Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

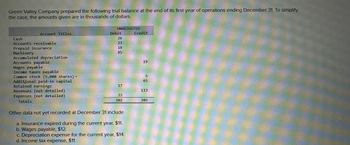

Transcribed Image Text:Green Valley Company prepared the following trial balance at the end of its first year of operations ending December 31. To simplify

the case, the amounts given are in thousands of dollars.

Cash

Account Titles

Accounts receivable

Prepaid insurance

Machinery

Accumulated depreciation

Accounts payable

Wages payable

Income taxes payable

Common stock (5,000 shares)

Additional paid-in capital

Retained earnings

Revenues (not detailed)

Expenses (not detailed)

Totals

UNADJUSTED

Debit

26

Credit

23

18

85

19

65

55

17

113

33

202

202

Other data not yet recorded at December 31 include

a. Insurance expired during the current year, $11.

b. Wages payable, $12.

c. Depreciation expense for the current year, $14.

d. Income tax expense, $11.

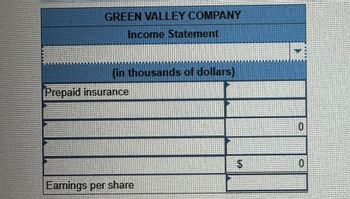

Transcribed Image Text:GREEN VALLEY COMPANY

Income Statement

(in thousands of dollars)

Prepaid insurance

10

0

Earnings per share

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- On June 1, Davis Inc. issued an $76,100, 12%, 120-day note payable to Garcia Company Assume that the fiscal year of Garcia ends June 30. Using a 360-day year in your calculations, what is the amount of interest revenue recognized by Garcia in the following year? When required, round your answer to the nearest dollar. a.$1,522 b.$9,132 c.$761 d.$2,308arrow_forwardAmerican Laser, Inc., reported the following account balances on January 1. Accounts Receivable Accumulated Depreciation. Additional Paid-in Capital Allowance for Doubtful Accounts Bonds Payable Buildings. Cash Common Stock, 10,000 shares of $1 part Notes Payable (long-term) Retained Earnings Treasury Stock TOTALS Requirement View transaction list General Journalarrow_forwardUse the following information for the next three questions:The ledger of COLTISH UNDISCIPLINED Co. in 20x1 includes the following:Jan. 1, 20x1 Dec. 31, 20x1Current assets 1,200,000 ? Noncurrent assets 4,000,000 ? Current liabilities 900,000 1,000,000Noncurrent liabilities ? 3,000,000 Additional information:- COLTISH’s working capital as of December 31, 20x1 is twice as much as the working capital as of January 1, 20x1. - Total equity as of January 1, 20x1 is ₱1,700,000. Profit for the year is ₱2,400,000 while dividends declared amounted to ₱1,000,000. There were no other changes in equity during the year.How much is the total noncurrent liabilities as of January 1, 20x1?a. 2,600,000b. 2,800,000c. 3,200,000d. 3,400,000arrow_forward

- Use the following information for the next three questions:The ledger of COLTISH UNDISCIPLINED Co. in 20x1 includes the following:Jan. 1, 20x1 Dec. 31, 20x1Current assets 1,200,000 ?Noncurrent assets 4,000,000 ?Current liabilities 900,000 1,000,000Noncurrent liabilities ? 3,000,000 Additional information:- COLTISH’s working capital as of December 31, 20x1 is twice as much as the working capital as of January 1, 20x1.- Total equity as of January 1, 20x1 is ₱1,700,000. Profit for the year is ₱2,400,000 while dividends declared amounted to ₱1,000,000. There were no other changes in equity during the year. How much is the total current assets as of December 31, 20x1?a. 1,600,000b. 800,000c. 300,000d. 2,200,000arrow_forwardSelected accounts from Lue Company's adjusted trial balance for the year ended December 31 follow. Prepare a classified balance sheet. Total equity Equipment Salaries payable Accounts receivable Cash Current portion of long-term debt Notes payable (due in 6 years) LUE COMPANY Balance Sheet December 31 Assets $ 31,500 Employee federal income taxes payable 41,500 Federal unemployment taxes payable 35,500 FICA-Medicare taxes payable 8,300 55,100 5,500 10,000 FICA-Social Security taxes payable Employee medical insurance payable State unemployment taxes payable Sales tax payable (due in 2 weeks) $ 10,300 210 560 4, 200 3,500 3,200 430arrow_forwardOn September 1. Year 1, Western Company loaned $36,600 cash to Eastern Company. The one year note carried a 6% rate of interest. The amount of interest revenue on the income statement and the amount of cash flow from operating activities shown on Western's Year 2 financial statements would be Multiple Choice $732 interest revenue and $2196 cash inflow from operating activmes $1.464 imerest revenue and $2,196 cash inflow from operating activitiesarrow_forward

