FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

JOURNAL

| DATE | DESCRIPTION | POST. REF. | DEBIT | CREDIT | ASSETS | LIABILITIES | EQUITY | |

|---|---|---|---|---|---|---|---|---|

|

1

|

|

|

|

|

|

|

|

|

|

2

|

|

|

|

|

|

|

|

|

|

3

|

|

|

|

|

|

|

|

|

|

4

|

|

|

|

|

|

|

|

|

|

5

|

|

|

|

|

|

|

|

|

|

6

|

|

|

|

|

|

|

|

|

|

7

|

|

|

|

|

|

|

|

|

|

8

|

|

|

|

|

|

|

|

|

|

9

|

|

|

|

|

|

|

|

|

|

10

|

|

|

|

|

|

|

|

|

|

11

|

|

|

|

|

|

|

|

|

|

12

|

|

|

|

|

|

|

|

|

|

13

|

|

|

|

|

|

|

|

|

|

14

|

|

|

|

|

|

|

|

|

|

15

|

|

|

|

|

|

|

|

|

|

16

|

|

|

|

|

|

|

|

|

|

17

|

|

|

|

|

|

|

|

|

|

18

|

|

|

|

|

|

|

|

|

|

19

|

|

|

|

|

|

|

|

|

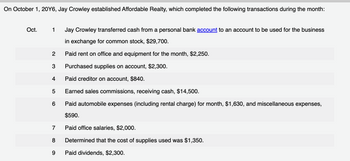

Transcribed Image Text:On October 1, 20Y6, Jay Crowley established Affordable Realty, which completed the following transactions during the month:

Oct.

1 Jay Crowley transferred cash from a personal bank account to an account to be used for the business

in exchange for common stock, $29,700.

Paid rent on office and equipment for the month, $2,250.

Purchased supplies on account, $2,300.

Paid creditor on account, $840.

2

3

4

5 Earned sales commissions, receiving cash, $14,500.

Paid automobile expenses (including rental charge) for month, $1,630, and miscellaneous expenses,

$590.

7

Paid office salaries, $2,000.

8 Determined that the cost of supplies used was $1,350.

Paid dividends, $2,300.

6

9

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The information below is taken from the shareholders' equity section of the statement of financial position for Cullumber Cable: Shareholders' equity Preferred shares, authorized 10,000,000 shares, 4,580,000 and 2,120,000 issued and outstanding at December 31, 2024, and December 31, 2023, respectively. Common shares, authorized 25,000,000 shares, 1,000,000 and 2,120,000 shares issued and outstanding at December 31, 2024, and December 31, 2023, respectively. Retained earnings Accumulated other comprehensive income (loss) Total shareholders' equity a. b. 2024 C. $12,824,000 5,000,000 135,560,000 (19,400,000) $133,984,000 Provide the journal entries for the following: (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) 2023 The issuance of preferred shares during 2024. The repurchase of 1,120,000…arrow_forwardGreg Thomas purchased one-half of lan Hamilton's interest in the Freidman and Hamilton partnership for $35,250. Prior to the investment, land was revalued to a market value of $146,000 from a book value of $88,000. Adam Freidman and lan Hamilton share net income equally. Hamilton had a capital balance of $27,800 prior to these transactions. Required: a. On December 31, provide the journal entry for the revaluation of land.* b. On December 31, provide the journal entry to admit Thomas.*arrow_forwardSubject: accountingarrow_forward

- Credit termog 1/10, n/30 meansarrow_forwardJournal entry: If a company uses the ALLOWANCE method for valuing Accounts Receivable on the balance sheet, what will the journal entry be (with out amounts) at the end of the accounting period. Journal: Debit Account Credit Accountarrow_forwardThree different lease transactions are presented below for Sandhill Enterprises. Assume that all lease transactions start on January 1, 2024. Sandhill does not receive title to the properties, either during the lease term or at the end of it. The yearly rental for each of the leases is paid at the beginning of each year. Sandhill Enterprises prepares its financial statements using ASPE. Lease term Estimated economic life Yearly rental payment Fair market value of leased asset Present value of lease rental payments Interest rate Manufacturing Equipment 5 years 15 years $18,000 $126,000 $81,270 3.5% Vehicles 6 years 7 years $19,260 $109,200 $100,962 4% Office Equipment 3 years 5 years $5,010 $22,500 $12,912 8% Ass me that Sandhill Enterprises has purchased the vehicle for $109,200 instead of leasing it and that the amount borrowed was $109,200 at 8% interest, with interest payable at the end of each year. Prepare the entries for 2024. (List all debit entries before credit entries. Credit…arrow_forward

- Credit terms of 1/10, n/30 meansarrow_forwardOn January 31, Outback Coast Resorts Inc. reacquired 23,900 shares of its common stock at $31 per share. On April 20, Outback Coast Resorts sold 14,000 of the reacquired shares at $40 per share. On October 4, Outback Coast Resorts sold the remaining shares at $29 per share. Required: Journalize the transactions of January 31, April 20, and October 4. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered.arrow_forward3arrow_forward

- Selected journal entries for Sunland Enterprises are presented as follows. J1 Date Account Titles and Explanation Ref. Debit Credit May 5 Accounts Receivable 5,690 Service Revenue 5, 690 (Billed for services performed) 12 Cash 1, 660 Accounts Receivable 1, 660 (Received cash in payment of account) 15 Cash 3,350 Service Revenue 3, 350 (Received cash for services performed) Post the transactions using the standard form of account. (Post entries in the order presented in the problem.) Casharrow_forwardInstructions Keller Corporation (the lessee) entered into a general equipment lease with Dallo Company (the lessor) on January 1 of Year 1. The following information pertains to this lease agreement: 1. The equipment reverts back to the lessor at the end of the lease, and there is no bargain purchase option. 2. The lease term is 8 years and requires annual payments $10,000 at the beginning of each year. 3. The fair value of the equipment at lease inception is $100,000. Assume that the present value of lease payments discounted at a 10% interest rate is $58,684.19. 4. The equipment has an estimated economic life of 20 years and has zero residual value at the end of this time. Required: Prepare the journal entry that Keller Corporation would make during the first year of the lease assuming that the lease is classified as an operating lease.arrow_forwardRubin Enterprises had the following sales-related transactions on a recent day: a. Billed customer $28,600 on account for services already provided. b. Collected $5,715 in cash for services to be provided in the future. c. The customer complained about aspects of the services provided in Transaction a. To maintain a good relationship with this customer, Rubin granted an allowance of $1,500 off the list price. The customer had not yet paid for the services. d. Rubin provided the services for the customer in Transaction b. Additionally, Rubin granted an allowance of $480 because the services were provided after the promised date. Because the customer had already paid, Rubin paid the $480 allowance in cash. Required: Prepare the necessary journal entry (or entries) for each of these transactions.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education