Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

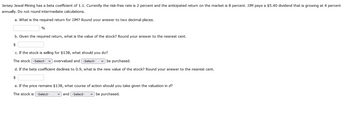

Transcribed Image Text:Jersey Jewel Mining has a beta coefficient of 1.1. Currently the risk-free rate is 2 percent and the anticipated return on the market is 8 percent. JJM pays a $5.40 dividend that is growing at 4 percent

annually. Do not round intermediate calculations.

a. What is the required return for JJM? Round your answer to two decimal places.

%

b. Given the required return, what is the value of the stock? Round your answer to the nearest cent.

$

c. If the stock is selling for $138, what should you do?

The stock -Select-

overvalued and -Select- ✓ be purchased.

d. If the beta coefficient declines to 0.9, what is the new value of the stock? Round your answer to the nearest cent.

$

e. If the price remains $138, what course of action should you take given the valuation in d?

The stock is -Select-

and -Select- ✓ be purchased.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 6 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The level of the Syldavian market index is 21,600 at the start of the year and 26,100 at the end. The dividend yield on the index is 4.3%. a. What is the return on the index over the year? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Retur b. If the interest rate is 5%, what is the risk premium over the year? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Risk Premium % Real Return % c. If the inflation rate is 7%, what is the real return on the index over the year? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) %arrow_forwardSuppose rRF = 4%, rM = 13%, and bi = 1.1. What is ri, the required rate of return on Stock i? Round your answer to one decimal place. % 1. Now suppose rRF increases to 5%. The slope of the SML remains constant. How would this affect rM and ri? Both rM and ri will remain the same. Both rM and ri will increase by 1 percentage point. rM will remain the same and ri will increase by 1 percentage point. rM will increase by 1 percentage point and ri will remain the same. Both rM and ri will decrease by 1 percentage point. 2. Now suppose rRF decreases to 3%. The slope of the SML remains constant. How would this affect rM and ri? rM will remain the same and ri will decrease by 1 percentage point. Both rM and ri will increase by 1 percentage point. Both rM and ri will remain the same. Both rM and ri will decrease by 1 percentage point. rM will decrease by 1 percentage point and ri will remain the same. 1. Now assume that rRF remains at 4%, but rM increases to 14%.…arrow_forwardKaiser Aluminum has a beta of 0.70. If the risk-free rate (Rs) is 5.0%, and the market risk premium (RPM) is 7.4%, what is the firm's cost of equity from retained earnings based on the CAPM? Your answer should be between 8.70 and 11.25, rounded to 2 decimal places, with no special characters.arrow_forward

- 2 (CAPM and expected returns) a. Given the following holding-period returns, compute the average returns and the standard deviations for the Zemin Corporation and for the market. b. If Zemin's beta is 0.83 and the risk-free rate is 9 percent, what would be an expected return for an investor owning Zemin? (Note: Because the preceding returns are based on monthly data, you will need to annualize the returns to make them comparable with the risk-free rate. For simplicity, you can convert from monthly to yearly returns by multiplying the average monthly returns by 12.) c. How does Zemin's historical average return compare with the return you believe you should expect based on the capital asset pricing model and the firm's systematic risk? a. Given the holding-period returns shown in the table, the average monthly return for the Zemin Corporation is %. (Round to two decimal places.) The standard deviation for the Zemin Corporation is %. (Round to two decimal places.) Given the…arrow_forwardInvestors expect the market rate of return this year to be 17.00%. The expected rate of return on a stock with a beta of 0.9 is currently 15.30%. If the market return this year turns out to be 15.00%, how would you revise your expectation of the rate of return on the stock? (Do not round intermediate calculations. Round your answer to 1 decimal place.)arrow_forwardJersey Jewel Mining has a beta coefficient of 1.5. Currently the risk-free rate is 4 percent and the anticipated return on the market is 6 percent. JJM pays a $5.00 dividend that is growing at 3 percent annually. Do not round intermediate calculations. What is the required return for JJM? Round your answer to two decimal places. % Given the required return, what is the value of the stock? Round your answer to the nearest cent. $ If the stock is selling for $159, what should you do? The stock overvalued and be purchased. If the beta coefficient declines to 1.2, what is the new value of the stock? Round your answer to the nearest cent. $ If the price remains $159, what course of action should you take given the valuation in d? The stock is and be purchased.arrow_forward

- The risk-free rate of return is 5%, the required rate of return on the market is 10%, and High-Flyer stock has a beta coefficient of 1.8. If the dividend per share expected during the coming year, D1, is $3.60 and g = 5%, at what price should a share sell? (Do not round intermediate calculations. Round your answer to 2 decimal places.)arrow_forwardFrontyard Inc has a beta of 0.9. The risk-free rate is 2.5% and the market risk premium is equal to 7%. The company is expected to pay a dividend of $2 per share. The current stock price is equal to $40. Dividends are expected to grow at a constant rate, g a. Calculate the required rate of return r, using the CAPM model The required rate of return r, is equal to b. Calculate the growth rate of dividends g c. Calculate Do Do S d. Calculate Ps De S Ps= Sarrow_forwardCurrently, the risk-free return is 2 percent, and the expected market rate of return is 11 percent. What is the expected return of the following three-stock portfolio? Do not round intermediate calculations. Round your answer to two decimal places. Investment Beta $ 200,000 1.0 100,000 0.1 700,000 2.9 %arrow_forward

- Fisher Corp has a beta value of 0.5. If the risk free rate is 2.5% and the Market Risk Premium is 11.0%, what is the Expected/Required return on Fisher Corp's stock? Using the Capital Asset Pricing Model, calculate the expected / required rate of return. (Enter your answer as a percentage, not in decimal form. E.g. 15% should be entered as 15.00 and not as 0.15.)arrow_forwardPaycheck, Inc. has a beta of 1.02. If the market return is expected to be 16.90 percent and the risk-free rate is 9.90 percent, what is Paycheck’s risk premium? (Round your answer to 2 decimal places.) Paycheck's Risk Premium: ___.__%arrow_forwardThe current price of a non-dividend-paying biotech stock is $140 with a volatility of 25%. The risk-free rate is 4%. For a 3-month time step: (a) What is the percentage up movement? (b) What is the percentage down movement? (c) What is the probability of an up movement in a risk-neutral world? (d) What is the probability of a down movement in a risk-neutral world? Use a two-step tree to value a 6-month European call option and a 6-month European put option. In both cases the strike price is $150. Answer: (For (a) to (d), answer XX.XX if the answer is XX.XX% or 0.XXXX; for the option prices: please round you answers to the second decimal places.) (a, (c) (d) Price of the Call: Price of the Put: % % % %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education