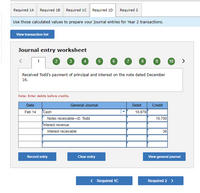

need help with 1D, Feb 14.! Received Todd’s payment of principal and interest on the note dated December 16.

The following transactions are from Ohlm Company. (Use 360 days a year.)

Year 1

| Dec. | 16 | Accepted a $10,700, 60-day, 8% note in granting Danny Todd a time extension on his past-due |

||

| 31 | Made an |

Year 2

| Feb. | 14 | Received Todd’s payment of principal and interest on the note dated December 16. | ||

| Mar. | 2 | Accepted a(n) $6,600, 8%, 90-day note in granting a time extension on the past-due account receivable from Midnight Co. | ||

| 17 | Accepted a(n) $3,300, 30-day, 7% note in granting Ava Privet a time extension on her past-due account receivable. | |||

| Apr. | 16 | Privet dishonored her note. | ||

| May | 31 | Midnight Co. dishonored its note. | ||

| Aug. | 7 | Accepted a(n) $7,900, 90-day, 10% note in granting a time extension on the past-due account receivable of Mulan Co. | ||

| Sep. | 3 | Accepted a(n) $3,210, 60-day, 11% note in granting Noah Carson a time extension on his past-due account receivable. | ||

| Nov. | 2 | Received payment of principal plus interest from Carson for the September 3 note. | ||

| Nov. | 5 | Received payment of principal plus interest from Mulan for the August 7 note. | ||

| Dec. | 1 | Wrote off the Privet account against the Allowance for Doubtful Accounts. |

Required:

1-a. First, complete the table below to calculate the interest amount at December 31, Year 1.

1-b. Use the calculated value to prepare your

1-c. First, complete the table below to calculate the interest amounts.

1-d. Use those calculated values to prepare your journal entries for Year 2 transactions.

2. If Ohlm pledged its receivables as security for a loan from the bank, where on the financial statements does it disclose this pledge of receivables?

As per the accrual principal, revenue and expenses need to be accounted in the period in which they accrue.

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

- Martinez Co. borrowed $60,000 on March 1 of the current year by signing a 60-day, 8%, interest-bearing note. Assuming a 360-day year, when the note is paid on April 30, the entry to journalize the payment should include a a. debit to Interest Payable for $800 Ob. debit to Interest Expense for $800 Oc. credit to Cash for $60,000 C. Od. credit to Cash for $64,800 Barrow_forwardDo not give solution in imagearrow_forwardJournalize the following, assuming a 360-day year is used for interest computations: Apr. 30 Issued a $126,000, 30-day, 6% note dated April 30 to Misner Co. on account. May 30 Paid Misner Co. the amount owed on the note dated April 30. If an amount box does not require an entry, leave it blank. Apr. 30 May 30 3 3 000 ?arrow_forward

- On October 1, 2023 PT. Leci borrowed $500,000 from Pineapple Bank by signing a 10-month, 6% note. If on December 31 PT. Leci makes adjusting entries, then on August 1, 2024 what is the amount of interest expense recorded by PT. Lychee when paying off the notes? a. 17.500 b. 21 000 c. 9.000 d. 30.000 e. 7.500arrow_forwardces Required information [The following information applies to the questions displayed below.] Following are transactions of Danica Company. December 13 Accepted a $20,000, 45-day, 4% note in granting Miranda Lee a time extension on her past-due account receivable. December 31 Prepared an adjusting entry to record the accrued interest on the Lee note. Complete the table to calculate the interest amounts at December 31st and use the calculated value to prepare your journal entries. Note: Do not round your intermediate calculations. Use 360 days a year. Complete this question by entering your answers in the tabs below. Interest Amounts General Journal Complete the table to calculate the interest amounts at December 31st, Interest Recognized December 31 20,000 4% 18/360 Principal Rate (%) Time Total interest Total Through Maturity $ 20,000 $ 4% 45/360 Check my workarrow_forwardFollowing are transactions for Vitalo Company. November 1 Accepted a $10,000, 180-day, 7% note from Kelly White in granting a time extension on her past-due account receivable. December 31 Adjusted the year-end accounts for the accrued interest earned on the White note. April 30 White honored her note when presented for payment. Complete the table to calculate the interest amounts at December 31st and April 30th and use those calculated values to prepare your journal entries. (Do not round intermediate calculations. Use 360 days a year.) Complete this question by entering your answers in the tabs below. General Journal Interest Amounts Complete the table to calculate the interest amounts at December 31st and April 30th Total Through Maturity November 1 Through December 31 January 1 Through April 30 Principal Rate (%) Time Total interest Amounts General Journal > ere to search 68°F 40 4. ort se deletearrow_forwardon Nov 1 alan co. signed a 120 - day, 9% note payable with a face value of 18,000. alan made the appropriate year-end accrual. what is the journal entry as of March 1 to record the payment of the note assuming no reversing entry was madearrow_forwardKeesha Co. borrows $230,000 cash on November 1 of the current year by signing a 180-day, 7%, $230,000 note. 1. On what date does this note mature? 2. & 3. What is the amount of interest expense in the current year and the following year from this note? 4. Prepare journal entries to record (a) issuance of the note, (b) accrual of Interest on December 31, and (c) payment of the note at maturity. O Answer is not complete. Complete this question by entering your answers in the tabs below. Req 1 Reg 2 and 3 Reg 4 Prepare journal entries to record (a) issuance of the note, (b) accrual of interest on December 31, and (c) payment of the note at maturity. (Use360 days a year. Do not round intermediate calculations.) No Transaction General Journal Debit Credit 230,000 1 (a) Cash 230.000 O Notes payable 2,728 (b) Interest expense 2,728 8 Interest payable 230,000 2,728 3 3 (c) Notes payable Interest payable 5,322 Interest expensearrow_forwardarrow_back_iosarrow_forward_ios

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education