FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

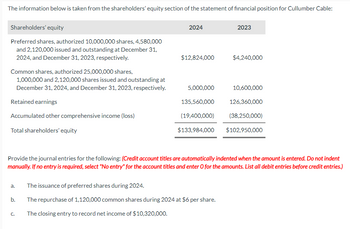

Transcribed Image Text:The information below is taken from the shareholders' equity section of the statement of financial position for Cullumber Cable:

Shareholders' equity

Preferred shares, authorized 10,000,000 shares, 4,580,000

and 2,120,000 issued and outstanding at December 31,

2024, and December 31, 2023, respectively.

Common shares, authorized 25,000,000 shares,

1,000,000 and 2,120,000 shares issued and outstanding at

December 31, 2024, and December 31, 2023, respectively.

Retained earnings

Accumulated other comprehensive income (loss)

Total shareholders' equity

a.

b.

2024

C.

$12,824,000

5,000,000

135,560,000

(19,400,000)

$133,984,000

Provide the journal entries for the following: (Credit account titles are automatically indented when the amount is entered. Do not indent

manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.)

2023

The issuance of preferred shares during 2024.

The repurchase of 1,120,000 common shares during 2024 at $6 per share.

The closing entry to record net income of $10,320,000.

$4,240,000

10,600,000

126,360,000

(38,250,000)

$102,950,000

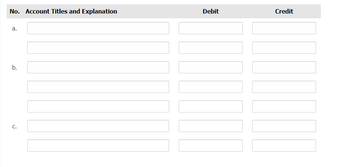

Transcribed Image Text:No. Account Titles and Explanation

a.

b.

C.

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Bacon Inc. has the following stockholders’ equity section in its May 31, 2019, comparative balance sheets: May 31, 2019 April 30, 2019 Paid-in capital: Preferred stock, $120 par value, 9%, cumulative, 200,000 shares authorized, 140,000 shares issued and outstanding $ 16,800,000 $ 16,800,000 Common stock, $5 par value, 1,000,000 shares authorized, 600,000 and 540,000 shares issued, respectively ? 2,700,000 Additional paid-in capital 26,100,000 23,220,000 Retained earnings 36,200,000 34,640,000 Less: Treasury common stock, at cost; 72,000 shares and 68,000 shares, respectively (4,412,000 ) (4,148,000 ) Total stockholders' equity $ ? $ 73,212,000 c. What was the average cost per share of the common stock purchased for the treasury during the month?arrow_forwardThe following data is available for Crane Corporation at December 31, 2025: Common stock, par $10 (authorized 31500 shares) $283500 Treasury stock (at cost $15 per share) $1080 Based on the data, how many shares of common stock are issued? O 28278. O 31428. O 31500. O 28350.arrow_forwardShown below is information relating to shareholder's equity of R2K Corporation as of December 31,2018 (SEE PICTURE BELOW):What is the amount of total shareholder’s equity that R2K Corporation should report on December 31, 2018?arrow_forward

- The shareholders’ equity section of Superior Corporation’s balance sheet as of December 31, 2018, is as follows: Shareholders’ Equity Preferred stock, $100 par value; authorized, 300,000 shares; issued, 32,500 shares $3,250,000 Common stock, $5 par value; authorized, 2,000,000 shares; issued, 442,000 shares 2,210,000 Paid-in capital in excess of par—preferred 87,000 Paid-in capital in excess of par—common 875,000 Retained earnings 2,980,000 $9,402,000 The following events occurred during 2019: Jan. 5 10,000 shares of authorized and unissued common stock were sold for $6 per share. 16 12,000 shares of authorized and unissued preferred stock were sold for $107 per share. Apr. 1 78,000 shares of common stock were repurchased for the treasury at a price of $17 per share. Superior uses the cost method to account for treasury stock. Sept. 1 2,500 shares of preferred stock are issued in exchange for a piece of land. The land has an appraised value of $280,500. The preferred stock currently…arrow_forwardBelow are the accounts shown in the December 31, 2020 trial balance of ABC Corporation: Preference shares, P50 par, 100,000 authorized, 40,000 shares issued Ordinary shares, P100 par, 200,000 authorized, 50,000 shares issued Subscribed preference share, 20,000 shares Subscribed ordinary shares, 20,000 shares Subscription receivable, preference due March 31, 2021, P180,000 Subscription receivable, ordinary due June 1, 2021, P260,000 Treasury stock, preference, 10,000 shares reacquired at P86 Share premium – Ordinary shares, P1,500,000 Share premium – Preference shares, P2,100,000 Share premium from Treasury, P400,000 Donated Capital, P600,000 Ordinary share warrants outstanding, P300,000 Ordinary share options outstanding, P200,000 Accumulated Profits, P3,100,000 Revaluation Surplus, P1,500,000 Reserve for plant expansion, P1,200,000 Unrealized Gain on financial asset at FMV through OCI/L, P200,000 How much is the total contributed capital of ABC Corporation? Group of answer choices…arrow_forwardAshvinarrow_forward

- Bacon Inc. has the following stockholders’ equity section in its May 31, 2019, comparative balance sheets: May 31, 2019 April 30, 2019 Paid-in capital: Preferred stock, $120 par value, 9%, cumulative, 200,000 shares authorized, 140,000 shares issued and outstanding $ 16,800,000 $ 16,800,000 Common stock, $5 par value, 1,000,000 shares authorized, 600,000 and 540,000 shares issued, respectively ? 2,700,000 Additional paid-in capital 26,100,000 23,220,000 Retained earnings 36,200,000 34,640,000 Less: Treasury common stock, at cost; 72,000 shares and 68,000 shares, respectively (4,412,000 ) (4,148,000 ) Total stockholders' equity $ ? $ 73,212,000 Assume that on June 1 the board of directors declared a cash dividend of $0.60 per share on the outstanding shares of common stock. The dividend will be payable on July 15 to stockholders of record on June 15.e-1. Calculate the total amount of the dividend.arrow_forwardPlease show your work.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education