 In the credit account statement below, the values of the annual percentage rate (APR), finance charge, and the new balance must be calculated. PreviousBalance AnnualPercentageRate (APR) MonthlyPeriodicRate(as a %) FinanceCharge(in $) Purchasesand CashAdvances PaymentsandCredits NewBalance(in $) $1,026.61 1.75% $322.20 $300.00 Recall that the annual percentage rate (APR) is tied to the monthly periodic rate by the following formula. monthly periodic rate = APR 12 By solving this equation for the APR, the known value for the monthly periodic rate can be substituted to calculate the APR. APR = monthly periodic rate ✕ 12 The…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education