FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

for

Transcribed Image Text:2

3

4

LO

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

A

C

F

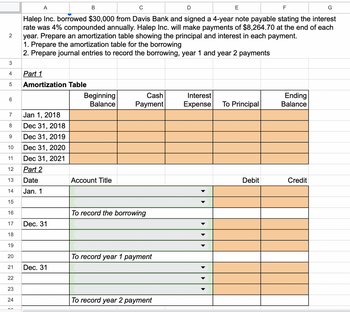

Halep Inc. borrowed $30,000 from Davis Bank and signed a 4-year note payable stating the interest

rate was 4% compounded annually. Halep Inc. will make payments of $8,264.70 at the end of each

year. Prepare an amortization table showing the principal and interest in each payment.

1. Prepare the amortization table for the borrowing

2. Prepare journal entries to record the borrowing, year 1 and year 2 payments

Part 1

Amortization Table

Jan 1, 2018

Dec 31, 2018

Dec 31, 2019

Dec 31, 2020

Dec 31, 2021

Part 2

Date

Jan. 1

Dec. 31

Dec. 31

B

Beginning

Balance

Account Title

Cash

Payment

To record the borrowing

To record year 1 payment

To record year 2 payment

D

Interest

Expense

E

To Principal

Debit

Ending

Balance

Credit

G

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Subject: accountingarrow_forwardWhen posting the column totals of a cash payments journal, a debit should be posted to a.Unearned Revenue b.Sales Discounts c.Accounts Payable d.Casharrow_forwardJournal entry: If a company uses the ALLOWANCE method for valuing Accounts Receivable on the balance sheet, what will the journal entry be (with out amounts) at the end of the accounting period. Journal: Debit Account Credit Accountarrow_forward

- for the journal entry what about record cash paid for frieght cost and record cash paid for specialist feearrow_forwardInstructions The following equity investment transactions were completed by Romero Company during a recent year. Apr. July Sept. 10 Purchased 4,700 shares of Dixon Company for a price of $49 per share plus a brokerage commission of $120. 8 Received a quarterly dividend of $0.70 per share on the Dixon Company investment. 10 Sold 1,900 shares for a price of $41 per share less a brokerage commission of $75. Journalize the entries for these transactions. Refer to the Chart of Accounts for exact wording of account titles. When required, round your answers the nearest dollar.arrow_forwardIdentify the normal balance (debit [Dr] or credit [Cr]) for each of the following accounts: __________ Accounts Receivable. __________Equipment.arrow_forward

- 46) The journal entry behind the screen that QuickBooks creates when a bill is recorded using the Enter Bills window includes: A) Debit Accounts Payable, Credit Checking accountB) Debit Checking account, Credit Accounts PayableC) Debit Expense account, Credit Accounts PayableD) Debit Accounts Payable, Credit Expense account Group of answer choices A B C Darrow_forwardplease help and provide answer with explanation calculation intermediate calculation use commas and dollars sign with steps formulasarrow_forwardDiamondback Welding & Fabrication Corporation sells and services pipe welding equipment in Illinois. The following selected accounts appear in the ledger of Diamondback Welding & Fabrication at the beginning of the current year: Preferred 2% Stock, $80 par (100,000 shares authorized, 60,000 shares issued) Paid-In Capital in Excess of Par-Preferred Stock Common Stock, $9 par (3,000,000 shares authorized, 1,750,000 shares issued) Paid-In Capital in Excess of Par-Common Stock Retained Earnings During the year, the corporation completed a number of transactions affecting the stockholders' equity. They are summarized as follows: a. Purchased 87,500 shares of treasury common for $8 per share. b. Sold 55,000 shares of treasury common for $11 per share. c. Issued 20,000 shares of preferred 2% stock at $84. d. Issued 400,000 shares of common stock at $13, receiving cash. e. Sold 18,000 shares of treasury common for $7.50 per share. f. Declared cash dividends of $1.60 per share on preferred…arrow_forward

- Instructions Adele Corp., a wholesaler of music equipment, issued $31,400,000 of 20-year, 5% callable bonds on March 1, 20Y1, at their face amount, with interest payable on March 1 and September 1. The fiscal year of the company is the calendar year. Journalize the entries to record the following selected transactions Refer to the Chart of Accounts for exact wording of account fifles 20Y1 Mar. Sept. 20Y5 Sept. Chart of Accounts Journal 1 Issued the bonds for cash at their face amount. Paid the interest on the bonds 1 1 Called the bond issue at 103, the rate provided in the bond indenture. (Omit entry for payment of interest.) Xarrow_forwardMultiple choicearrow_forwardPrepaid Expense has the account type of Checking with a starting balance ofarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education