Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Your broker has recommended that you purchase stock in Beacan, Inc. Beacan recently paid its annual dividend ($14.00). The firm also boasts an ROE of 15%, of which 50% is paid as dividends. Analysts estimate that the stock has a beta of 0.79. The current risk-free rate is 2.00% and the market return (RM) is 11.10%. Assuming that

Expert Solution

arrow_forward

Step 1

Given information:

Annual dividend is $14.00

ROE is 15%

Retention ratio is 50%, pay-out is 50%

Stock beta is 0.79

Risk free rate is 2.00%

Market return is 11.10%

arrow_forward

Step 2

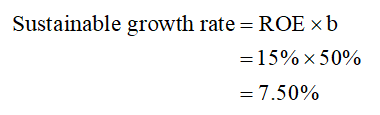

Calculation of sustainable growth rate:

Step by stepSolved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 1arrow_forwardFlavR Company stock has a beta of 2.14, the current risk-free rate is 2.14 percent, and the expected return on the market is 9.14 percent. What is FlavR Company's cost of equity?arrow_forwardChance Inc's stock has an expected return of 12.25%, a beta of 1.5, and is in equilibrium. If the nominal risk-free rate is 4.00%, what is the market risk premium? What is the equity risk premium?arrow_forward

- You live in a world where assets are priced by the CAPM. The following information is given to you regarding stock X. The expected payoff from the stock X=£105.00 Expected return of stock X = 18% Risk-free rate =5% Market Risk Premium = 9% Assume there are no other changes, except that the correlation between the returns of Stock X and the market becomes twice what it is currently. How would this change affect the current price of Stock X? Explain why the change of the correlation causes the observed change in the stock price. [hint: Provide a risk-based explanation]arrow_forwardWild Swings, Inc.'s stock has a beta of 2.09. If the risk-free rate is 5.99% and the market risk premium is 7.11%, what is an estimate of Wild Swings' cost of equity? Wild Swings's cost of equity capital is __ % ? (Round to two decimal places.)arrow_forwardA financial analyst for the ZZZ Corporation uses the Security Market line to estimate the cost of equity, Re. The analyst observes the current risk-free interest rate, Rf, is 3%. The analyst estimates that ZZ has a beta of 2. If the analyst finds that RE is 13%, what does the analyst use as the value of [E(RM) – R¡]? -arrow_forward

- The risk-free rate of return is 3 percent, and the expected return on the market is 7 percent. Stock A has a beta coefficient of 1.3, an earnings and dividend growth rate of 5 percent, and a current dividend of $2.10 a share. Do not round intermediate calculations. Round your answers to the nearest cent. What should be the market price of the stock? $ If the current market price of the stock is $91.00, what should you do? The stock -Select-shouldshould notItem 2 be purchased. If the expected return on the market rises to 13.1 percent and the other variables remain constant, what will be the value of the stock? $ If the risk-free return rises to 4.5 percent and the return on the market rises to 13.9 percent, what will be the value of the stock? $ If the beta coefficient falls to 1.2 and the other variables remain constant, what will be the value of the stock? $ Explain why the stock’s value changes in c through e. The increase in…arrow_forwardYour broker has recommended that you purchase stock in Beacan, Inc. Beacan recently paid its annual dividend ($7.00). Dividends have consistently grown at a rate of 2.50%. Analysts estimate that the stock has a beta of 1.42. The current risk-free rate is 2.80% and the market risk premium (RM - RF) is 6.50%. Assuming that CAPM holds, what is the intrinsic value of this stock?arrow_forwardThe risk-free rate of return is 1 percent, and the expected return on the market is 7.1 percent. Stock A has a beta coefficient of 1.6, an earnings and dividend growth rate of 7 percent, and a current dividend of $1.50 a share. Do not round intermediate calculations. Round your answers to the nearest cent. What should be the market price of the stock? $ If the current market price of the stock is $55.00, what should you do? The stock be purchased. If the expected return on the market rises to 12.4 percent and the other variables remain constant, what will be the value of the stock? $ If the risk-free return rises to 2 percent and the return on the market rises to 13 percent, what will be the value of the stock? $ If the beta coefficient falls to 1.3 and the other variables remain constant, what will be the value of the stock? $ Explain why the stock’s value changes in c through e. The increase in the return on the market the…arrow_forward

- YNA is expected to pay a dividend of $1.0 in Year 1 and $1.2 in Year 2. Analysts expect the price of YNA shares to be $19 two years from now. The risk-free rate of return is 4%, and the expected return on the market portfolio is 14%. The beta of the stock is 1.2. Compute the intrinsic value of the stock. Round your answer to two decimal places and enter without the dollar sign.arrow_forwardB24&Co stock has a beta of 1.50, the current risk- free rate is 3.00 percent, and the expected return on the market is 10.50 percent. What is B24&Co's cost of equity? Which of the following is correct? а.) 15.00% b.) 14.25% c.) 23.25% d.) 18.75%arrow_forwardThe risk-free rate is 1.54% and the market risk premium is 8.58%. A stock with a β of 1.39 just paid a dividend of $1.30. The dividend is expected to grow at 22.14% for five years and then grow at 3.47% forever. What is the value of the stock? Don't use any AI otherwise I will give.......arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education