EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

can you please help me to this account questions

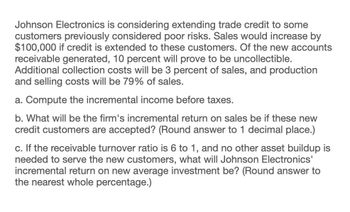

Transcribed Image Text:Johnson Electronics is considering extending trade credit to some

customers previously considered poor risks. Sales would increase by

$100,000 if credit is extended to these customers. Of the new accounts

receivable generated, 10 percent will prove to be uncollectible.

Additional collection costs will be 3 percent of sales, and production

and selling costs will be 79% of sales.

a. Compute the incremental income before taxes.

b. What will be the firm's incremental return on sales be if these new

credit customers are accepted? (Round answer to 1 decimal place.)

c. If the receivable turnover ratio is 6 to 1, and no other asset buildup is

needed to serve the new customers, what will Johnson Electronics'

incremental return on new average investment be? (Round answer to

the nearest whole percentage.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Sunny Manufacturing is considering extending trade credit to some customers previously considered poor risks. Sales would increase by $220,000 if credit is extended to these new customers. Of the new accounts receivable generated, 10 percent will prove to be uncollectible. Additional collection costs will be 5 percent of sales, and production and selling costs will be 70 percent of sales. a. Compute the incremental income before taxes. $ Incremental income before taxes b. What will the firm's incremental return on sales be if these new credit customers are accepted? (Round the final answer to 2 decimal place.) Incremental return on sales % c. If the receivable turnover ratio is 4 to 1, and no other asset buildup is needed to serve the new customers, what will Sunny Manufacturing's incremental return on new average investment be? (Do round intermediate calculations. Round the final answer to the nearest whole percentage.) Incremental return on new average investment %arrow_forwardCan you please solve this accounting question ?arrow_forwardJohnson Electronics is considering extending trade credit to some customers previously considered poor risks. Sales would increase by $270,000 if credit is extended to these new customers. Of the new accounts receivable generated, 9 percent will prove to be uncollectible. Additional collection costs will be 6 percent of sales, and production and selling costs will be 75 percent of sales. 1. Compute the incremental income before taxes. 2. What will the firm’s incremental return on sales be if these new credit customers are accepted? (Round final answer to 2 decimals) 3. If the receivable turnover ratio is 5 to 1, and no other asset buildup is needed to serve the new customers, what will Johnson Electronics’ incremental return on new average investment be? (Round only the final answer to %)arrow_forward

- am. 118.arrow_forwardProposal #1 would extend trade credit to some customers that previously have been denied credit because they were considered poor risks. Sales are projected to increase by $200,000 per year if credit is extended to these new customers. Of the new accounts receivable generated, 7% are projected to be uncollectible. Additional collection costs are projected to be 3% of incremental sales (whether they actually end up collected or not), and production and selling costs are projected to be 80% of sales. Your firm expects to pay a total of 40% of its income after expenses in taxes. 1.Compute the incremental income after taxes that would result from these projections: 2.Compute the incremental Return on Sales if these new credit customers are accepted: If the receivable turnover ratio is expected to be 4 to 1 and no other asset buildup is needed to serve the new customers… 3.Compute the additional investment in Accounts Receivable 4.Compute the incremental Return on New Investment…arrow_forwardJamboo Corporation is considering extending trade credit to some customers previously considered poor risks. Sales would increase by $230009 if credit is extended. Of the new accounts receivable generated, 10 percent will prove to be uncollectible. Additional collection costs will be 5 percent of sales, and production and selling costs will be 75 percent of sales. The firm needs to pay 1,500 tax on additional sales. Compute Net income after tax. ANSWER FORMAT: 1234.56 Answer:arrow_forward

- Tara’s Textiles currently has credit sales of $360 million per year and an average collection period of 60 days. Assume that the price of Tara’s products is $60 per unit and that the variable costs are $55 per unit. The firm is considering an accounts receivable change that will result in a 20% increase in sales and a 20% increase in the average collection period. No change in bad debts is expected. The firm’s equal-risk opportunity cost on its investment in accounts receivable is 14%. (Note: Use a 365-day year.) Calculate the additional profit contribution from sales that the firm will realize if it makes the proposed change. What marginal investment in accounts receivable will result? Calculate the cost of the marginal investment in accounts receivable. Should the firm implement the proposed change? What other information would be helpful in your analysis?arrow_forwardDinshaw Company is considering the purchase of a new machine. The invoice price of the machine is $87,306, freight charges are estimated to be $2,620, and installation costs are expected to be $7,370. The annual cost savings are expected to be $14,980 for 11 years. The firm requires a 20% rate of return. Ignore income taxes. What is the internal rate of return on this investment? Internal rate of return % Round to 0 decimal placesearrow_forwardFinally, assume that the new product line isexpected to decrease sales of the firm’s otherlines by $50,000 per year. Should this be considered in the analysis? If so, how?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning