Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

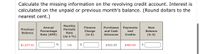

Transcribed Image Text:Calculate the missing information on the revolving credit account. Interest is

calculated on the unpaid or previous month's balance. (Round dollars to the

nearest cent.)

Monthly

Annual

Finance

Purchases

Payments

and

New

Previous

Periodic

Percentage

Rate (APR)

Charge

(in $)

and Cash

Balance

Balance

Rate

Advances

Credits

(in $)

(as a %)

$1,027.61

%

1%

$322.20

$400.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Using ordinary interest, 360 days, calculate the missing information for the simple discount note. (Round dollars to the nearest cent.) Discount Date of Maturity Date Bank Discount Proceeds Face Value Term Rate (%) Note (days) (in $) (in $) $73,000 5 May 5 51 --Select--- 2$ $arrow_forward1 Required: Complete the following table by computing the missing amounts for the following independent cases. (Do not round intermediate calculations. Round "Annual Interest Rate" to 1 decimal place.) Principal Amount on Notes Annual Interest Time Period Rate Interest Earned Receivable ok a S 65,000 11.4 % 6 months b. $ 43,000 % 9 months $ 3,483 C. 9.3 % 12 months $ 3,069 ncesarrow_forwardRequired: Complete the following table by computing the missing amounts for the following independent cases. (Do not round intermediate calculations. Round "Annual Interest Rate" to 1 decimal place.) a. b. C. Principal Amount on Notes Receivable $ $ 50,000 40,000 Annual Interest Rate 12.0% % 9.0 % Time Period 6 months 9 months 12 months Interest Earned $ $ 3,600 2,700arrow_forward

- Calculate the missing information on the revolving credit account. Interest is calculated on the unpaid or previous mo th's balance. (Round dollars to the nearest cent.) Annual Monthly Finance Purchases Payments New Previous Percentage Rate (APR) (as a %) Periodic Charge and Cash and Balance Balance Rate (in $) Advances Credits (in $) 1-% $ 31.12 $2,490.00 15 % $1,354.98 $300.00 3576.1 4arrow_forwardplease solve with proper explanation , computation ,formula with steps answer in text thanksarrow_forwardAssuming a 360-day year, the interest charged by the bank, at the rate of 6%, on a 90-day, discounted note payable of $106,407 isarrow_forward

- Round answers to nearest dollararrow_forwardJohn Lee Wholesale provides the following information: Accounts Receivable - 01/07/2020 $150 Accounts Receivable - 30/06/2021 900 Cash received from accounts receivable 8,050 What would be the credit sales for the year? Select one: 8,950 750 8,800 1,050arrow_forwardSuppose you want to estimate your transportation expenses for the year.Explain how you could use this one-month statement to make an estimate for one year of transportation expenses.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education