- The following accounts, in alphabetical order, appear on the trial balance for a company. What is the total for long-term liabilities? Accounts Payable $32,000Deferred Income Taxes $61,000Interest Payable $17,000Current Portion of Long-term Notes $19,000Mortgage $92,000Notes Payable-Short term $11,000Notes Payable-Long term $41,000Salaries Payable $7,000Taxes Payable $23,000Unearned Revenue $15,000 $194,000 $124,000 $213,000 $217,000 $109,000arrow_forwardOn June 1, Davis Inc. issued an $89,300, 8%, 120-day note payable to Garcia Company. Assume that the fiscal year of Garcia ends June 30. Using a 360-day year, what is the amount of interest revenue recognized by Garcia in the following year? When required, round your answer to the nearest dollar. a. $1,806 Ob. $7,144 O c. $595 Od. $1,191 Barrow_forwardCora's Cookie Company provided the following account balances from its year-end trial balance. During the year, Cora issued no-par common stock. The proceeds of the new issue were $30,000. The company is subject to a 40% income tax rate. The beginning balance in common stock was $510,000. Cora’s Cookie Company Trial Balance (Selected Accounts) For the Current Year Ended December 31 Account Debit Credit Retained Earnings, Beginning Balance $1,317,000 Accumulated Other Comprehensive Income, Beginning Balance $56,750 Dividends 53,000 Sales 1,405,000 Interest Income 3,600 Dividend Income 3,850 Gain on Sale of Property 6,200 Gain on Disposal of Plant Assets 65,000 Unrealized Gain on Trading Investments 27,350 Unrealized Gain on Available-for-Sale Bonds before Tax 3,700 Gain on Sale of Discontinued Operations before Tax 59,200 Cost of Goods Sold 600,000 Selling Expenses 36,000 Office Supplies Expense 55,600 Amortization Expense 11,500 Sales Salaries…arrow_forward

- On June 1, Davis Inc. issued an $84,000, 5%, 120-day note payable to Garcia Company. Assume that the fiscal year of Garcia ends June 30. Using the 360-day year, what is the amount of interest revenue (rounded) recognized by Garcia in the following year? a.$4,200 b.$1,600 c.$700 d.$1,050arrow_forwardCollette's Cookie Company provided the following account balances from its year-end trial balance. During the year, Collette issued no-par common stock. The proceeds of the new issue were $20,000 . The company is subject to a 40% income tax rate. The beginning balance in common stock was $460,000 . Collette’s Cookie CompanyTrial Balance (Selected Accounts)For the Current Year Ended December 31AccountDebitCreditRetained Earnings, Beginning Balance $1,100,300Accumulated Other Comprehensive Income, Beginning Balance$52,350 Dividends54,000 Sales 1,100,000Interest Income 3,300Dividend Income 3,650Gain on Sale of Property 6,500Gain on Disposal of Plant Assets 85,000Unrealized Gain on Trading Investments 27,350Unrealized Gain on Available-for-Sale Bonds before Tax 3,400Gain on Sale of Discontinued Operations before Tax 50,600Cost of Goods Sold400,000 Selling Expenses33,000 Office Supplies Expense56,700 Amortization Expense11,500 Sales Salaries Expense24,000 Advertising Expense23,000…arrow_forwardOn June 1, Davis Inc. issued an $84,000, 5%, 120-day note payable to Garcia Company. Assume that the fiscal year of Garcia ends June 30. Using 360-day year, what is the amount of interest revenue recognized by Garcia in the following year? a. $700 b. $1,600 c. $1,062 d. $4,200 e. None of the above.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning